- Published on 30 September 2022

Who Owns Cairo: Case Study Companies

Overview

Name: Porto Group Holding SAE PORT.CA

Name change 2022: Arab Developers Holding SAE ARAB.CA

Established: 2015 (Split from Amer Group SAE AMER.CA originally established in 2007)

Listed on the EGX: 2015 (Split from Amer Group SAE AMER.CA originally listed in 2010)

Scope and activities: The company focuses on various activities in the fields of real estate development and investment, education, marketing, and project management.[1]

Company Vitals:

| Indicator | Value | Case Study Ranking |

| Annual Profits (Avg. 2010-2021) * | LE 166mn | 10/10 |

| Market Capitalization (12.2021) | LE 624mn | 10/10 |

| Cairo Land Ownership – De Jure (12.2021) | 174 acres | 10/10 |

| Cairo Land Ownership – Control (12.2021) | 540 acres | 10/10 |

| *Includes AMER profits until split in 2015 | ||

How much land does Porto own in Cairo?

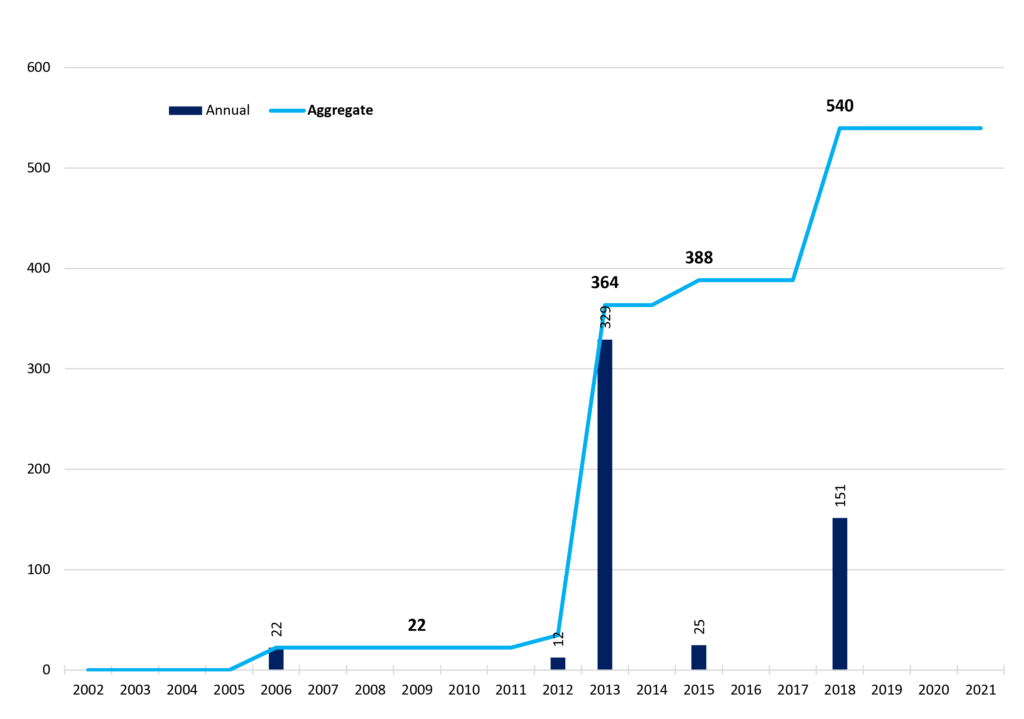

Porto has the smallest landholdings in Cairo under the de jure method (See Methodology), among the case study companies at 174 acres (See Appendix A). This is primarily due to the fact that Porto has acted as a marketing developer, going into co-development agreements for most of its projects. Thus, under the control method, its landholdings rise more than threefold to 540 acres, though still remaining the tenth largest company in the case study by landholdings. Under the control method, we find that Proto, originally known for seaside resorts, did not start having a significant interest in Cairo until 2013 with Porto October, buying two other land plots since (Figure 1). This makes it the only company in the case study with more land acquired after 2011 than before.

Figure 1: PORTO landbank accumulation analysis – Control Method 2002-2021 (Acres). Sources: See Appendix A

Who Owns Porto?

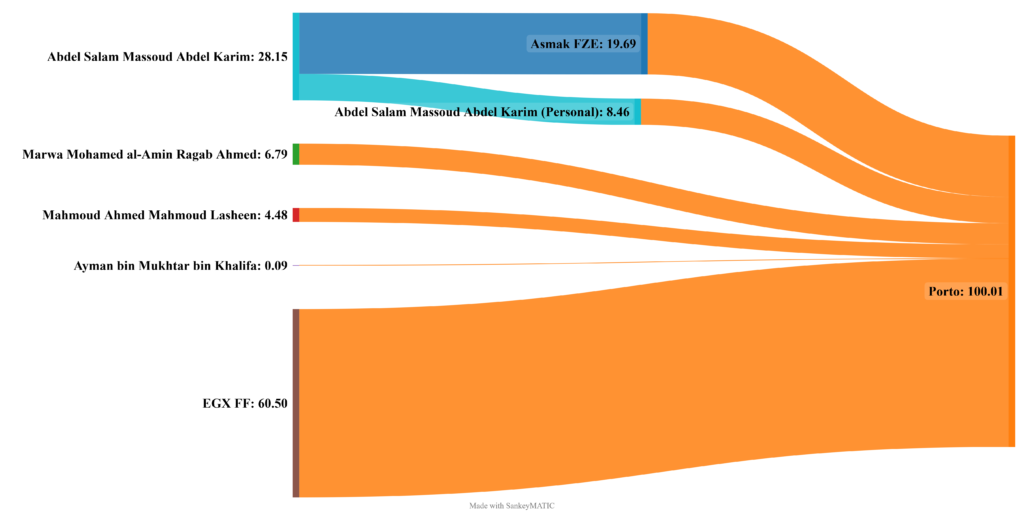

Originally part of Amer Group Holding SAE until its split in 2015, co-founder Mansour Amer, an Egyptian restauranteur turned real estate developer and member of parliament representing former president Mubarak’s NDP (2005-2010) held a controlling stake – over half the company – over the first few years. After selling his stake through 2020, Libyan businessman Abdel Salam Abdel Karim became Porto’s single largest owner holding 28% of the company at the end of 2021 both directly, and indirectly through a UAE registered company (Figure 2). The second co-founder, Mohamed Al-Amin, an Egyptian media mogul owner of satellite channels and newspapers, and currently serving a three-year sentence for child molestation,[2] remained Porto’s second largest shareholder owning approximately 7% of the company until 2020, when he sold his stake to daughter Marwa,[3] who remains Porto’s second largest shareholder. Mahmoud Lasheen, an Egyptian businessman and founder of Speed Medical SAE (SPMD.CA), is Porto’s third largest shareholder, owning less than 5% of its shares, while 60% of the company is held by unidentifiable smallholders on the EGX free float.

Figure 2: PORTO shareholding structure according to the UBO method as of 2021 Q4 (See Appendix B and Methodology)

Investor Nationalities

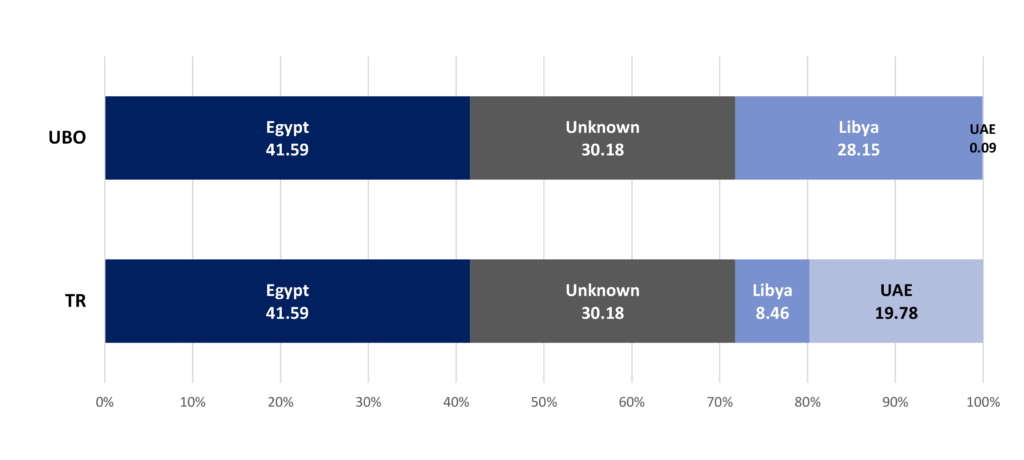

Using the tax resident method, Porto’s largest owner by nationality are the hundreds of foreign smallholders on the EGX free float, holding 38% of company shares (Figure 3). Second are Egypt-based investors, holding 34% of the company, followed by UAE-based investors with a 20% stake. In fourth place is Libya, with 8.5% of the company.

Under the control method, the first two groups hold their places, followed by Libya which balloons to 28% after investments in the UAE are rerouted to a Libyan investor.

Figure 3: PORTO shareholding by nationality under the TR and UBO methods

Investor Types

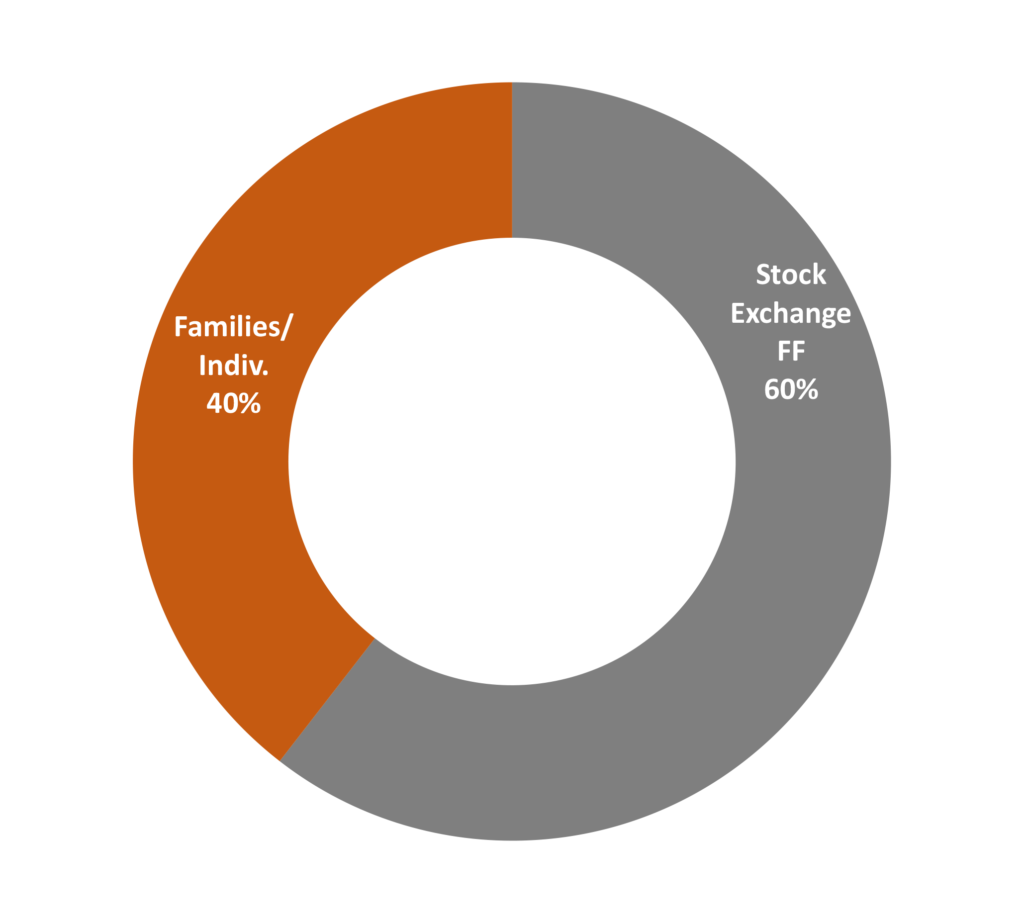

Smallholders on the EGX free float make the largest investor group in Porto holding 60% of its shares, while investor families and individuals are the second largest group holding 40% of Porto shares. No other investor group has significant holdings in the company.

Figure 4: PORTO shareholding by investor type – UBO

Back to Case Study Companies Page

Appendix A: Landholding Information (on 31.12.2021)

| Location | Development (Allocation date) |

Subsidiary / Co-development (% Owned) |

Land Area (Feddans) | Sources | ||

| Initial Land | De Jure Owned 2021 | Control 2021 | ||||

| 6th of October | Porto October (2013) | Port 6 October SAE, Co-dev. KUWADICO SAE (75%) | 329.0 | 0.0 | 329.0 | MoH 309/2020 |

| Giza | Porto Pyramids (2015) | Porto Pyramids for Real Estate SAE, Co-dev. Unknown (81%) | 24.7 | 0.0 | 24.7 | PORTO IP 2017 |

| New Cairo | Golf Porto Cairo (2018) | Porto for Touristic Development SAE, co-dev. Mostaqbal City SAE (67%) | 151.3 | 151.3 | 151.3 | MoH 908/2019 |

| Porto Cairo (2006) | 22.2 | 22.2 | 22.2 | PORTO IP 2017 | ||

| Porto New Cairo (2012) | Porto New Cairo SAE, Co-dev. NREC.KW (75%) | 12.4 | 0.0 | 12.4 | PORTO IP 2017 | |

| PORTO TOTAL | 539.6 | 173.6 | 539.6 | |||

| MoH: Minister of Housing Decree, CFS: Consolidated Financial Statements, IP: Investor Presentation. All co-development percentages based on the annual consolidated financial statements of 2021 | ||||||

Appendix B: Shareholding Information (on 31.12.2021)

Direct Shareholding:

| Shareholders | Shares | Sources |

| Asmak FZE (UAE)* | 19.69 | Porto Group Holding Shareholders’ Disclosure, 2021 Q4

“Porto Group Holding Shareholders’ and Related Party Disclosure”, 01.09.2021

“Arab Developers Holding SAE – Ownership”, Simply Wall St n.d., Accessed: 15.02.2022 |

| Abdel Salam Massoud Abdel Karim (Libya)* | 8.46 | |

| Marwa Mohamed al-Amin Ragab Ahmed (Egypt) | 6.79 | |

| Mahmoud Ahmed Mahmoud Lasheen (Egypt) | 4.48 | |

| Ayman bin Mukhtar bin Khalifa (UAE) | 0.085 | |

| EGX FF | 60.50 | |

| *Related parties. Mr. Abdel Karim is the sole owner of Asmak FZE | ||

[1] Porto Consolidated Financial Statement, 2021, Q1. p.10

[2] Egypt Independent, ‘Cairo Court Convicts Media Figure Mohamed Al-Amin over Molesting Girls at Orphanage’, Egypt Independent (blog), 23 May 2022, https://egyptindependent.com/cairo-court-convicts-media-figure-mohamed-al-amin-over-molesting-girls-at-orphanage/.

[3] Porto Group Holding, Disclosure According to Article 29 (Sale), 18.11.2020 and: Porto Group Holding, Disclosure According to Article 29 (Buy), 18.11.2020