- Published on 30 September 2022

Who Owns Cairo: Case Study Companies

Overview

Company name: Pioneers Properties for Urban Development SAE (Reuters code: PRDC.CA)

Established: 2021 (Split from Pioneers Capital now Aspire Capital SAE PIOH.CA, originally est. 1997)

Listed on the EGX: 2021 (Split from Pioneers Capital now Aspire Capital SAE PIOH.CA, originally listed 2007)

Scope and activities: The company participates directly and indirectly in all areas of real estate investments, contracting, real estate development, planning, construction, and development of urban areas.[1]

Company Vitals:

| Indicator | Value | Case Study Ranking |

| Annual Profits (Avg. 2010-2021) | LE 299mn | 7/10 |

| Market Capitalization (12.2021) | LE 2.8bn | 8/10 |

| Cairo Land Ownership – De Jure (12.2021) | 545 acres | 9/10 |

| Cairo Land Ownership – Control (12.2021) | 833 acres | 9/10 |

How much land does PRDC own in Cairo?

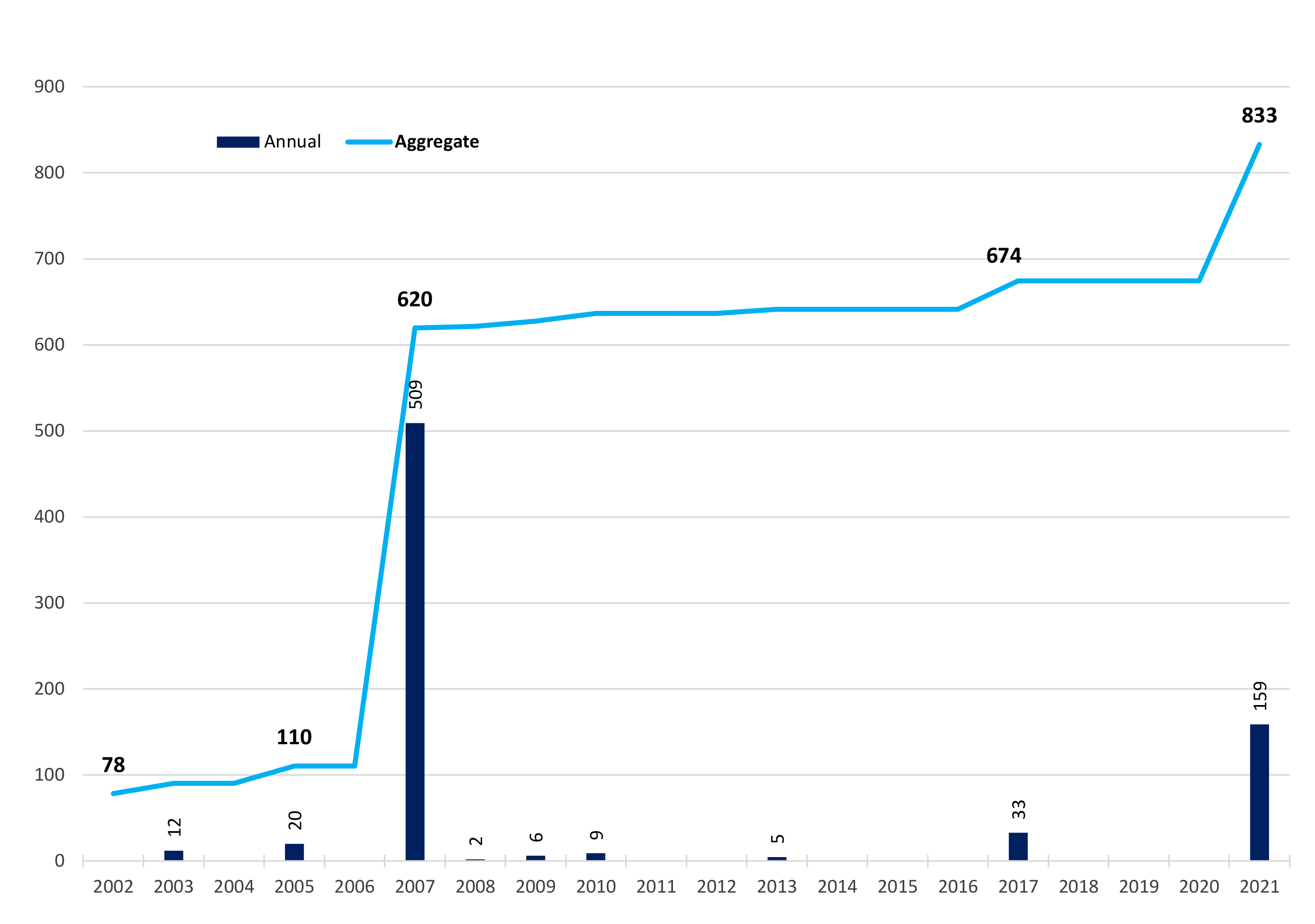

Pioneers owns 545 acres in Cairo according to the de jure method (See Methodology), rendering it in ninth place in our case study companies (See Appendix A below). This rises to 833 acres under the control method (See Methodology), leaving it also in ninth place. The majority of this landbank (75%) was acquired by 2007, with a significant acquisition of land in 2021 (Figure 1). It is worth mentioning that Pioneers acts as a holding company where all of its land in Cairo is owned and marketed by seven subsidiary companies it acquired controlling stakes in since 2010, including the privately established Rooya for Real Estate Investment SAE and Masharek for Real Estate Investments SAE, as well as the once state-owned and later listed real estate and construction companies: El Kahera Housing and Development Co. SAE (ELKA), United Company for Housing and Development SAE (UNIT), Giza General Contracting and Real Estate Investment Co SAE (GGCC) and Elsaeed Contracting and Real Estate Investment Company SAE (UEGC).

Figure 1: PRDC landbank accumulation analysis – Control Method 2002-2021 (Acres). Sources: See Appendix A

Who Owns PRDC?

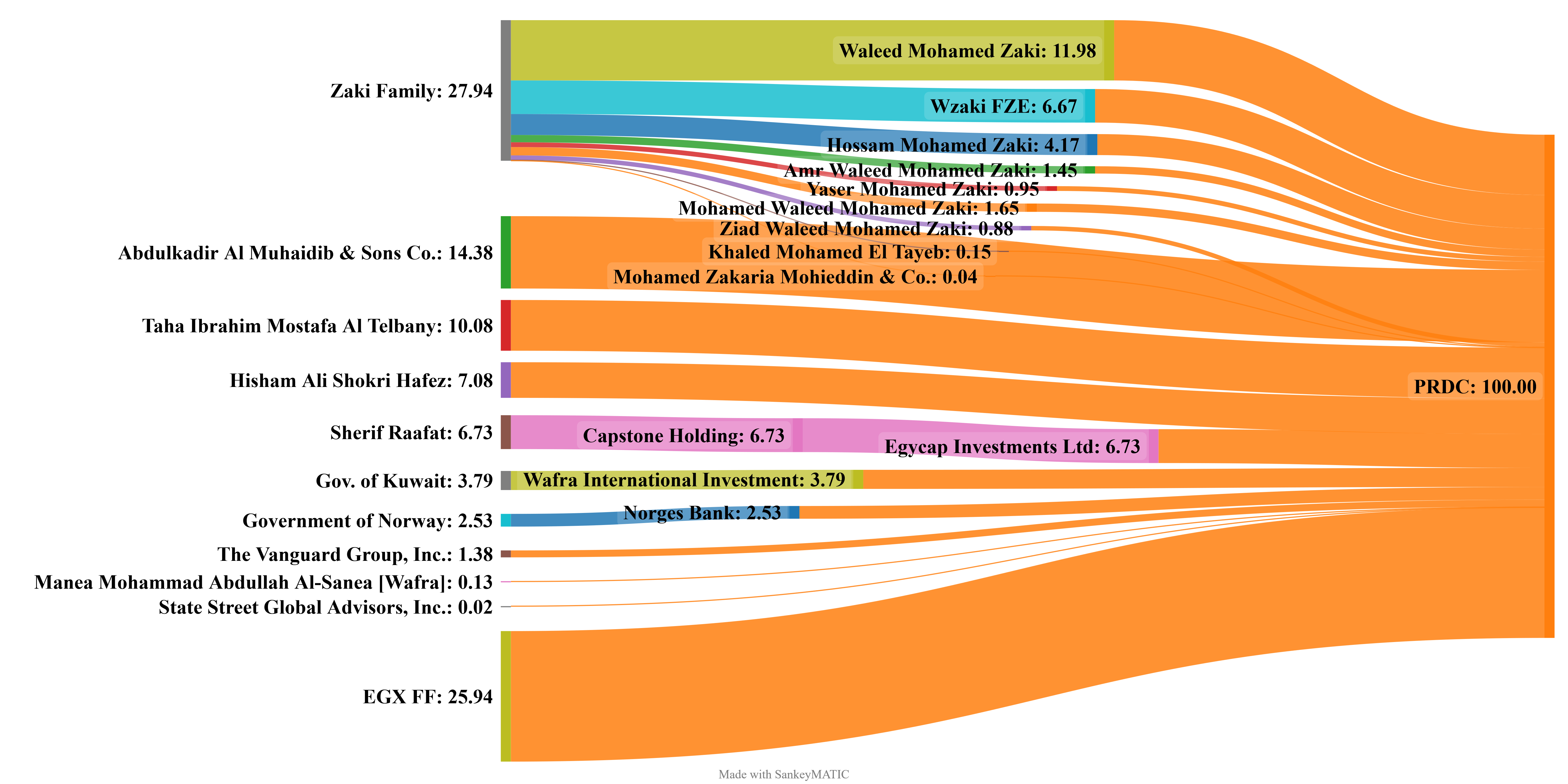

The Egyptian Zaki family led by CEO Waleed Zaki, is the largest single shareholder of PRDC, owning almost 28% of the company directly through family members, as well as a small indirect portion through a private company (Figure 2). In second place is the Saudi Al-Muhaidib family owning 14% of PRDC. Three Egyptian businessmen own between 7 to 10% of the company each. The sixth and seventh largest shareholders are the governments of Kuwait, and Norway holding 3.8% and 2.5% of PRDC respectively through their sovereign wealth funds. A little more than a quarter of the company’s stock is owned by unidentifiable smallholders on the EGX free float.

Figure 2: PRDC shareholding structure according to the UBO method as of 2021 Q4 (See Appendix B and Methodology)

Investor Nationalities

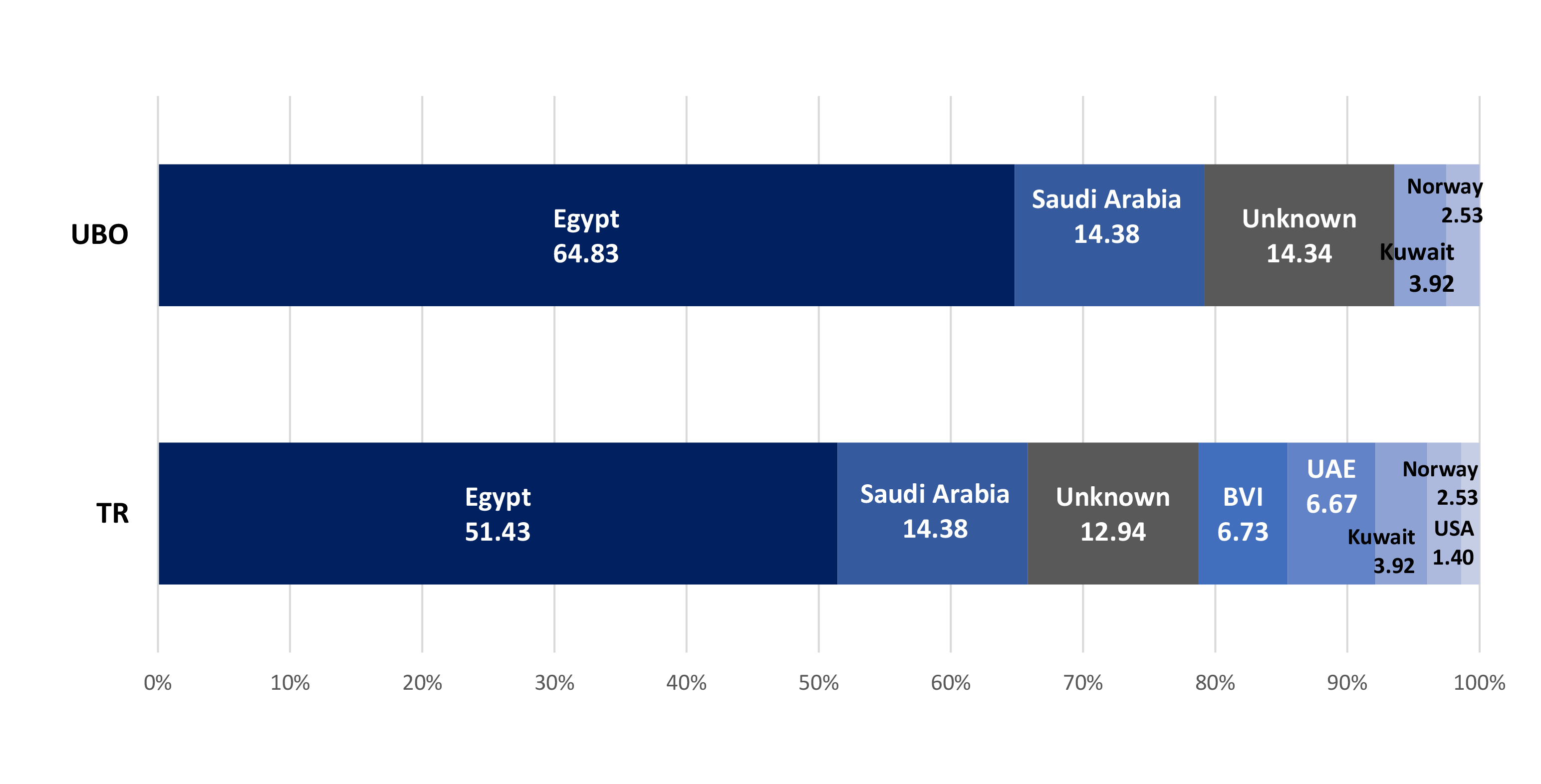

Using the tax resident (TR) method, Egypt-based investors are the largest investors in PRDC, though they own slightly more than half of the company (Figure 3). The second largest investors are from Saudi Arabia owning 14% of the company. In third place are unidentifiable foreign smallholders on the EGX free float who own 13% of PRDC, followed by an investor in the British Virgin Islands holding roughly 7% of the shares. An investor based in the UAE is the fifth largest holder, followed by funds based in Kuwait, Norway, and the USA.

Under the ultimate beneficiary ownership (UBO) method, investors based in the BVI and the UAE shift to Egypt, bringing that country’s ownership up to 65% of PRDC. Saudi Arabian investors remain the second largest group (14%), followed by Unidentifiable foreign smallholders (14%) and funds in Kuwait (4%) and Norway (2.5%).

Figure 3: PRDC shareholding by nationality under the TR and UBO methods

Investor Types

Using the UBO method, investor families and individuals represent the largest investor type in PRDC holding two thirds of its shares (Figure 4). The second largest group are unidentifiable smallholders on the EGX holding a little more than one quarter of the company. SOEs have a small but significant share of PRDC holding 6% of its shares, while private non-listed companies own 1.4% of PRDC.

Figure 4: PRDC shareholding by investor type – UBO

Back to Case Study Companies Page

Appendix A: Landholding Information

| Location | Development (Allocation date) |

Subsidiary / Co-development (% Owned) |

Land Area (Feddans) | Sources | ||

| Initial Land | De Jure Owned 2021 | Control 2021 | ||||

| New Cairo | Stone Park/ Residence/Street (2007) | Rooya for Real Estate Investment SAE (72%) | 451.9 | 326.6 | 451.9 | MoH 396/2015 |

| The Brooks (2021) | Masharek for Real Estate Investments SAE (47%) | 158.7 | 73.9 | 158.7 | MoH 1186/2021 | |

| Sakan (2010) | ELKA (81%) | 9.0 | 7.3 | 9.0 | ELKA Website, GE | |

| Point 90 (2007) | ELKA (81%) | 10.4 | 8.4 | 10.4 | Okaz Stock Brokers & Investmets Report on ELKA, 2014 | |

| El Patio 1 (2003) | Rooya for Real Estate Investment SAE (72%) | 12.0 | 8.7 | 12.0 | Rooya Website, GE | |

| El Patio 2 (2005) | Rooya for Real Estate Investment SAE (72%) | 20.0 | 14.5 | 20.0 | Rooya Website, GE | |

| Giza | Hadaba (2017) | Rooya for Real Estate Investment SAE (72%) | 33.0 | 23.8 | 33.0 | PRDC Website, GE |

| 6th of October | Al-Fardous 1-4 (1997) | UNIT (44%) | 17.0 | 7.6 | 17.0 | UNIT Website |

| October Paradise (1997) | GGCC (70%) | 25.0 | 17.4 | 25.0 | MoH 966/2020, GGCC Website | |

| Lotus (1997) | UEGC (50%) | 24.4 | 12.2 | 24.4 | MoH 966/2020, SSCD Website | |

| Al Reham (1997) | UEGC (50%) | 12.0 | 6.0 | 12.0 | MoH 966/2020, SSCD Website | |

| Cairo | Five Stars (2008) | ELKA (81%) | 2.0 | 1.6 | 2.0 | ELKA Website, GE |

| Emerald Residence 1/2/3 (2009) | ELKA (81%) | 6.2 | 5.0 | 6.2 | ELKA Website, GE | |

| Darna (2007) | SSCD (50%) | 23.0 | 11.5 | 23.0 | SSCD Website, GE | |

| El Shorouk | Montaga’ Al Shorouk (2007) | GGCC (70%) | 23.8 | 16.6 | 23.8 | GGCC Wesbite, GE |

| New Heliopolis Land Plot (2013) | ELKA (81%) | 4.6 | 3.8 | 4.6 | Okaz Stock Brokers & Investmets Report on ELKA, 2014 | |

| PRDC Total | 833.0 | 544.7 | 833.0 | |||

| MoH: Minister of Housing Decree. All subsidiary ownership percentages based on the annual consolidated financial statements of 2021 for PRDC (p10) in addition to the share of listed twin company Gadwa for Industrial Development SAE (GDWA) (p20) which had the exact shareholding structure as PDRC in 2021. | ||||||

Appendix B: Shareholding Information

Direct Shareholding as of 31.12.2021:

| Shareholders | Shares | Sources |

| Waleed Mohamed Zaki* | 11.98 | “Pioneers Property for Urban Development BoD and Shareholder Disclosure 2021 Q4”

“Pioneers Property for Urban Development Post Split Disclosure”, 11.10.2021

“Pioneers Property for Urban Development Ownership” Simply WallSt. n.d. Accessed 06.02.2022

“Government Pension Fund Global Holdings of Equities at 31 December 2021” (Norges Bank) |

| Abdulkadir Al Muhaidib and Sons Company (SA) | 14.38 | |

| Taha Ibrahim Mostafa Al Telbany | 10.08 | |

| Hisham Ali Shokri Hafez | 7.08 | |

| Egycap Investments Ltd (BVI) | 6.73 | |

| Wzaki FZE (UAE)* | 6.67 | |

| Hossam Mohamed Zaki* | 4.17 | |

| Wafra International Investment (Kuwait)** | 3.79 | |

| Norges Bank Investment Management | 2.53 | |

| Mohamed Waleed Mohamed Zaki* | 1.65 | |

| Amr Waleed Mohamed Zaki* | 1.45 | |

| The Vanguard Group, Inc. | 1.38 | |

| Yaser Mohamed Zaki* | 0.95 | |

| Ziad Waleed Mohamed Zaki* | 0.88 | |

| Khaled Mohamed El Tayeb | 0.15 | |

| Manea Mohammad Abdullah Al-Sanea** | 0.13 | |

| Mohamed Zakaria Mohieddin & Co.* | 0.04 | |

| State Street Global Advisors, Inc. | 0.02 | |

| EGX FF | 25.94 | |

| *Related parties: Zaki Family, ** Related Parties: Wafra International Investment | ||

Indirect Shareholding as of 31.12.2021:

| Company | Nationality | Shareholders/ Ultimate Parent | Sources |

| Egycap Investments Ltd | BVI | Capstone Holding | “Capstone Group: About Capstone Holding.” Capstone Holding. n.d. Accessed 02.06.2022 |

| Capstone Holding | Egypt | Sherif Raafat | “Capstone Holding Team and Shareholders.” Capstone Holding. n.d. Accessed 02.06.2022 |

| Waleed Mohamed Zaki

Hossam Mohamed Zaki Mohamed Waleed Mohamed Zaki Amr Waleed Mohamed Zaki Yaser Mohamed Zaki Ziad Waleed Mohamed Zaki Khaled Mohamed El Tayeb Mohamed Zakaria Mohieddin (International co.) |

Egypt | Zaki Family | “Pioneers Property for Urban Development BoD and Shareholder Structure 2021 Q4” English Mubasher, EGX. |

| Wafra International Investment Co. | Kuwait | Kuwait Gov. (Public Institution for Social Security of Kuwait PIFSS) | “About Us”, Wafra International Investment Co. n.d. Accessed: 09.02.2022 |

Notes and references

[1] Pioneers Property for Urban Engineering Consolidated Financial Statement for the year ended 31.12.2021, p9