- Published on 04 September 2022

Who Owns Cairo: Case Study Companies

Overview

Name: Palm Hills Development Company SAE PHDC.CA

Established: 2005

Listed on the EGX: 2008

Other listings: Cross-listed on the London Stock Exchange (LSE) 2010 – 2020

Scope and activities:

Real estate investment in the new cities and urban communities, land reclamation and cultivation, and other activities associated with the company’s operations.[1]

Company Vitals:

| Indicator | Value | Case Study Ranking |

| Annual Profits (Avg. 2010-2021) | LE 533mn | 3/10 |

| Market Capitalization (12.2021) | LE 6.1bn | 5/10 |

| Cairo Land Ownership – De Jure (12.2021) | 6251 acres | 3/10 |

| Cairo Land Ownership – Control (12.2021) | 6357 acres | 2/10 |

| 15% of case study land |

How much land does PHDC own in Cairo?

PHDC owns 6251 acres in Cairo according to the de jure method (See Methodology), ranking third among the case study companies (See Appendix A). Its 18 developments are owned through a host of subsidiaries. However, under the control method (See Methodology), PHDC’s landholdings rise to 6357 acres ranking it a distant second among the ten companies in this study. This is mostly due to two developments that it is building under co-development agreements. The most land it has owned was 6885 acres, however it has recently sold part of an agricultural plot, Botanica, to change its land use to urban. Half its current landbank was bought within the first five years of its founding, representing 14 of its 18 developments (Figure 1). This half was also bought before the 2011 Revolution, before falling by almost 10% due to land disputes and cases with NUCA where four allocations were cancelled.[2] After settlements between 2014 and 2018 PHDC re-acquired some land under new agreements, while the majority of land acquisitions since has been a single 3000 acre land plot, Badya, that it bought from NUCA in 2018 under a revenue share agreement, and represents the second largest plot sold to a developer in Cairo over the last ten years.

Figure 1: PHDC landbank accumulation analysis – Control Method 2002-2021 (Acres). Sources: See Appendix A

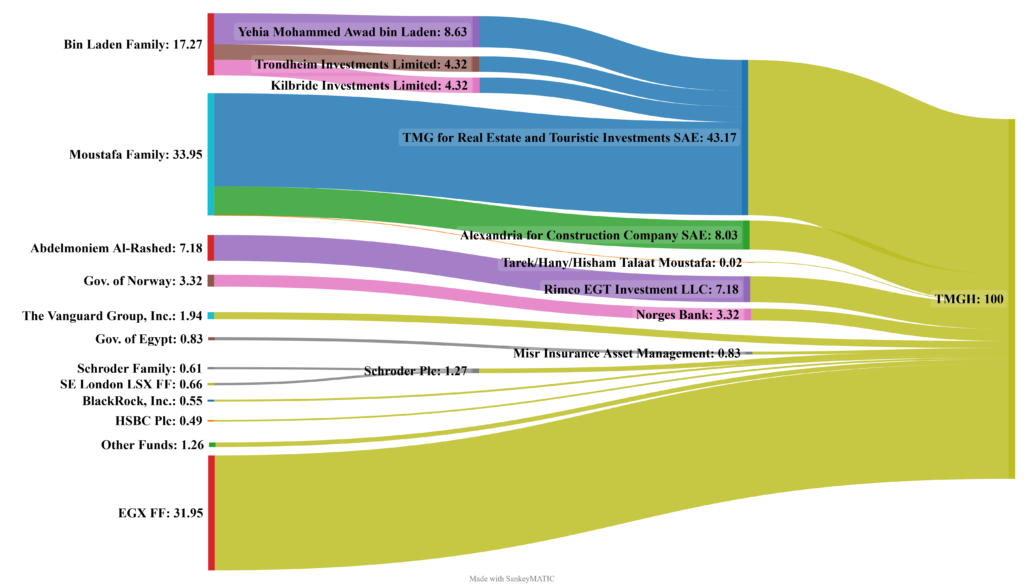

Who Owns PHDC?

Four groups of investors have major holdings in PHDC. The highest by far is the Egyptian Mansour family, which owns 30% of the company (Figure 2), both directly, but mostly indirectly through its Mansour Group which has a 60% holding of the Mansour and Maghraby Investment and Development (MMID) company, PHDC’s major shareholder. Yaseen Mansour is Chairman and CEO, and brother Mohamed Lotfy Mansour is Mansour Group Chairman and former transport minister (2005-2009).[3]

The second largest shareholder at 16% is the Maghraby family, whose Saudi based Maghraby group owns 40% of MMID. The family was made famous by Ahmed El-Maghraby who served as housing minister between 2006-2011 raising controversy, and later court cases, around the allocation of land to PHDC of which he was an indirect shareholder, during his reign,[4] forcing PHDC to return land to the state. [5]

In third place is the Government of Egypt, which owns almost 10% of PHDC through two state-owned banks: a 3.37% stake through Banque Misr, and a 6.2% stake through the Arab African International Bank (AAIB), which the GoE owns half of. The AAIB’s remaining 6.2% stake is owned by another government, that of Kuwait, making it PHDC’s fourth largest shareholder.

Around 7% of PHDC is held by a number of funds – led by the Vanguard Group, Norges Bank and BlackRock. A further 3% is owned by the PHDC ESOP, its executive management and board members as well Alaa Mubarak, former President Hosny Mubarak’s son. The remaining 30% of PHDC is held by unidentifiable smallholders on the EGX free float.

Figure 2: PHDC shareholding structure according to the UBO method as of 2021 Q4 (See Appendix B and Methodology)

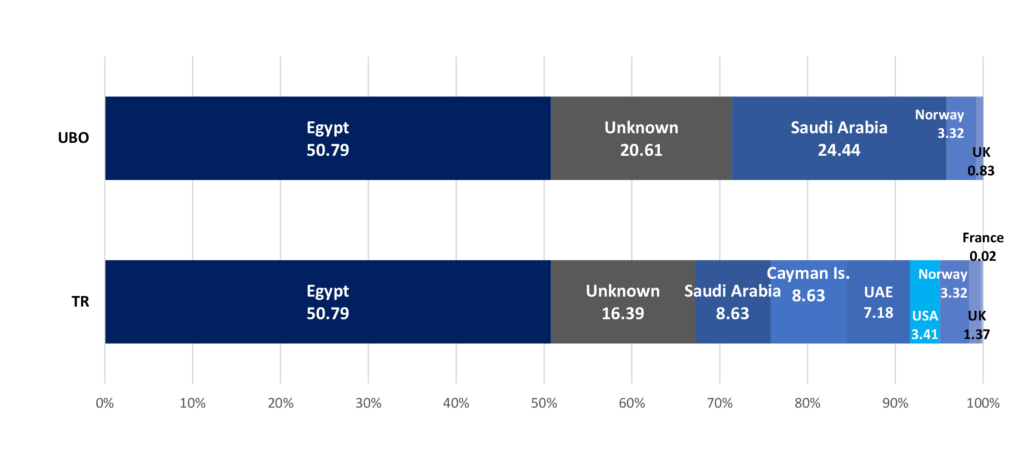

Investor Nationalities

PHDC is 58% Egyptian-owned according to the tax resident method (TR – See Methodology) (Figure 3). Investors from Saudi Arabia hold 16% of the company, rendering them in second place. Around 15% of shareholders are of unknown nationalities, mostly non-Egyptian smallholders on the stock market free float. Kuwait comes fourth with 6.2% of holdings, followed by the USA, Norway and other mostly Western countries.

Using the ultimate beneficial ownership (UBO) method (See Methodology), Egyptian holdings remain unchanged at 58%, while that of unknown nationalities grows to 18% as the nationality of investors in funds domiciled in the USA and other countries shifts. Saudi Arabia becomes the third largest shareholder, followed by Kuwait in fourth, and Norway in fifth.

Figure 3: PHDC shareholding by nationality under the TR and UBO methods

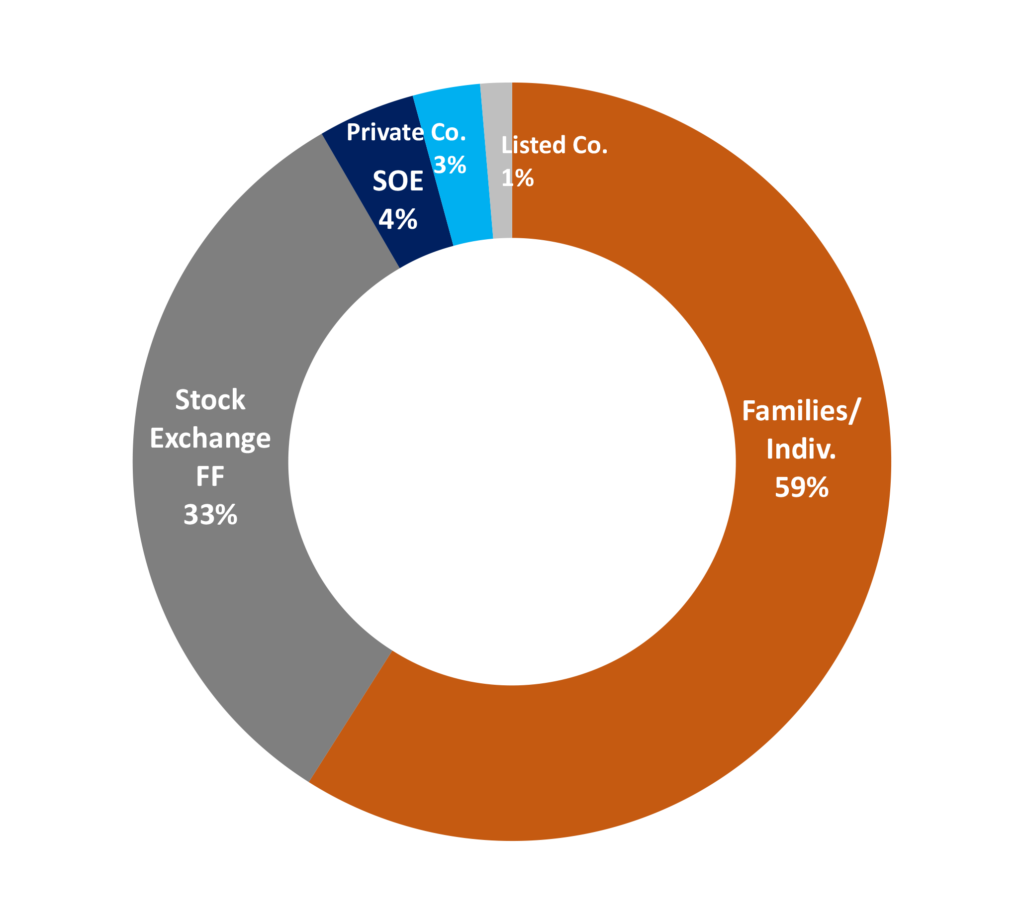

Investor Types

Under the UBO method, almost half of PHDC is family-owned given the Mansour and El-Maghraby families’ holdings (Figure 4), while 33% of its stock is owned by unidentified smallholders on the stock market free float. The third largest investor group is state-owned enterprises (SOEs), which own 17% of the company’s stock. Private companies own 4% of PHDC, and other listed companies’ funds own the remaining 1%.

Figure 4: PHDC shareholding by investor type – UBO

Back to Case Study Companies Page

Appendix A: Landholding Information

| Location | Development (Allocation date) |

Subsidiary / Co-development (% Owned) |

Land Area (Feddans) | Sources | ||

| Initial Land | De Jure Owned 2021 | Control 2021 | ||||

| 6th of October | Palm Hills October: Royal Palm, Solitaire Palm, Princes Palm, Golden Palm (2005) | Frmr. Ethadia for Real Estate (1997) | 263.0 | 263.0 | 263.0 | PHDC IP 09.2015 |

| Palm Hills Golf: Golf Views, Golf Extension, Woodville, Golf Central (2005) | 4th District Plot 6a-6c, and Plot 12-13-14 (2005-07) | 123.9 | 591.7 | 591.7 | MoH 437/2015 | |

| 4th District Plot 5 (2008) | 309.7 | 309.7 | 309.7 | |||

| Bamboo + Ext (2003) | Gawda for Trade Services SAE (100%) | 53.6 | 53.6 | 53.6 | PHD IP 09.2015 | |

| The Crown (2008) | 190.7 | 190.7 | 190.7 | MoH 419/2010 & 135/2018 | ||

| Palm Parks (2008) | Rakeen Egypt for Real Estate Investment SAE (99.95%) | 113.0 | 112.9 | 113.0 | MoH 563/2019 | |

| Palm Valley (1997) | Saudi Urban Development Co. SAE (51%, Talaat Lamy 49%) | 56.3 | 28.7 | 56.3 | MoH 432/2015 | |

| Sheikh Zayed | The 205 (2018) | Arkan Palm for Real Estate Investment SAE (40%,Badr Al Din Real Estate Development Company 60%) | 205.0 | 82.0 | 0.0 | MoH 852/2020 |

| Casa (2007) | Royal Gardens for Real Estate Investment SAE (51%, SODIC 20%, 29% others) | 70.0 | 35.7 | 70.0 | PHD IP 09.2015 | |

| Hadayek October | Badya (2018) | Palm for Urban Development SAE (99.40%) | 3,000.0 | 3,000.0 | 3,000.0 | MoH 1067/2018 |

| New Sphinx | Botanica (2008 on hold) | Half of plot given up to NUCA in 2021 in exchange for urban land use | 1,283.0 | 641.5 | 641.5 | PHD EGM 01.04.2021 |

| New Cairo | Palm Hills Katameya (2006) | 221.1 | 221.1 | 221.1 | MoH 862/2017 | |

| Palm Hills Katameya Ext (2009) | East New Cairo for Urban Development SAE (89% direct, 10.998% indirect) | 109.7 | 109.7 | 109.7 | MoH 68/2017 | |

| Capital Gardens (2015) | Co-development w MNHD (64%) through Palm Real Estate Developments SAE (99.40%) | 0.0 | 0.0 | 103.3 | PHDC PR 05.07.2015 | |

| Palm Hills New Cairo (2015) | Palm for Real Estate Investment and Development SAE (99.40%) | 501.1 | 498.1 | 501.1 | MoH 517/2018 | |

| The Village (2005) | New Cairo for Real Estate Developments SAE (100%) | 25.0 | 25.0 | 25.0 | PHD IP 09.2015 | |

| The Village Avenue (2007) | Saudi Urban Development Co. SAE (51%, Talaat Lamy 49%) | 8.3 | 4.2 | 8.3 | PHD IP 09.2015 | |

| The Village Gate (2007) | Saudi Urban Development Co. SAE (51%, Talaat Lamy 49%) | 31.2 | 15.9 | 31.2 | PHD IP 09.2015 | |

| Village Garden Katameya (2009) | East New Cairo for Urban Development SAE (89% direct, 10.998% indirect) | 67.8 | 67.8 | 67.8 | PHD IP 09.2015 | |

| PHD TOTAL | 6,632.3 | 6,251.3 | 6,356.9 | |||

| MoH: Minister of Housing Decree, IP: Investor Presentation, PR: Press Release. All subsidiary ownership percentages based on the annual consolidated financial statements of 2021 | ||||||

Appendix B: Shareholding Information

Direct Shareholding:

| Company | Shares | Sources |

| El Mansour & El Maghraby Investment & Development SAE (MMID)* | 39.65 | “PHDC Shareholder Disclosure 2021 Q4”

“PHDC Extraordinary General Meeting Minutes”, 01.04.2021

“Palm Hills Developments – Ownership” Simply WallSt. n.d. Accessed 31.03.2022

“Government Pension Fund Global Holdings of Equities at 31 December 2021” (Norges Bank) |

| Arab African Investment Management (Wholly owned subsidiary of Arab African Investment Bank)** | 12.39 | |

| Yasseen Ibrahim Mansour* | 4.94 | |

| Banque Misr SAE** | 3.37 | |

| The Vanguard Group, Inc. | 1.93 | |

| Norges Bank Investment Management | 1.64 | |

| Mahmoud Lotfy Ismail Mansour* | 0.92 | |

| PHDC ESOP* | 1.27 | |

| BlackRock, Inc. | 0.85 | |

| Hazem Mohamed Magdy Badran | 0.59 | |

| Alaa Mohamed Hosny al-Sayid (Mubarak) | 0.49 | |

| Tarek Mohamed Salah El Deen Tantawy | 0.49 | |

| Royal Insurance Company* | 0.39 | |

| Azimut Egypt Asset Management | 0.27 | |

| Van Eck Associates Corporation | 0.20 | |

| Yousef Mohamed Yousef al-Far | 0.12 | |

| Hassan Mohamed Hassan Darwish* | 0.05 | |

| EGX FF | 30.44 | |

| *Related parties, Mansour family, **Related parties, Government of Egypt | ||

Indirect Shareholding:

| Company | Nationality | Shareholding | Sources |

| Mansour & El Maghraby Investment & Development SAE (MMID) | Egypt | Mansour Group/Yassin Mansour (EG) 60.00

El-Maghraby Group (SA) 40.00 |

“MMID.” Mansour Group. n.d. Archived 10.06.2010.

and: Palm Hills Developments SAE, “Public subscription notice”, 27.09.2018

|

| El-Maghraby Group | Saudi Arabia | Maghraby Family 100

[Mohamed Akef Amin Abdelmaqsoud ElMaghraby, Ahmed Alaeldin Amin Abdelmaksoud ElMaghraby, possibly others] |

“El Mansour & El Maghraby Investment & Development BoD.” Misr for Central Clearing, Depository and Registry – MCDR. n.d. Accessed 04.04.2022

“MMID”, Mansour Group website, n.d. Archived: 19.06.2010 |

| Mansour Group | Egypt | Mansour Family 100

[Yasseen-Ibrahim Lotfy Mansour, Mohamed Lotfy Mansour, Youssef Lotfy Mansour, Rawya Lotfy Mansour, Mahmoud Lotfy Ismail Mansour, Mohamed Al Amin Lotfy Mansour, possibly others] |

“Palm Hills Development Company BoD and Shareholders Disclosure 2021 Q4”

“Who We Are”, Mansour Group Website. n.d. Accessed 30.03.2022

|

| Arab African Investment Bank | Egypt | Central Bank of Egypt (CBE) 50

Kuwait Investment Authority 50 |

“Arab African Investment Bank Shareholders.” AAIB. n.d. Accessed 30.03.2022 |

| Central Bank of Egypt (CBE) | Egypt | Government of Egypt 100 | “CBE BoD” CBE. n.d. Accessed 13.07.2022 |

| Kuwait Investment Authority | Kuwait | Government of Kuwait 100 | “KIA BoD” KIA. n.d. Accessed 13.07.2022 |

| Banque Misr SAE | Egypt | Government of Egypt 100 | “Banque Misr Ownership.” Banque Misr. n.d. Accessed 30.03.2022 |

| Norges Bank | Norway | Government of Norway 100 | About the Bank. Norges Bank, n.d. Accessed 30.03.2022 |

| Royal Insurance Company SAE | Egypt | MMID 49

Royal & Sun Alliance Middle East RSAME (UAE) 51 |

“Royal Insurance Company Ownership.” Royal Insurance. n.d. Accessed 30.03.2022 |

| Royal & Sun Alliance Middle East RSAME | UAE | RSA Insurance Group plc (UK) 100 | “Intact Financial Corporation and Tryg A/S Complete Acquisition of RSA Insurance Group Plc.” RSA. n.d. Accessed 31.03.2022 |

| RSA Insurance Group plc | United Kingdom | Intact Financial Corporation (CN) 100 | “RSA Insurance Group plc Ownership: History 2021.” RSA Group. n.d. Accessed 30.03.2022 |

| Azimut Egypt Asset Management | Egypt | AZ International Holdings | “Azimut Egypt: Who we are – Azimut Group” Azimut EG. n.d. Accessed 13.07.2022 |

| AZ International Holdings | Luxembourg | Azimut Holding SPA | “Azimut Group Shareholders” Azimut. n.d. Accessed 13.07.2022 |

| Azimut Holding spa | Italy | Timone Fiduciaria Slr 22.10

The Vanguard Group, Inc. 2.89 Norges Bank 2.15 Italian SX FF 77.9 |

Azimut Group: “Azimut Group.” n.d. Accessed: 30.03.2022 |

Back to Case Study Companies Page

[1] Palm Hills Development Company Consolidated Financial Statement for the year ended 31.12.2021, p.1

[2] Palm Hills Katameyya, The Crown, Palm Valley, and Palm Parks plots. See MoH decrees in Appendix A.

[3] ‘Who We Are’, Mansour Group, accessed 24 August 2022

[4] ‘UPDATE 2-Egypt’s Palm Hills Chairman Cleared of Corruption’, Reuters, 5 July 2011, sec. Financials,

[5] In 2011, PHDC revealed that a number of land plots were either part of court disputes or were returned to the state as part of ongoing investigations of the company. See: PHDC PR 09.06.2011.