- Published on 04 September 2022

Overview

Name: Housing & Development Bank SAE Reuters Code HDBK.CA

Established: 1979

Listed on the EGX: 1983

Scope and activities: The Housing and Development Bank SAE is an Egypt-based commercial and investment bank that principally operates in the housing and development sector. HDBK has two distinct operations. Financial operations, with personal and business retail banking, public housing projects financing, as well as mortgage financing and fund management. HDBK is also directly invested in real estate activities, through both wholly and partially owned subsidiaries that develop, construct and sell residential, commercial, and touristic real estate, as well as manage and secure communities, in addition to marketing real estate for third parties and managing reservations for government-built housing projects. The company also works on accepting deposits, issuing housing and construction savings certificates, banking, granting loans and affiliation facilities, and investing the bank’s funds to ensure achieving its objectives and develop its resources, in particular: -Establishment of joint companies -Financing all housing-related businesses – Collection, reception, and payment of money, including agency and financial representation for clients, and provision of investment services. [1]

Company Vitals:

| Indicator | Value | Case Study Ranking |

| Annual Profits (Avg. 2010-2021) | LE 392mn* | 5/10 |

| Market Capitalization (12.2021) | LE 1.97bn** | 9/10 |

| Cairo Land Ownership – De Jure (12.2021) | 1420 acres | 7/10 |

| Cairo Land Ownership – Control (12.2021) | 1621 acres | 7/10 |

| 3.9% of case study land | ||

| *Isolated housing and real estate profits **Prorated to housing and real estate profits | ||

How much land does HDBK own?

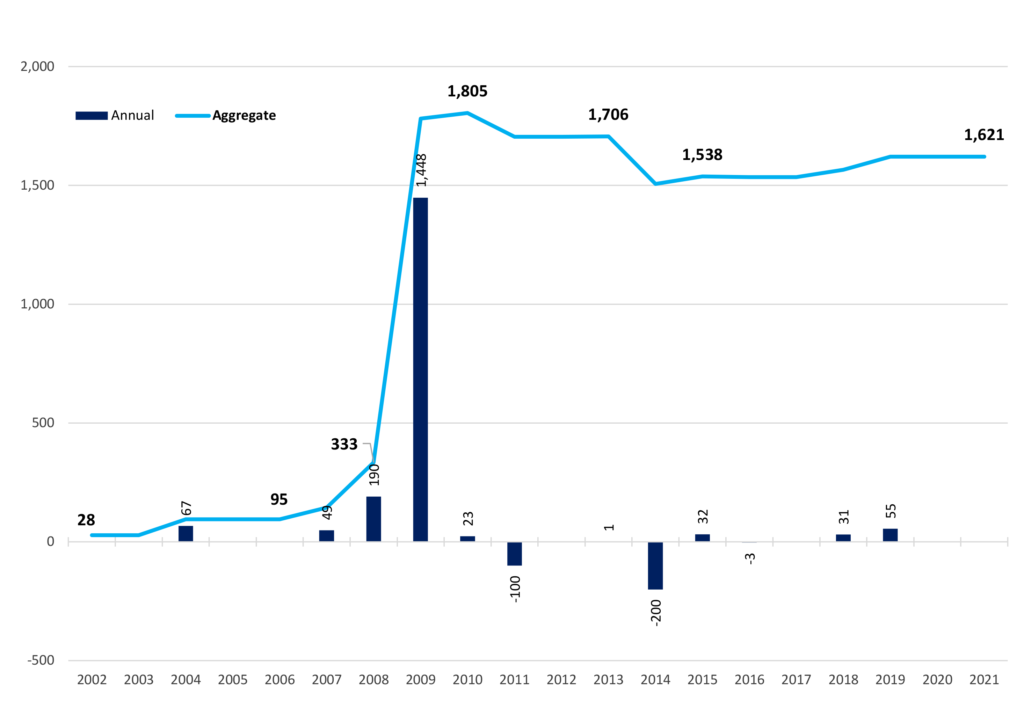

Based on the de jure method (See Methodology), HDBK owns 1420 acres in Cairo, both directly, but mostly indirectly through three main subsidiaries: The Housing and Development for Real Estate Investment Co., which it owns 95% of, and Hyde Park Properties for Development SAE (54%), which are its major subsidiaries. HDBK also owned 40% of City edge Developments SAE by the end of 2021, though its major shareholder – as well as HDBK’s major holder, the New Urban Communities Authority (NUCA), has since upped its share. This varied shareholding means that under the control method (See Methodology), HDBK’s landholdings rise to 1621 acres, where 100% of Hyde Park’s landholdings are included, while all of City Edge’s land is omitted given the minority shareholding. Overall, the bulk of HDBK’s land was acquired by 2010, reaching a peak of 1805 acres (Figure 1). Since then, its main subsidiaries have not acquired any significant land, and two co-development agreements on its Hyde Park New Cairo plot have seen its holdings under control drop to 1621 acres at the end of 2021.

Figure 1: HDBK landbank accumulation analysis – Control Method 2002-2021 (Acres). Sources: See Appendix A

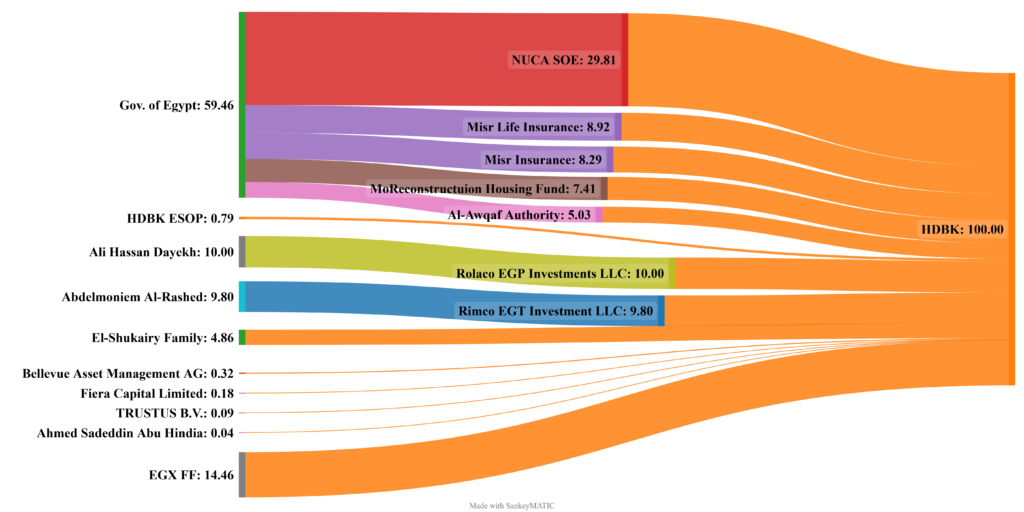

Who owns HDBK?

HDBK was originally set up by the government of Egypt in 1979 as a sectoral bank, used to finance applicants for government housing units. It has since expanded into other facets of the housing and real estate industry, where it was partly floated on the EGX in 1983. Since then, however, the government of Egypt is still HDBK’s largest shareholder by far, owning almost 60% of the company through five SOEs (Figure 2). The second largest holder is Saudi businessman Ali Dayekh (10%), followed by another countryman, Abdelmoniem al-Rashed (9.8%). The Egyptian El-Shukairy family own a little less than 5% of HDBK, led by businessman Mohamed El-Shukairy. The remaining 15% of company stock is held by a handful of international funds and smallholders on the EGX.

Figure 2: HDBK shareholding structure according to the UBO method as of 2021 Q4 (See Appendix B and Methodology)

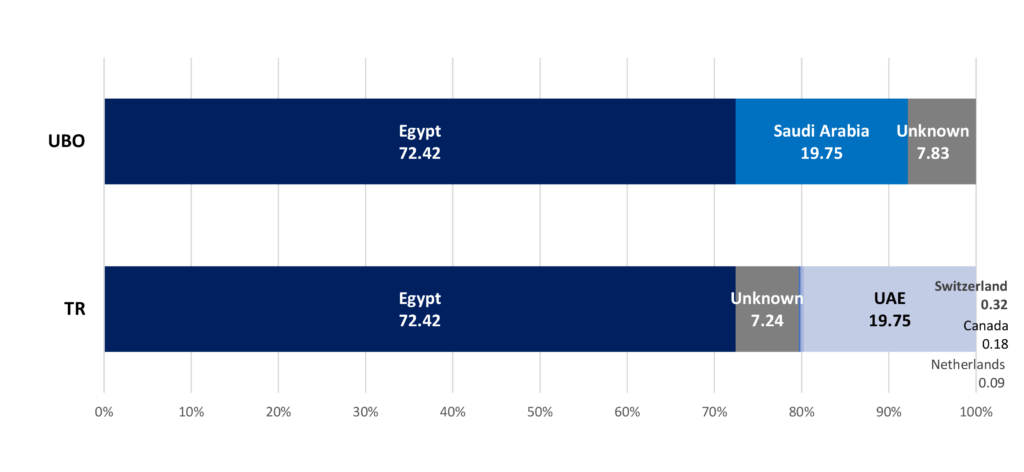

Investor Nationalities

Using the tax resident (TR) method (See Methodology), Egypt-based investors are the largest holder of HDBK stock at 72% (Figure 3). They are followed by companies based in the UAE holding almost 20% of the company. The third largest shareholders are smallholders on the EGX of unknown nationalities (8%),

According to the ultimate beneficial owner (UBO) method (See Methodology), Egypt remains the largest shareholder with 72% of HDBK stock, now followed by Saudi Arabia-based investors holding 20% of the company. Owners of unknown nationalities, mostly smallholders on the EGX free float, are the third largest shareholders owning less than 8% of HDBK.

Figure 3: HDBK shareholding by nationality under the TR and UBO methods

Investor Types

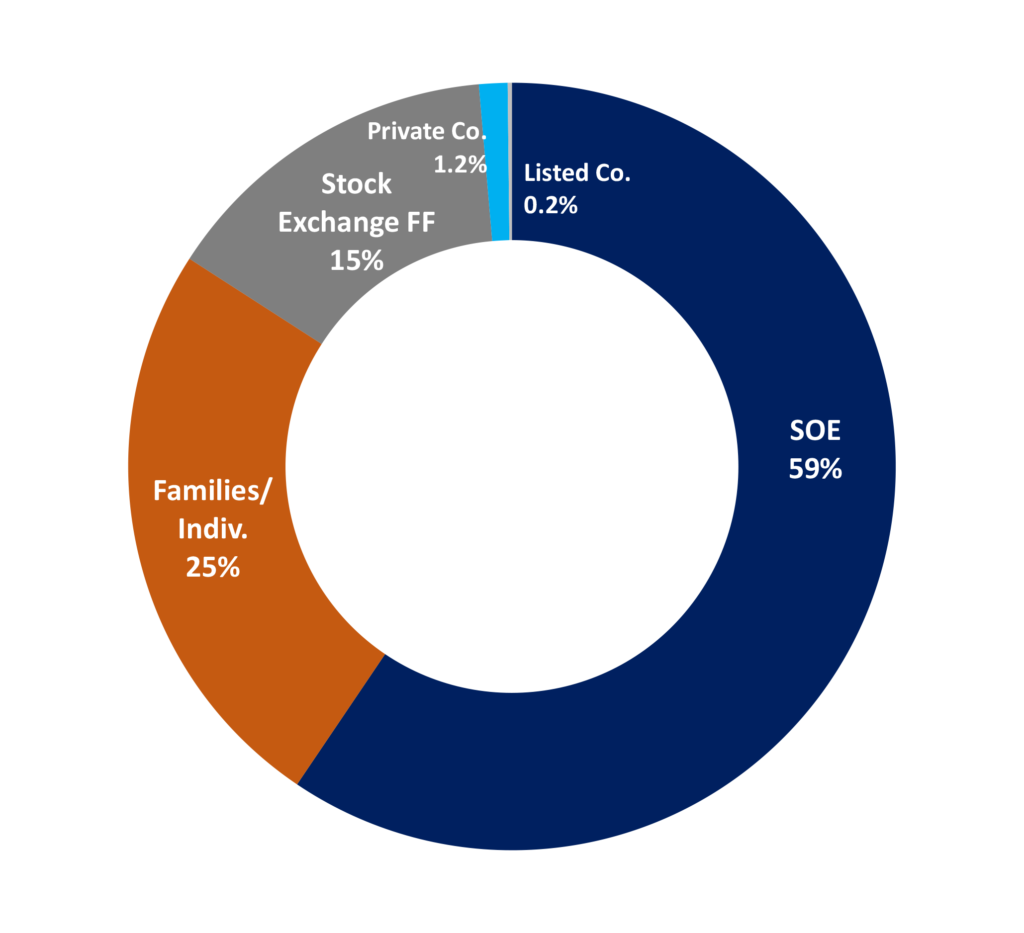

Egypt-based SOEs hold 59% of HDBK under the UBO method, making them the largest shareholder type by far (Figure 4). High net worth individuals – the two Saudi Arabian and the Egyptian businessman, are the second largest investor type holding one-quarter of HDBK shares. Smallholders on the EGX hold 15% of the company, while investors in private non-listed, as well as listed companies and funds, own less than 2% of HDBK.

Figure 4: HDBK shareholding by investor type – UBO

Back to Case Study Companies Page

Appendix A: Landholding Information

| Location | Development (Allocation date) |

Subsidiary / Co-development (% Owned) |

Land Area (Feddans) | Sources | ||

| Initial Land | De Jure Owned 2021 | Control 2021 | ||||

| New Cairo City | Al-Mostaqbal City Land Plot (part of La Mirada Dev.) (2018) | HDRIC (95%) | 30.6 | 29.1 | 30.6 | Amwal al-Ghad 28.11.2018 |

| Land Plot (2020) | City Edge (40%) | 0.0 | 0.0 | 0.0 | Al Mal 25.03.2021 | |

| Palma, former Al-Safa (2008) | 26.0 | 26.0 | 26.0 | HDBK Website, GE | ||

| Palma – Sale to Waterway (2016) | -2.8 | -2.8 | Al-Mal 01.09.2019, GE | |||

| Acacia, former Al-Horreya (2007) | 48.7 | 48.7 | 48.7 | HDBK Website, GE | ||

| Hyde Park New Cairo, frmr Garden Heights (2009) | Hyde Park SAE (54%) | 1,447.9 | 777.0 | 1,447.9 | MoH 506/2019, Emirates 24/7 26.02.2009 | |

| Hyde Park Mountain View (2014) | Co-development sale w Mountain View SAE (?) | -200.0 | Mountain View Website, Hyde Park Website, GE | |||

| Hyde Park The Square (2011) | Co-development sale w Al-Ahly Sabbour SAE (?) | -100.0 | Al-Ahly Sabbour Website, Hyde Park Website | |||

| Les Rois, Pearl Les Rois (2008) | HDRIC (95%) | 164.0 | 155.7 | 164.0 | HDRIC Website | |

| Cairo | Etlalah (2013) | HDRIC (95%) | 1.3 | 1.2 | 1.3 | HDRIC Website |

| El Taamier Towers Matareya (Pre 2002) | HDRIC (95%) | 2.8 | 2.6 | 2.8 | HDRIC Website | |

| Helwan Plot (Pre 2002) | 25.0 | 25.0 | 25.0 | Cairo Governor Decree 2927/2019 | ||

| 6th of October City | Eshraqa (2015) | HDRIC (95%) | 32.0 | 30.4 | 32.0 | HDRIC Website |

| Tala (2019) | HDRIC (95%) | 24.0 | 22.8 | 24.0 | HDRIC T&C 2019 | |

| Montazah (2010) | 23.3 | 23.3 | 23.3 | HDBK Website | ||

| Tawny (2019) | Hyde Park SAE (54%) | 31.1 | 16.7 | 31.1 | MoH 881/2020 | |

| Sheikh Zayed City | Opera City (2004) | 67.0 | 67.0 | 67.0 | HDBK Website | |

| Etapa (2015) | City Edge (40%) | 77.1 | 30.5 | 0.0 | MoH 111/2018 | |

| New Capital City | Al-Maqsad (2019) | City Edge (40%) | 421.6 | 166.6 | 0.0 | City Edge Website |

| HDB TOTAL | 2,422.4 | 1,419.7 | 1,620.9 | |||

| HDRIC: Housing & Development for Real Estate Investment Co. SAE, RS: Revenue Share Agreement, MoH: Minister of Housing Decree, T&C: Unit Sale Terms and Conditions. All subsidiary ownership percentages based on the annual consolidated financial statements of 2021 | ||||||

Appendix B: Shareholding Information

Direct Shareholding:

| Company | Shares | Sources |

| New Urban Communities Authority* | 29.81 | “BoD and Shareholder Disclosure 2021 Q4.”, Housing and Development Bank

“Related Parties Transaction Disclosure.”, Housing and Development Bank, 30.08.2021

“Housing and Development Bank – Ownership” Simply WallSt. n.d. Accessed 31.03.2022 |

| Rolaco EGB Investment LLC | 10.00 | |

| Rimco EGT Investment LLC | 9.80 | |

| Misr Life Insurance SAE* | 8.92 | |

| Misr Insurance SAE* | 8.29 | |

| Ministry of Reconstruction Housing Fund* | 7.41 | |

| Al-Awqaf Authority* | 5.03 | |

| El-Shukairy Family** | 4.86 | |

| Housing and Development Bank ESOP* | 0.79 | |

| Bellevue Asset Management AG | 0.32 | |

| Fiera Capital Limited | 0.18 | |

| Trustus Capital Management B.V. | 0.09 | |

| Ahmed Sadeddin Abu Hindia* | 0.04 | |

| EGX FF | 14.51 | |

| *Related parties (Egypt SOEs and HDBK management)

**Mohamed Yassine El-Shukairy (1.23%), Fatma Mohamed Yassine (0.73%), Asia Mohamed Yassine (0.73%), Laila Mohamed Yassine (0.73%), Aya Mohamed Yassine (0.73%), Laila Biban Al-Sayed Khashab (0.71%) |

||

Indirect Shareholding:

| Company | Nationality | Shareholder(s) | Sources |

| New Urban Communities Authority (NUCA) | Egypt | Egyptian Government 100 | Law 59/1979 |

| Rolaco EGP Investment | UAE | Ali Hassan Ali Ben Dayekh (Saudi Arabia) 100 | “Related party disclosure”, MMTE, 10.03.2022 |

| Rimco EGT Investment LLC | UAE | Abdulmonem Rashed Alrashed (Saudi Arabia) 100 | “Rimco E G T Investment Owned By Abdulmonem Rashed Alrashed One Person Company L.L.C in Dubai” Dubai Chamber: Dubai Commercial Directory. n.d. Accessed 30.03.2022 |

| Misr Life Insurance | Egypt | Egyptian Government 100 | Misr Insurance Holding Company ownership p.5 |

| Misr Insurance | Egypt | Egyptian Government 100 | Misr Insurance Holding Company ownership p.5 |

| Ministry of Reconstruction Housing Fund

|

Egypt | Egyptian Government 100 | Presidential Decree 494/1979 |

| Awqaf Authority

|

Egypt | Egyptian Government (Ministry of Religious Endowments) 100 | Law 80/1971 and 209/2020 |

| Bellevue Asset Management AG

|

Switzerland | Bellevue Group 100 | Bellevue Asset Management ownership |

| Bellevue Group | Switzerland | Martin Bisang (Switzerland) 20.67

Hans Wyss (Switzerland) 9.77 Jürg Schäppi (Switzerland) 9.15 SWX FF 60.41 |

Bellevue Group top shareholders |

| Fiera Capital Limited | Cayman Is. | Fiera Capital Corporation (Canada) | “Building a Global Asset Management Firm”, Fiera Capital Corporation. June, 2020 |

Back to Case Study Companies Page

[1] HDBK Consolidated Financial Statement for the year ended 31.12.2021, p.1