- Published on 04 September 2022

Overview

Name: Orascom Development Egypt SAE ORHD.CA

Established: 1995

Listed on the EGX: 1998

Name Change 2017: Changed from Orascom Hotels and Development SAE

Scope and activities: The company develops resort towns and hotels, and is involved in land sub-division, and extending needed utilities and infrastructure such as water, lighting, sewage, public transportation, and telecommunications networks, health, cultural, and recreational centers, alongside places of worship. The company also works on the construction of affordable housing (cooperative housing).[1]

Company Vitals:

| Indicator | Value | Case Study Ranking |

| Annual Profits (Avg. 2010-2021) | LE 216bn | 9/10 |

| Market Capitalization (12.2021) | LE 6.78bn | 4/10 |

| Cairo Land Ownership – De Jure (12.2021) | 705 acres | 8/10 |

| Cairo Land Ownership – Control (12.2021) | 1007 acres | 8/10 |

| 2.4% of case study land |

How much land does ORHD own in Cairo?

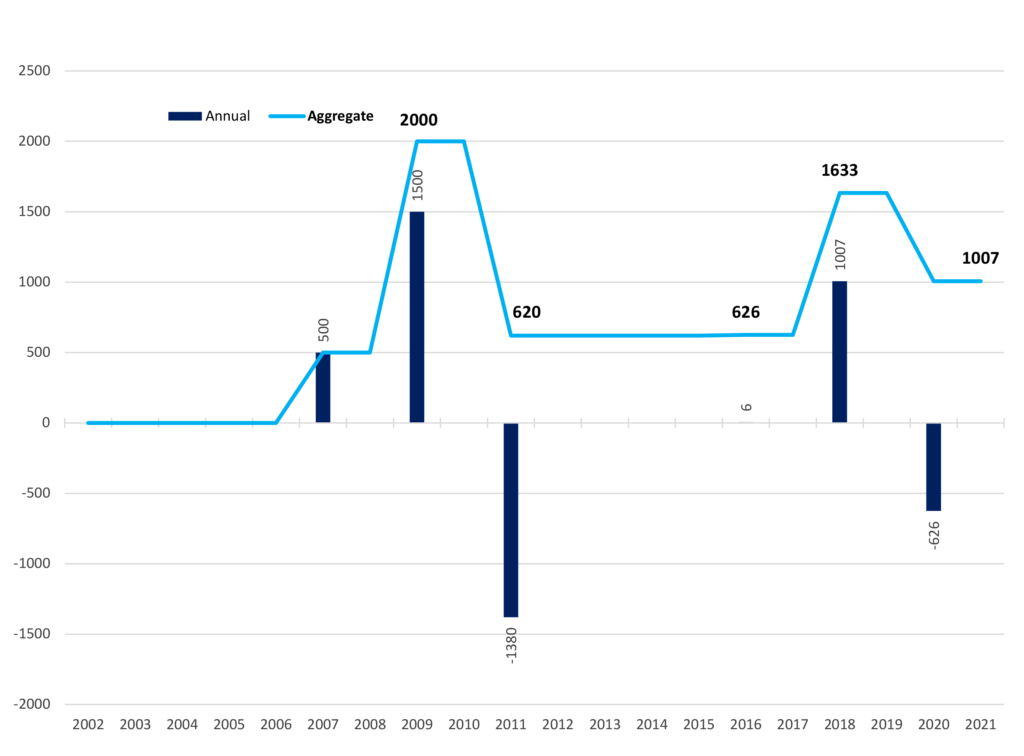

Orascom owned 705 acres in Cairo at the end of 2021 under the de jure method (See methodology), which constituted just one development owned through a subsidiary, Orascom Real Estate (For more information see Appendix A below). This grew to 1007 under the control method (See methodology) after the full land plot area is considered. However, this is significantly down from two peaks of 2000 and 1633 acres in 2010 and 2019 respectively when it still owned the Haram City development (Figure 1). ORHD was allocated 500 acres of the Haram City plot in 2007 with a promise from NUCA to raise that to 2000 feddans based on conditions for developing it as low-income housing under the National Housing Program, where a further 1500 acres were allocated in 2009.[2] However, a dispute over these conditions resulted in the retrieval of all the as yet undeveloped land (approximately 1380 acres) in 2011.[3] This led to an international arbitration case, the settlement of which concluded with the 2018 agreement to re-allocate part of the retrieved land as the O West development.[4] In 2020 ORHD sold its stake in the Haram City subsidiary (Orascom Housing Communities), ending its involvement in low-income housing.[5]

Figure 1: ORHD landbank accumulation analysis – Control Method 2002-2021 (Acres). Sources: See Appendix A

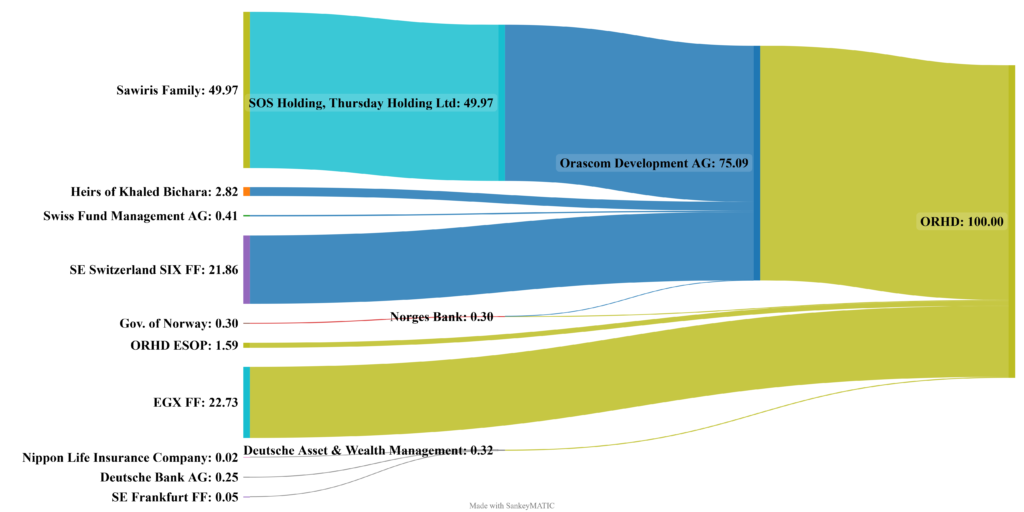

Who Owns ORHD?

ORHD acts as a subsidiary of Orascom Development Holding AG (ODHN.S) which owns 75% of ORHD and is itself listed on the Swiss stock exchange. This company’s largest shareholder is the Sawiris Family – through the Samih Sawiris branch, which indirectly own 50% of ORHD.[6] The second largest owner are the heirs of late CEO Khalid Bichara who indirectly own less than 3% of ORHD, followed by the ORHD ESOP and a handful of investment funds. The remaining 44% of the company are owned by thousands of smallholders split on the Swiss and the Egyptian stock exchange free floats.

Figure 2: ORHD shareholding structure according to the UBO method as of 2021 Q4 (See Appendix B and methodology)

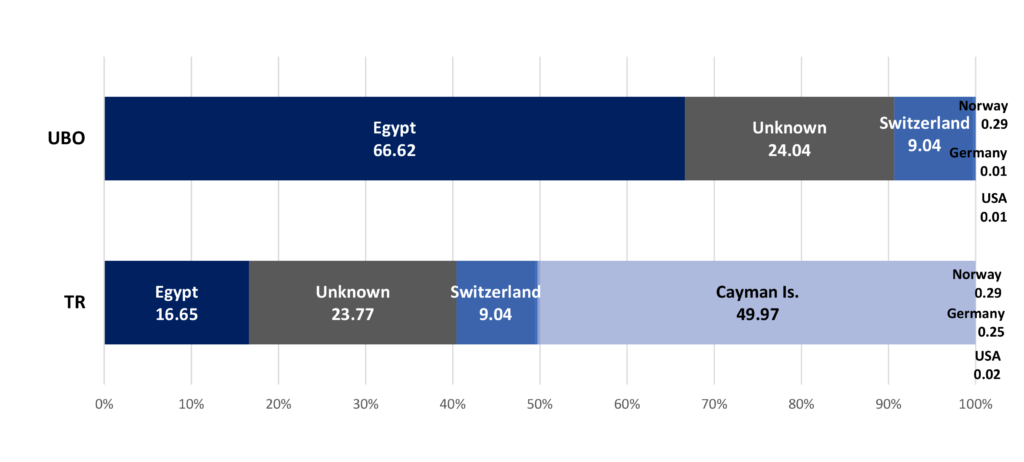

Investor Nationalities

Based on the tax resident (TR) method (See methodology), half of ORHD is owned by investors based in the Cayman Islands (Figure 3). The second largest shareholders by nationality are unidentifiable smallholders on the Swiss and Egyptian stock exchanges (24%), followed by investors based in Egypt (17%). Swiss-based investors are in fourth place, constituting 9% of ORHD.

Under the ultimate beneficiary owner (UBO) method (See methodology), Egypt-based investors are the largest owners of ORHD at 67%, after the Sawiris family holdings shift from the Cayman Islands company to them personally. Unidentifiable smallholders on the Swiss and Egyptian free floats remain the second largest holding 24% of ORHD stock. In third place are Swiss-based investors holding 9% of the company.

Figure 3: ORHD shareholding by nationality under the TR and UBO methods

Investor Types

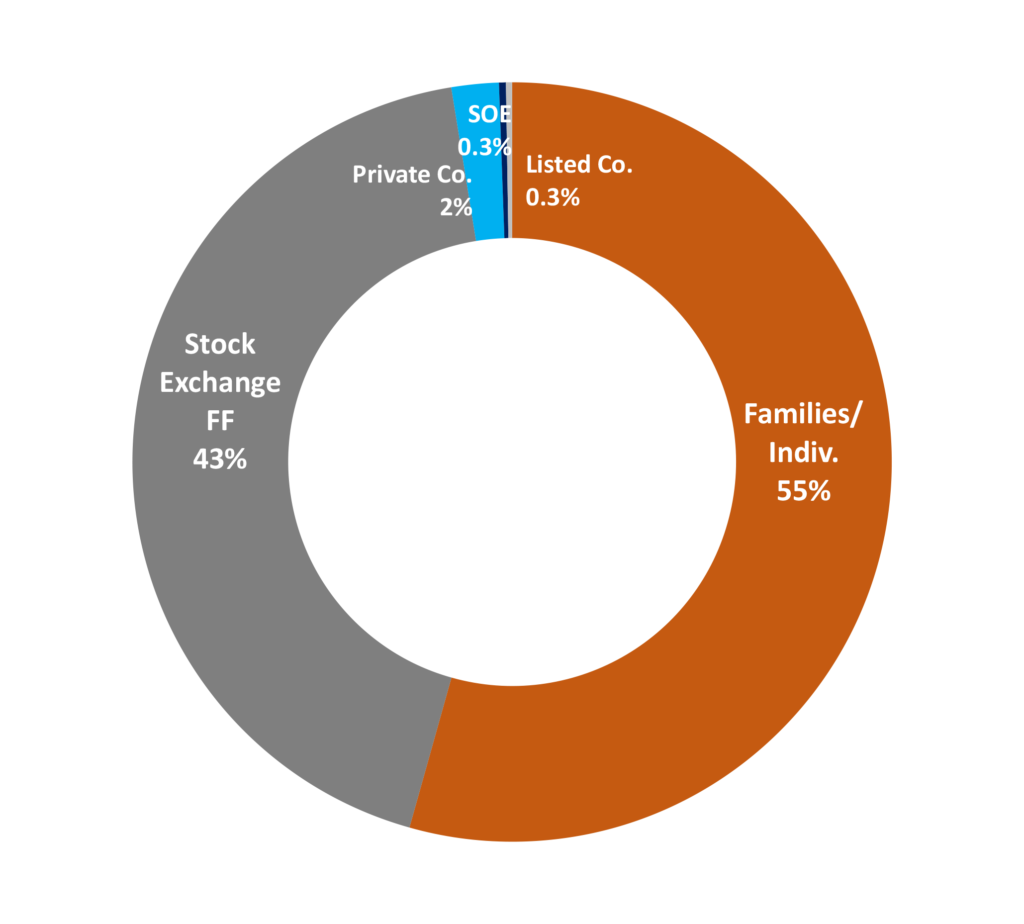

Given the Sawiris family being the largest shareholder, the Families/individual investor type is ORHD’s largest holder at 55% (Figure 4). This is closely followed by smallholders on the Swiss and Egyptian exchanges constituting 43% of ORHD shareholding. In distant third place are private non-listed companies (2%), followed by SOEs and listed companies holding 0.3% each.

Figure 4: ORHD shareholding by investor type – UBO

Back to Case Study Companies Page

Appendix A: Landholding Information

| Location | Development (Allocation date) |

Subsidiary / Co-development (% Owned) |

Land Area (Feddans) | Sources | ||

| Initial Land | De Jure Owned 2021 | Control 2021 | ||||

| Hadayek October | O West (2018) | Orascom Real Estate (ORHD 70%, Samih Sawiris 30%) | 1,007.3 | 705.1 | 1,007.3 | MoH 387/2019 |

| Haram City (2007-2020) | New City Housing & Communities SAE, former Orascom Housing Communities (35% sold in 2020 to GB Capital SAE and others) | 626.0 | 0.0 | 0.0 | MoH 42/2020,

|

|

| Ashgar City (2007-2021) | Ashgar City SAE, former Orascom for Housing & Establishments (39.9%, sold to IGI Real Estate SAE in 2021) | 148.5 | 0.0 | 0.0 | MoH 527/2021,

|

|

| ORHD TOTAL | 1,633.3 | 705.1 | 1,007.3 | |||

| RS: Revenue Share Agreement, MoH: Minister of Housing Decree. All subsidiary ownership percentages based on the annual consolidated financial statements of 2020 and 2021.

|

||||||

Appendix B: Shareholding Information

Direct Shareholding:

| Shareholders | Shares | Sources |

| Orascom Development AG

|

75.09

|

“BoD & Shareholder Structure Disclosure 2021 Q4“, Orascom Development Egypt SAE.

“Orascom Development Egypt SAE”, Simply Wall St. n.d. Accessed: 29.03.2022

“Government Pension Fund Global Holdings of Equities at 31 December 2021” (Norges Bank) |

| ORHD ESOP | 1.59 | |

| Norges Bank | 0.28 | |

| Deutsche Asset & Wealth Management (DWS) | 0.31 | |

| EGX FF | 22.73 |

Indirect Shareholding:

| Company | Nationality | Shareholders/ Ultimate Parent | Sources |

| Orascom Development AG (ODHN.S)

|

Switzerland | Thursday Holding Ltd & SOS, Holding Ltd 66.55

Heirs of Khaled Bichara 3.72 Naguib S. Sawiris 0.64 Swiss Fund Management AG 0.55 Eskandar Tooma 0.49 Jürgen Fischer 0.33 Jürg Weber 0.25 Carolina Müller-Möhl 0.22 Franz Egle 0.15 Norges Bank 0.03 SIX FF 27.04 |

“Significant Shareholders – Orascom Holding AG: Beneficial Owners.” SIX Exchange Regulation (Swiss Stock Exchange), as of 31.12.2021

“Consolidated Financial Statements for the year ended 31.12.2021”, Orascom Development Holding AG, p91

“Orascom Development Holding Ownership.” Simply WallSt. n.d. Accessed 04.04.2022

“Government Pension Fund Global Holdings of Equities at 31 December 2021” (Norges Bank) |

| Thursday Holding Ltd

SOS Holding Ltd |

Cayman Islands | Sawiris Family 100

[Samih O. Sawiris, Naguib S. Sawiris, Taya Sawiris, Tary Sawiris] (Egypt, Switzerland) |

“Significant Shareholders – Orascom Holding AG: Beneficial Owners.” SIX Exchange Regulation (Swiss Stock Exchange), as of 31.12.2021 |

| Heirs of Khaled Bichara | Egypt | Jeannedark Georges Mansour Gerges, Marianne Samir Mahfouz Simakia, Sherif Khaled Galal Bichara, Galal Khaled Galal Bichara (Egypt) | “Significant Shareholders – Orascom Holding AG: Beneficial Owners.” SIX Exchange Regulation (Swiss Stock Exchange), as of 31.12.2021 |

| Norges Bank | Norway | Government of Norway 100 | About the Bank. Norges Bank, n.d. Accessed 30.03.2022 |

| Deutsche Asset & Wealth Management LTD (DWS KGaA from 2018) | Germany | Deutsche Bank AG (Through DB Beteiligungs-Holding GmbH) 79.49

Nippon Life Insurance Company 5 SE Frankfurt FF 15.51 |

“Annual Report 2021”,DWS. pXXVI

|

| Deutsche Bank AG | Germany | BlackRock, Inc 5.23

The Capital Group Companies, Inc. 5.20 (USA) Douglas L. Braunstein 3.18 Paramount Services Holdings Ltd. 3.05 (UK) Supreme Universal Holdings Ltd. 3.05 (Cayman Islands) |

“Deutsche Bank Shareholder Structure.” Investor Relations. n.d. Accessed 04.04.2022 |

Back to Case Study Companies Page

Notes & References

[1] ORHD Consolidated Financial Statements for the year ended 31.12.2021, p6

[2] MoH 42/2020. See Haram City in Appendix 1.

[3] ORHD Consolidated Financial Statements for the year ended 31.12.2011, p38-39

[4] ICSID Case No. Arb/16/37. See: MoH 387/2019 in Haram City, Appendix 1.

[5] A similar fate involved the Ashgar City development listed in the table below but omitted from the graph since it was never under ORHD control. See: appendix 1.

[6] Another real estate company, Ora Developers, is owned by a Sawiris family member, Naguib Sawiris. However, it is not a subsidiary of any listed company they are shareholders in and is thus not included in this case study.