- Published on 04 September 2022

Who Owns Cairo: Case Study Companies

Overview

Name: Heliopolis Housing and Development SAE HELI.CA

Established: January 1906

Nationalized:1961

Listed on the EGX: 1995

Scope and activities: The company engages in the construction and housing projects. The Company’s operations include land reclamation and subdivision, residential real estate development and management, real estate property purchase and sale, real estate projects planning and supervising, as well as the construction of homes, hotels, holiday resorts, touristic villages and cities, administrative and educational buildings, factories, and hospitals. The company also works on the distribution and sale of electricity, and it provides its investors with technical consultation if needed.[1]

Company Vitals:

| Indicator | Value | Case Study Ranking |

| Annual Profits (Avg. 2010-2021) | LE 237mn | 8/10 |

| Market Capitalization (12.2021) | LE 8.96bn | 3/10 |

| Cairo Land Ownership – De Jure (12.2021) | 6441 acres | 2/10 |

| Cairo Land Ownership – Control (12.2021) | 5786 acres | 3/10 |

| 14% of case study land |

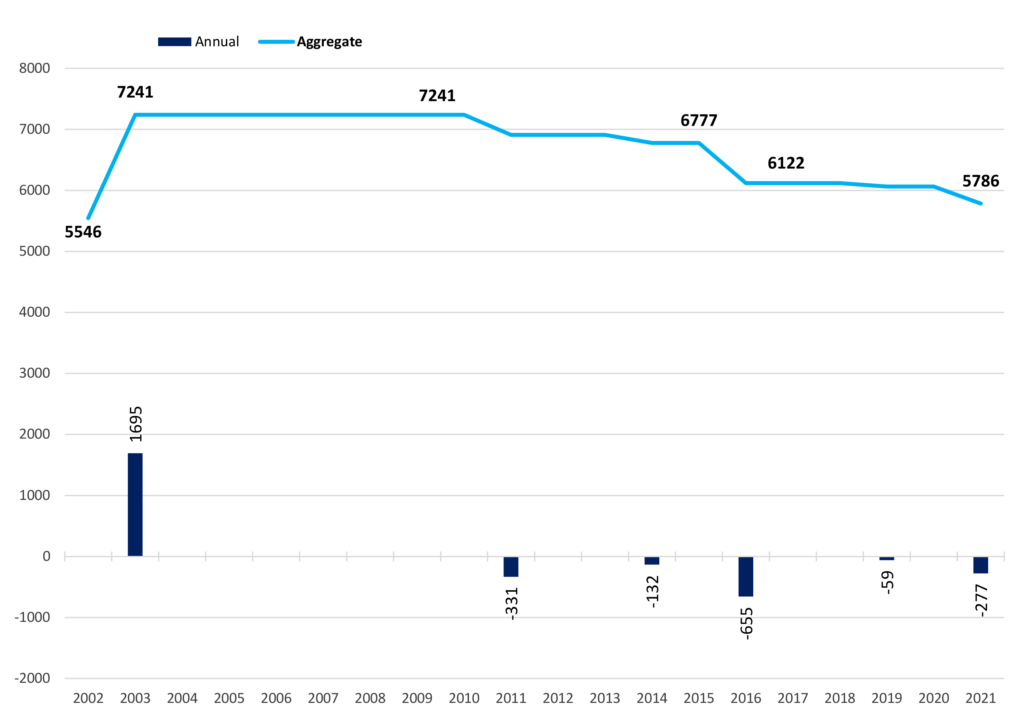

How much land does HELI own in Cairo?

HELI has the second largest landbank in Cairo under the de jure method (see Methodology) at 6441 acres (See Appendix A). This is mostly desert land in the new cities and does not include land in older parts of the Heliopolis district in Cairo that is already built on, with the exception of some large commercial assets. However, HELI’s landholdings fall to 5786 acres under the control method (see Methodology), ranking it third among the case study companies. This makes it the only company in this case study to have significantly more de jure land than it does under control, as well as significantly less land in 2021 than it did at its peak of 7241 acres in 2010 (Figure 1) as it acts more as a master developer, selling land plots and entering into co-development agreements, more than it builds its own developments. It is also worthy to note that even though HELI has been listed over 25 years ago, it has not bought a single land plot in Cairo since relying on the landbank it was given by the state when it was still (fully) government owned.

Figure 1: HELI landbank accumulation analysis – Control Method 2002-2021 (Acres). Sources: See Appendix A

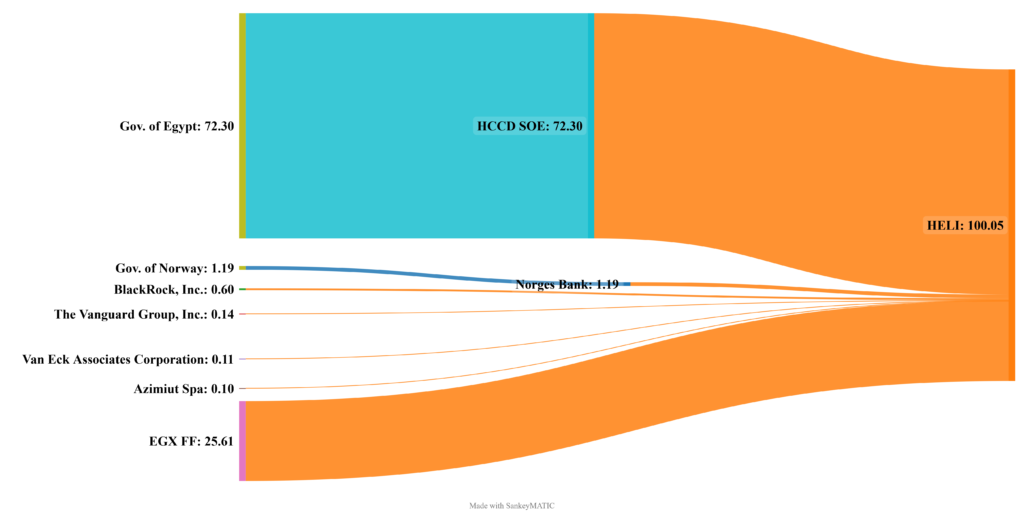

Who Owns HELI?

HELI was founded in 1906 to develop the eponymous Heliopolis district of Cairo. The company was nationalized in 1961 and remained a state owned enterprise (SOE) until it was listed on the EGX in 1995. Despite this, it is still very much an SOE as the Government of Egypt is its single major shareholder, where the Ministry of Public Business Sector owns 72% of its shares through the Holding Company for Construction and Development (HCCD) (Figure 2). Its second-largest shareholder by far is another government, that of Norway, whose Norges Bank owns 1.19% of HELI. A handful of funds own around 1% of the company, and one-quarter of its stock is held by unidentifiable smallholders on the EGX free float.

Figure 2: HELI shareholding structure according to the UBO method as of 2021 Q4 (See Appendix B and Methodology)

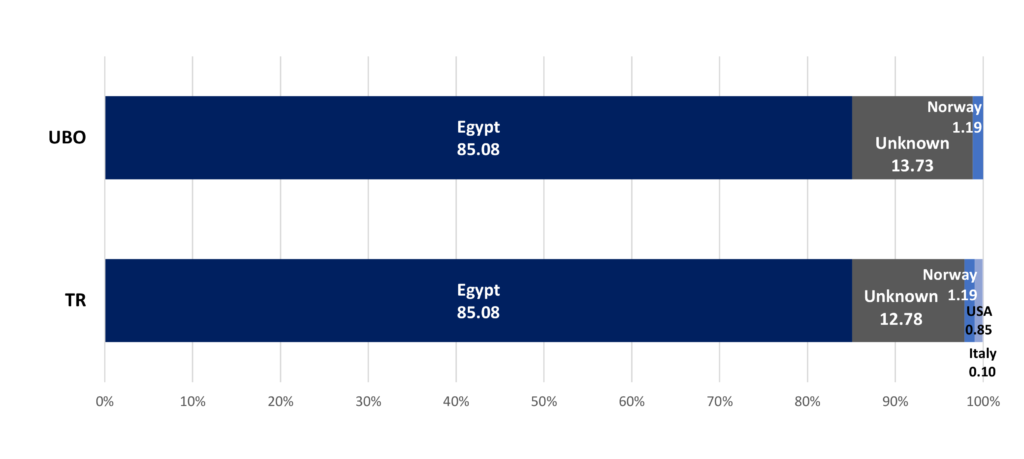

Investor Nationalities

Given that the Government of Egypt is the single largest shareholder by far, and the stock market free float, Egyptians hold 85% of HELI (Figure 3), and that is under the tax residence method (see Methodology) . The second largest group is that of unidentifiable smallholders on the EGX free float holding about 13% of the company. In distant third is Norway (1.19%), followed by funds in the USA (0.85%) and Italy (0.10%).

Under the UBO method (see Methodology) , investors from Egypt remain the largest holders by far at 85%, while holdings of the investment funds shift to the ‘unknown’ category, raising it slightly to almost 14%. Norway is the third largest shareholder at 1.19% of HELI.

Figure 3: HELI shareholding by nationality under the TR and UBO methods

Investor Types

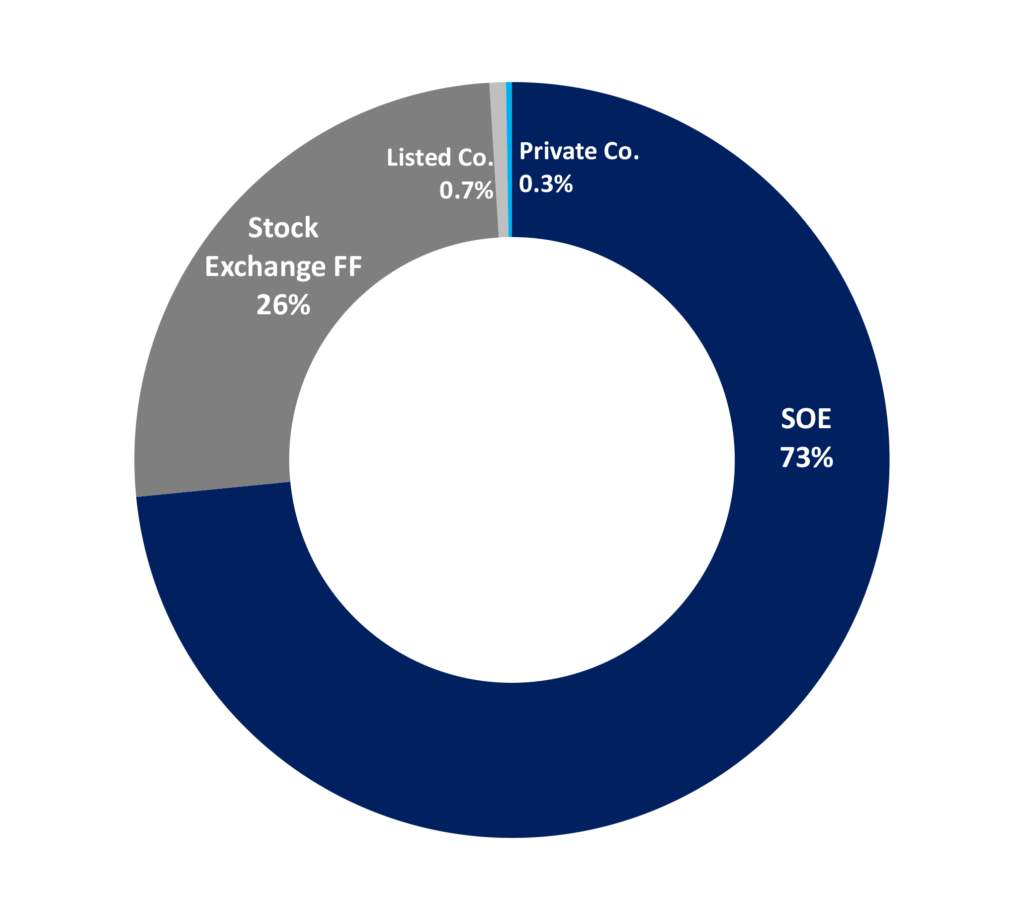

SOEs represent the single largest investor type by far, holding 73% of HELI (Figure 4). The second largest group are smallholders on the EGX free float owning 26% of the company. These are followed by listed companies or funds (0.7%) then private non-listed companies (0.3%).

Figure 4: HELI shareholding by investor type – UBO

Back to Case Study Companies Page

Appendix A: Landholding Information

| Location | Development (Allocation date) |

Subsidiary / Co-development (% Owned) |

Land Area (Feddans) | Sources | ||

| Initial Land | De Jure Owned 2021 | Control 2021 | ||||

| Shorouk | New Heliopolis City MAIN PLOT (1995) | 5,406.7 | 4,633.7 | 3,978.7 | PD 193/1995 & 165/2019 | |

| New Heliopolis – SALE Personal Land Plots (1995-2014) | -436.6 | HELI BoD Report 2011 & 2014 | ||||

| New Heliopolis – SALE Osolu & Zahraa Al-Maadi (2019) | -59.0 | HELI PR 16.12.2019 | ||||

| New Heliopolis – Land plots sales (2021) | -277.4 | HELI PR 21.03.2021 & 21.12.2021 | ||||

| New Heliopolis City – SODIC East Town (2016) | Co-dev w SODIC (30%) | -655.0 | HELI PR 03.03.2016 | |||

| Cairo | Sheraton Land Plots & Buildings (Pre 2002) | 90.4 | 63.6 | 63.6 | HELI BoD Report 2011 | |

| Granada City, Merryland & Other Rented Property (Pre 2002) | 48.5 | 48.5 | 48.5 | HELI BoD Report 2014 | ||

| New Cairo | Heliopark (2003) | 1,695.0 | 1,695.0 | 1,695.0 | PD 266/2003 & 126/2014 | |

| HELI TOTAL | 7,240.7 | 6,440.8 | 5,785.8 | |||

| MoH: Minister of Housing Decree, IP: Investor Presentation, PR: Press Release | ||||||

Appendix B: Shareholding Information

Direct Shareholding:

| Company | Shares | Sources |

| Holding Company for Construction & Development (HCCD) | 72.25 | “BoD and Shareholder Structure 2021 Q4.” Heliopolis for Housing and Development.

“Heliopolis for Housing & Development ownership.”, Simply WallSt., n.d. Accessed 03.04.2022

“Government Pension Fund Global Holdings of Equities at 31 December 2021” (Norges Bank) |

| Norges Bank | 1.19 | |

| BlackRock, Inc. | 0.60 | |

| The Vanguard Group, Inc. | 0.14 | |

| Van Eck Associates Corporation | 0.11 | |

| Azimut (DIFC) Limited | 0.10 | |

| EGX FF | 25.61 |

Indirect Shareholding:

| Company | Nationality | Shareholders/ Ultimate Parent | Sources |

| Holding Company for Construction & Development (HCCD) | Egypt | Egyptian Government

100

|

“Holding company for construction and development, Home.” HCCD Home. n.d. Accessed 31.03.2022 |

| Norges Bank | Norway | Government of Norway 100 | About the Bank. Norges Bank, n.d. Accessed 30.03.2022 |

| Azimut Limited | UAE | Azimut UK Holdings Limited 100 | DIFC: “Azimut Limited shareholders” n.d. Accessed 31.03.2022 |

| Azimut UK Holdings Limited | UK | Azimut Holding spa 100 | Azimut UK Holdings Limited: “CERTIFICATE OF INCORPORATION OF A PRIVATE LIMITED COMPANY” 29/07/2021. P. 7,8 |

| Azimut Holding SPA | Italy | Timone Fiduciaria Slr 22.10

The Vanguard Group, Inc. 2.89 Norges Bank 2.15 Italy SE BIT FF 72.9 |

Azimut Group: “Azimut Group.” n.d. Accessed: 30.03.2022 |

Back to Case Study Companies Page

[1] Heliopolis Company for Housing & Development Consolidated Financial Statements for the year ended 31.12.2020, p.1