- Published on 04 September 2022

Who Owns Cairo: Case Study Companies

Overview

Name: Madinet Nasr for Housing and Development SAE MNHD.CA

Established: 1959 (SOE)

Listed on EGX: 1995

Scope and activities: The Company is engaged in activities related to development of land, buildings and facilities, including acquisition of land, real estate sale and rental, dividing it and providing all types of facilities for reconstruction and connected to it in Nasr City and other areas nationwide. It also establishes, manages and invests in all residential, administrative, touristic, recreational and all projects, and real estate operations, financial, commercial and entertainment, as well as carrying out design, engineering and consultancy. [1]

Company Vitals:

| Indicator | Value | Case Study Ranking |

| Annual Profits (Avg. 2010-2021) | LE 498mn | 4/10 |

| Market Capitalization (12.2021) | LE 4.4bn | 7/10 |

| Cairo Land Ownership – De Jure (12.2021) | 2464 acres | 6/10 |

| Cairo Land Ownership – Control (12.2021) | 2360 acres | 6/10 |

How much land does MNHD own in Cairo?

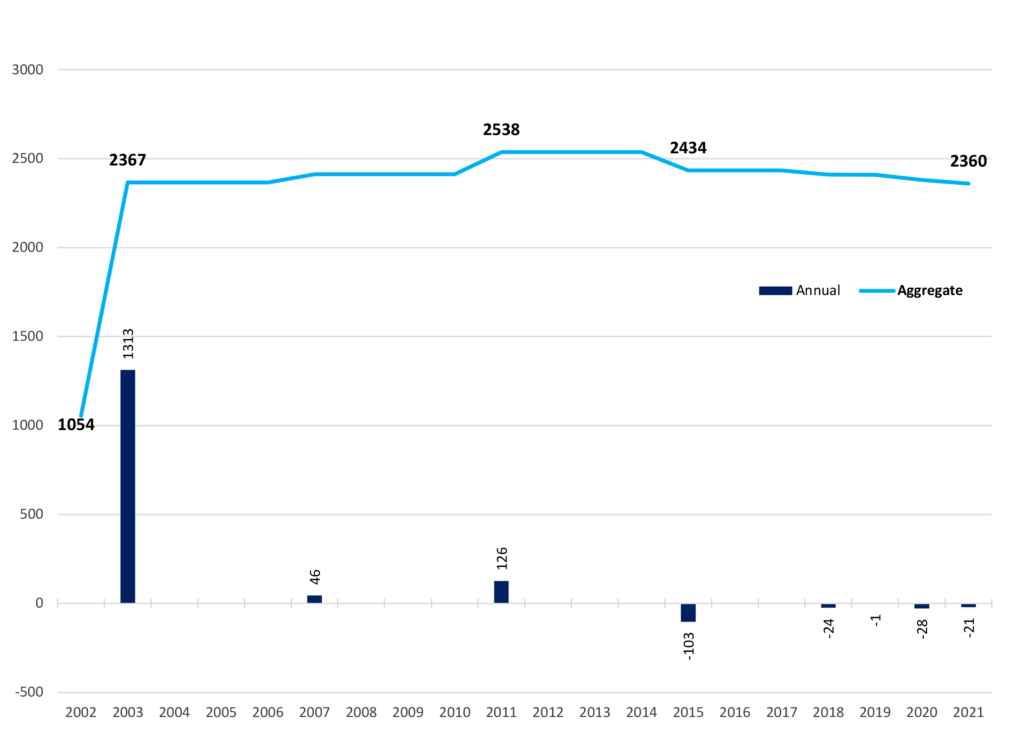

MNHD has the sixth largest landbank in Cairo under the de jure method (see Methodology) at 2464 acres (See Appendix A). This comprises mostly of two large plots, one of which was undeveloped land on the Eastern outskirts of the Madinet Nasr district in Cairo, that the company developed since the 1960s, and the other a relatively recent assignment in New Cairo. MNHD’s landholdings only fall slightly to 2360 acres under the control method (see Methodology), ranking it also sixth among the case study companies, as it sold land and went into a co-development agreement with PHDC. The timeline for land acquisition is very flat for MNHD, which even though was listed over 25 years ago, and majority privatised in the 2000s, has not bought any significant land in Cairo since, relying on the landbank it was given by the state when it was still (fully) government owned (Figure 1).

Figure 1: MNHD landbank accumulation analysis – Control Method 2002-2021 (Acres). Sources: See Appendix A

Who Owns MNHD?

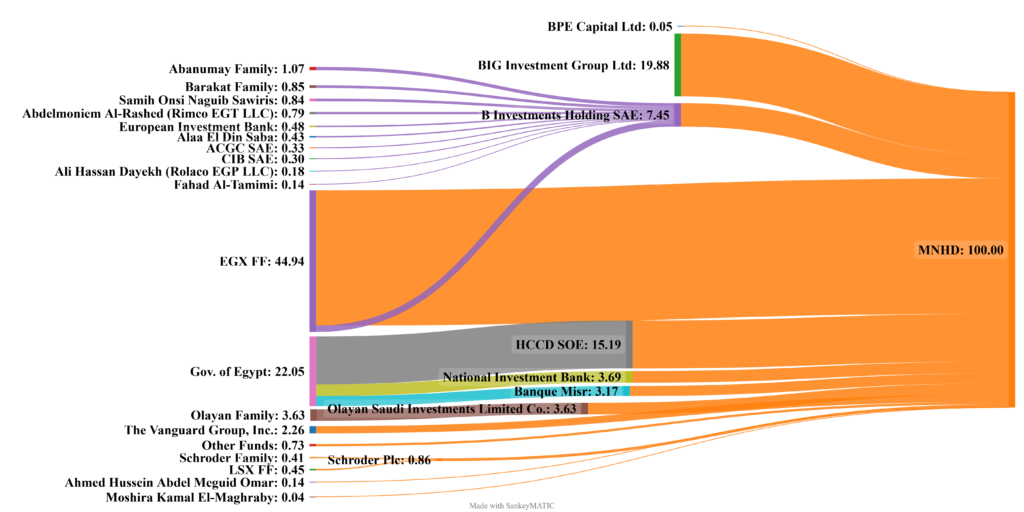

MNHD was founded by the Egyptian government in 1959 to develop its namesake Madinet Nasr district in east Cairo. The company was listed on the EGX in 1995, and remained majority state owned, until 2008 when a group of private investment funds bought a majority stake. This group was still the major shareholder in 2021 holding 27% of MNHD through the EGX listed B Investment Holding (BINV.CA), the British Virgin Islands (BVI) based BIG Investment Group, and BPE Capital Ltd (Figure 2). The listed company’s major holders are well known Egyptian and Saudi investors many of which have holdings in other real estate companies. However, the related offshore fund’s subscribers remain anonymous.[2] With a holding of 22%, the Government of Egypt is the second largest shareholder, through three SOEs including MNHD’s original owner ,the Holding Company for Construction and Development (HCCD). MNHD’s third largest holder is the Saudi Olayan family (3.63%), who have minority holdings in other companies such as SODIC. Global fund Vanguard is the fourth largest shareholder (2.26%), leading other funds. Around 45% of MNHD is held by anonymous smallholders on the EGX.

Figure 2: MNHD shareholding structure according to the UBO method as of 2021 Q4 (See Appendix B)

Investor Nationalities

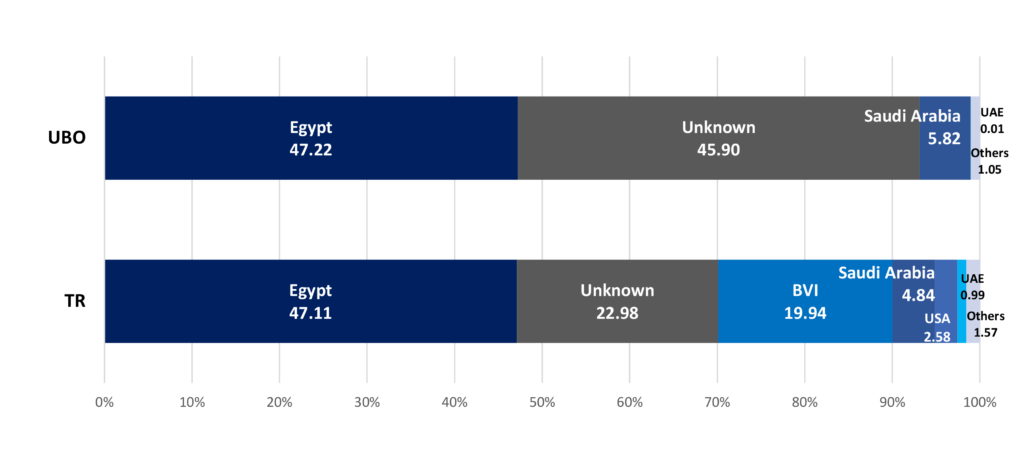

Egyptians hold 47% of MNHD (Figure 3), and that is under the tax residence method (See Methodology). The second largest group is that of unidentifiable smallholders on the EGX free float holding about 23% of the company. This is followed closely in third by the British Virgin Islands (BVI) holding 20% of MNHD. Saudi Arabia is the fourth largest holder at almost 5% of shares, followed by the UAE and funds in Western countries.

Under the UBO method (see Methodology), investors from Egypt remain the largest holders at 47%. However, they are followed closely by ‘unknown’ investors who hold 46% of MNHD, as the BVI fund’s shares, along with stock market free float smallholdings are added. Saudi Arabia is the third largest holder at almost 6%, followed by the UAE, the UK and the EU.

Figure 3: MNHD shareholding by nationality under the TR and UBO methods

Investor Types

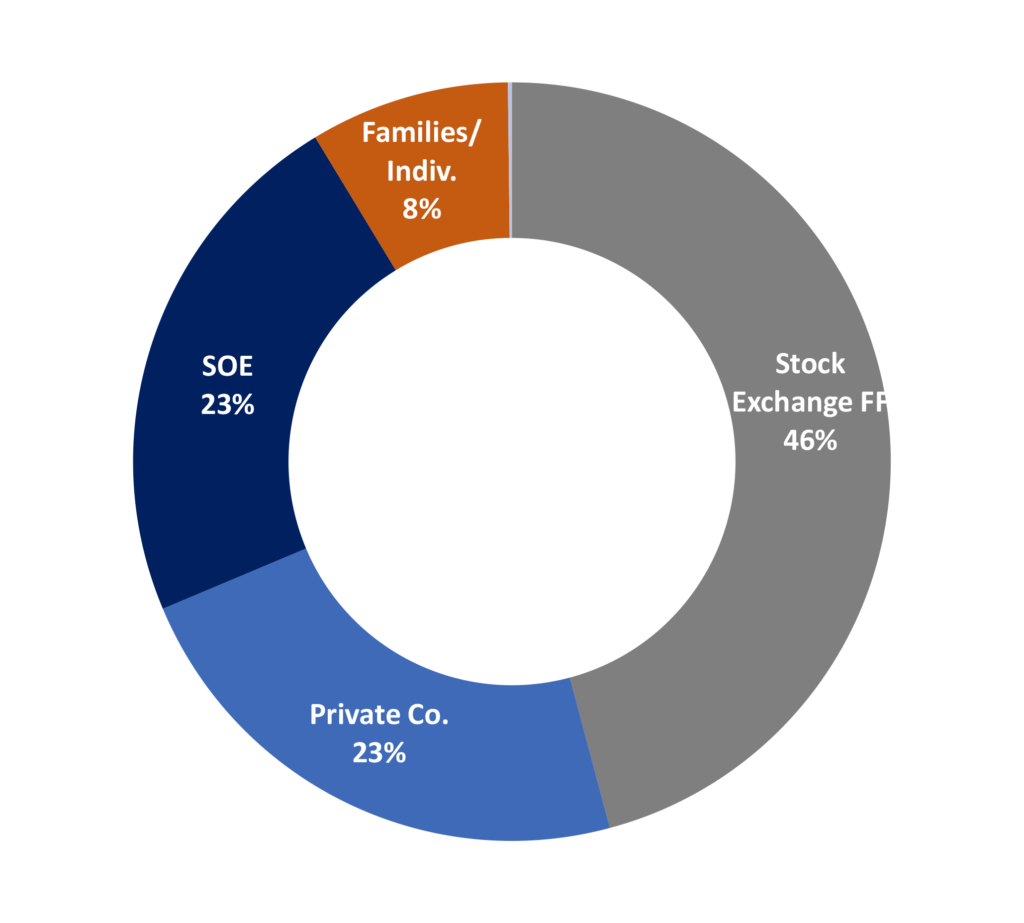

Smallholders on the EGX free float represent the single largest investor type by far, holding 46% of MNHD (Figure 4). The second largest group are Private Companies (mostly the BVI fund), owning 23% of the company. These are equal to SOEs who hold a similar share. Families/individuals are the smallest shareholder in MNHD at 8% of holdings.

Figure 4: MNHD shareholding by investor type – UBO

Back to Case Study Companies Page

Appendix A: Landholding Information

| Location | Development (Allocation date) |

Subsidiary / Co-development (% Owned) |

Land Area (Feddans) | Sources | ||

| Initial Land | De Jure Owned 2021 | Control 2021 | ||||

| Cairo | Taj City and Taj Sultan, former Teegan (1971) | 833.3 | 809.0 | 759.4 | MNHD IP 2018, Cairo Gov. Decree 10889/2018 | |

| Taj City – Land Plot Sale – The Hoft (2019) | SALE to Minka Developments SAE | -0.8 | MNHD PR 26.03.2019 | |||

| Taj City – Land Plot Sale – Kinda (2020) | SALE to Minka Developments SAE | -28.3 | MNHD PR 05.03.2020 | |||

| Taj City – Land Plot Sale (2021) | SALE to EgyGab Developments SAE | -20.5 | Zawya 28.02.2021 | |||

| Nasr City – Undeveloped Land (1959) | 107.7 | 107.7 | 107.7 | MNHD IP 2012 | ||

| El Waha/ Primera (1959) | 113.0 | 113.0 | 113.0 | MNHD IP 2015 | ||

| Hadayek October | El Nasr Gardens (2007) | 171.1 | 171.1 | 171.1 | MoH 209/2015 | |

| New Cairo City | Sarai (2003) | 1,312.5 | 1,312.5 | 1,312.5 | PD 306/2006, MoH 361/2016 | |

| Sarai – Capital Gardens (2015) | Co-dev. w PHDC (36% of revenue) | -103.3 | PHDC/ MNHD PR 15.07.2015 MoH 217/2021 | |||

| MNHD TOTAL | 2,537.6 | 2,463.6 | 2,360.3 | |||

| PD: Presidential Decree, MoH: Minister of Housing Decree, IP: Investor Presentation, PR: Press Release | ||||||

Appendix B: Shareholding Information

Direct Shareholding:

| Company | Shareholding (%) | Sources |

| BIG Investment Group Ltd* | 19.88 | “BoD and Shareholder Disclosure 2021 Q4”, Madinet Nasr for Housing and Development SAE

“Madinet Nasr for Housing and Development SAE – Ownership.” Simply WallSt. n.d. Accessed 04.04.2022

|

| Holding Company for Construction and Development HCCW** | 15.19 | |

| B Investment Holding SAE (BINV.CA)* | 7.45 | |

| National Investment Bank** | 3.69 | |

| Olayan Saudi Investments Company OSICO | 3.63 | |

| Banque Misr SAE** | 3.17 | |

| BPE Capital Ltd* | 0.05 | |

| The Vanguard Group, Inc. | 2.26 | |

| Schroder Investment Management Limited | 0.86 | |

| TRUSTUS Capital Management B.V. | 0.26 | |

| Van Eck Associates Corporation | 0.23 | |

| Ahmed Hussein Abdel Meguid Omar | 0.14 | |

| Azimut (DIFC) Limited, Asset Management Arm [Azimut Slr] | 0.07 | |

| BPI Gestão de Activos SA | 0.06 | |

| Eaton Vance Management | 0.04 | |

| Moshira Kamal Abdel Maqsoud El-Maghraby** | 0.04 | |

| DBX Advisors LLC | 0.03 | |

| MD Private Investment Counsel | 0.02 | |

| AXA Investment Managers S.A. | 0.02 | |

| EGX FF | 42.91 | |

| *Related parties under BPE Partners, ** Related parties under the Government of Egypt | ||

Indirect Shareholding:

| Company | Nationality | Shareholders/ Ultimate Parent | Sources |

| BIG Investment Group Ltd [Former Beltone Investment Group Ltd] | BVI | Unknown (Controlled by BPE Partners SAE) | Nationality: “Consolidated Financial Statements for the year ended 31 December 2017 “,BPE Holding for Financial Investments SAE

Name change: “Disclosure to the EGX”, MNHD 30.11.2016 |

| B Investment Holding SAE BINV.CA [Former BPE Holding for Financial Investments SAE, former Beltone Capital Holding SAE] | Egypt | Rimco EGT Investment LLC (UAE) 10.62

Samih Onsi Naguib Sawiris 9.18* SOS Holding (CY) 1.08* European Investment Bank (EU) 6.4 Barakat Family 5.95** Foray Capital for Investment SAE (Eg) 5.04** BPE Partners SAE (EG) 0.56 Abanumay Family 14.38*** Sabaa Egypt Investment LTD*** (?) 0.15 Aladdin Saba 4.26+ Electronic Partners Investments and Trading SAE+ (Eg) 1.19 Fahad Al-Tamimi (SA) 1.87 Rolaco EGP Investment (UAE) 2.47 Arabia Cotton Ginning Company SAE (Eg) 4.38 Commercial International Bank SAE (Eg) 3.99 Misr Insurance SAE (Eg) 0.97 Mosatafa Abdel Salam Mostafa Al-Anwar 0.30 EGX FF 27.16 |

“BoD and Shareholders Disclosure 2021 Q4”, B Investments Holding.

5%< Simply WallSt.: B Investment Holding – Ownership. Accessed: 30.03.2022 |

| BPE Partners SAE | Egypt | Mohamed Hazem Barakat 41.40*

Saba Associates Ltd 33.10 BPE MENA Holding Ltd (?) 10.00* SOS Holding 8.30 BPE Partners Ltd 7.20* |

“Summary of IPO”, BPE Holding for Financial Investments SAE”, 01.03.2018, p12 |

| BPE MENA Holding Ltd

BPE Partners Ltd |

Unknown | Mohamed Hazem Adel Fathallah Barakat (Control) | “Summary of IPO”, BPE Holding for Financial Investments SAE”, 01.03.2018, p12 |

| Foray Capital Investments SAE | Egypt | Mohamed Hazem Adel Fathallah Barakat (Control) | “B Investments Holding SAE BoD and Shareholders Disclosure 2021 Q4”, p4. |

| Barakat Family | Egypt | Mohamed Hazem Adel Fathallah Barakat, Mona Adel Fathallah Barakat, Mahmoud Mohamed Hazem Adel Mohamed Barakat, Omar Mohamed Hazem Adel Barakat, Alia Rafiq Al-Dafrawy | “B Investments Holding SAE BoD and Shareholders Disclosure 2021 Q4”, p4.

|

| Saba Associates Ltd [Former Beltone Associates Ltd] | Unknown | Alaa El Din Hassouna Mahmoud Saba (Control) | “Summary of IPO”, BPE Holding for Financial Investments SAE”, 01.03.2018, p12 |

| Electronic Partners Investments and Trading SAE | Egypt | Alaa El Din Hassouna Mahmoud Saba 100 | “Related party disclosure”, B Investment Holding SAE, 12.03.2019 |

| SOS Holding Ltd | Cayman Islands | Samih Onsi Naguib Sawiris | “B Investment Holding SAE BoD and Shareholders Disclosure 2021 Q4”, p4.

“Significant Shareholders in Orascom Holding AG: Beneficial Owners.” SIX Group. n.d. Accessed 04.04.2022 |

| Rimco EGT Investment LLC | UAE | Abdulmonem Rashed Alrashed (Saudi Arabia) 100 | “Rimco EGT Investment LLC”, Dubai Commercial Directory. n.d. Accessed 30.03.2022 |

| Rolaco EGP Investment | UAE | Ali Hassan Ali Dayekh (Saudi Arabia) 100 | “Related party disclosure”, MMTE, 10.03.2022 |

| Abanumay Family

|

Saudi Arabia | Walid bin Suleiman bin Abdel Mohsen Abanumay 2.55

Abanumay Family Other 9.9163 Mudhi Bint Saleh Bin Abdullah Al Misfer 1.91 |

“B Investments Holding SAE BoD and Shareholders Disclosure 2021 Q4”, p4. |

| Sabaa Egypt Investment Limited | Unknown | Abanumay Family 100 | “B Investments Holding SAE BoD and Shareholders Disclosure 2021 Q4”, p4. |

| European Investment Bank – EIB | Luxembourg | Member States of the European Union 100 | “Governance and Structure; Ownership.” European Investment Bank. n.d. Accessed 30.03.2022 |

| Arabia Cotton Ginning Company SAE (ACGC.CA) | Egypt | Sherif Adly Kyrollus Paulus 10.084

Ibrahim Ibrahim Ibrahim Al Saidi 9.34 Cooperative Association for Agrarian Reform 6.22 EGX FF 74.35 |

“Arab Cotton Ginning Company SAE: Shareholders’ Disclosure 2021 Q4”

|

| Commercial International Bank – CIB SAE (COMI.CA) | Egypt | Al-Ahly Bank 8.27

Fairfax Financial Holdings, Ltd. (USA) 6.50 Invesco Asset Management Ltds Investment Funds 4.99 Abu Dhabi Investment Authority 4.58 Norges Bank 2.30 EGX FF 73.363 |

“Commercial International Bank BoD and Shareholders Disclosure 2021 Q4”

“Commercial International Bank Ownership.” English Mubasher. n.d. Accessed: 30.03.2022

|

| Al-Ahly Bank SAE | Egypt | Egyptian Government 100 | “National Bank of Egypt” p.1. Bank Track. n.d. Accessed 30.03.2022. |

| Misr Insurance SAE | Egypt | Egyptian Government 100 | Misr Insurance Holding Company ownership p.5 |

| National Investment Bank | Egypt | Egyptian Government 100 | “National Investment Bank BoD” n.d. Accessed 13.07.2022 |

| Holding Company for Construction & Development (HCCD) | Egypt | Government of Egypt 100 | “Holding company for construction and development, Home.” HCCD Home. n.d. Accessed 31.03.2022 |

| Banque Misr SAE | Egypt | Egyptian Government 100 | “Banque Misr Ownership.” Banque Misr. n.d. Accessed 30.03.2022 |

| Olayan Saudi Investments Limited (OSICO) | Saudi Arabia | Olayan Family | Olayan Saudi Investment Company (OSICO) – oshco.com, n.d. Accessed 23.02.2022

About the Olayan Group – olayan.com, n.d. Accessed 23.02.2022 |

| Schroder Investment Management Limited

|

UK | Ultimate parent company: Schroders Plc

Main shareholders: Schroder Family (UK) 47.93 LSE FF (UK) 52.07 |

“Schroders Annual Reports and Accounts 2020”, Schroders Plc. p104 |

| Azimut Limited DFIC | UAE | Azimut UK Holdings Limited 100 | DIFC: “Azimut Limited shareholders” n.d. Accessed 31.03.2022 |

| Azimut UK Holdings Limited | UK | Azimut Holding spa 100 | Azimut UK Holdings Limited: “CERTIFICATE OF INCORPORATION OF A PRIVATE LIMITED COMPANY” 29/07/2021. P. 7,8 . n.d. Accessed 28.03.2022 |

| Azimut Holding spa | Italy | Timone Fiduciaria Slr 22.10

Italian SX FF 77.9 |

Azimut Group: “Azimut Group.” n.d. Accessed: 30.03.2022 |

Back to Case Study Companies Page

Notes and references

[1] MNHD Consolidated Financial Statement for the year ended 31.12.2021, p.10

[2] MNHD and BPE Partners were contacted for information, but non was released citing confidentiality.