- Published on 04 September 2022

Who Owns Cairo: Case Study Companies

Overview

Name: Sixth of October Development and Investment SAE SODIC OCDI.CA

Established: 1996

Listed on the EGX: 1998

Scope and activities:[1] Land division and sale or lease, construction contracting, construction of building for sale or lease, agricultural land reclamation, tourism development, leasing, information technology, communications technology and broadcasting, landscaping, ownership, and management of sport, medical, educational and restaurant facilities, investing in petrochemical activities. The company also works in the coordination and plantation of gardens, construction of roads and squares, and providing security, guarding, maintenance, and cleaning services.

Company Vitals:

| Indicator | Value | Case Study Ranking |

| Annual Profits (Avg. 2010-2021) | LE 323.6mn | 6/10 |

| Market Capitalization (12.2021) | LE 5.1bn | 6/10 |

| Cairo Land Ownership – De Jure (12.2021) | 2972 acres | 4/10 |

| Cairo Land Ownership – Control (12.2021) | 3613 acres | 4/10 |

| 8.8% of case study land |

How much land does SODIC own in Cairo?

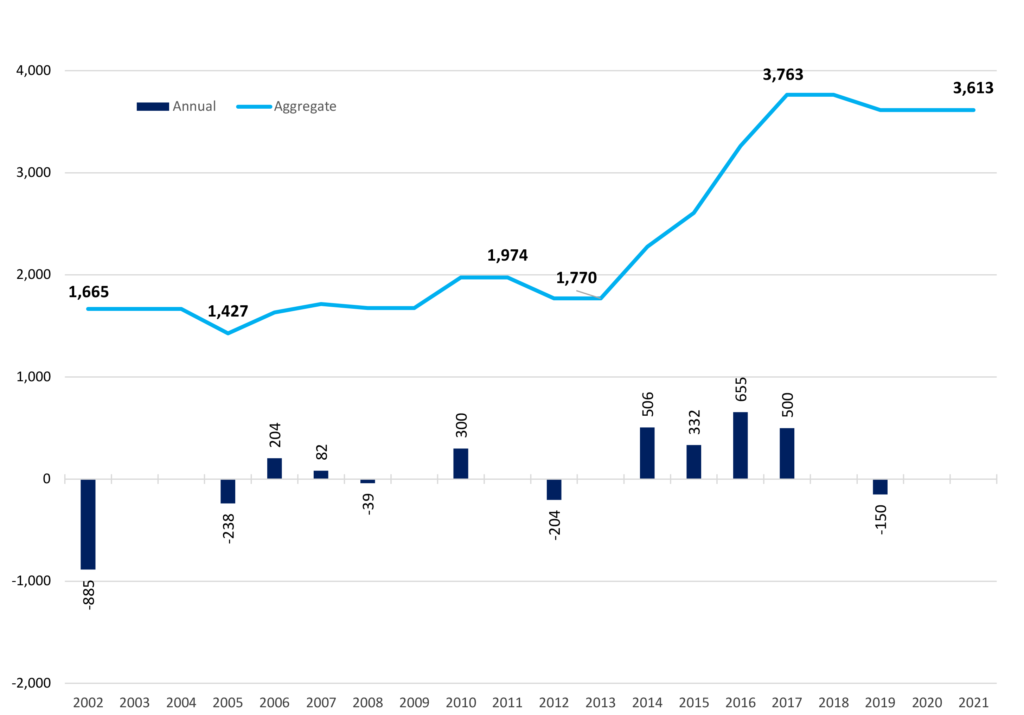

SODIC owns 2891 acres in Greater Cairo according to the de jure method (See methodology), both directly and indirectly through four subsidiaries (See Appendix A), ranking 4th among the case study companies. This is significantly down from an overall allocation of 4219 acres between 2002 and 2021, as it sold a plot, and returned almost 900 acres to NUCA in 2002 from its flagship Sodic West development (Figure 1). The entire plot was under threat of being revoked by the state almost a decade later, when in the wake of the 2011 revolution, the Illegal Gains Authority (IGA) accused founder and then chairman, Magdy Rasekh and others of illegal profiteering and the misappropriation of public funds in the sale to the company in 1995. A final ruling was passed in 2016, and in 2018 Sodic paid LE 800mn (USD 44.4mn at the time) to settle the dispute.[2]

In terms of control (See methodology), SODIC has 3613 acres under direct control, as one 655 acre plot co-developed with HELI raises its holdings by almost one fifth, though still ranking it 4th.

Figure 1: SODIC landbank accumulation analysis – Control Method 2002-2021 (Acres). Sources: See Appendix A

Who Owns SODIC?

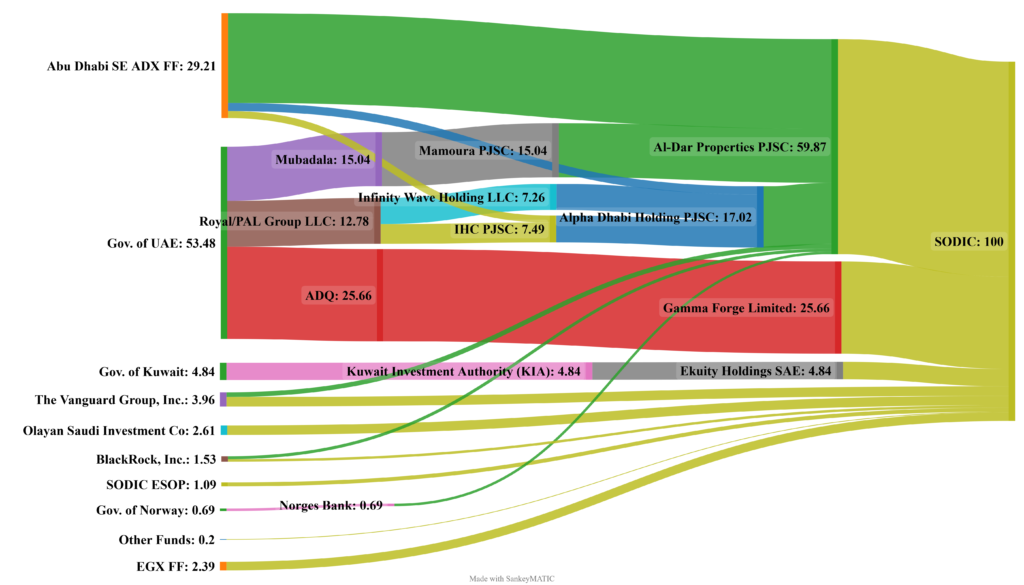

The company was founded by Magdy Rasekh,[3] an investor and in-law of the then-ruling Mubarak family, in 1996. Company control shifted to the Egyptian financial group EFG-Hermes (HRHO.CA) and the Bank of New York by the end of the 2000s,[4] the former majority controlled by an Emirati fund then.[5] In the mid-2010s an American fund and two Saudi business families, Olayan and Abanumay, bought controlling shares in SODIC,[6] and continued to hold interest in it until in 2021, companies controlled by the Government of the UAE completed a takeover bid, becoming the largest shareholder in SODIC holding over half of the company (Figure 2). The second largest shareholder today are small holder investors on the Abu Dhabi Stock Exchange indirectly owning their shares through the UAE listed but government-controlled companies Aldar, Alpha Dhabi and IHC PJSC. The third largest owner of SODIC is another government, that of Kuwait, owning almost 5% through its SWF. The Vanguard Group Inc., one of the top three global asset managers, is SODIC’s fourth largest shareholder, owning 4% of the company through both direct and indirect holdings – via Aldar. The Saudi Olayan family still own 2.6% of the company making them the fifth largest shareholder, followed by a number of investment funds led by BlackRock, Inc. – with direct and indirect holdings, the Norges Bank and others.

Figure 2: SODIC shareholding structure according to the UBO method as of 2021 Q4 (See Appendix B and methodology)

Investor Nationalities

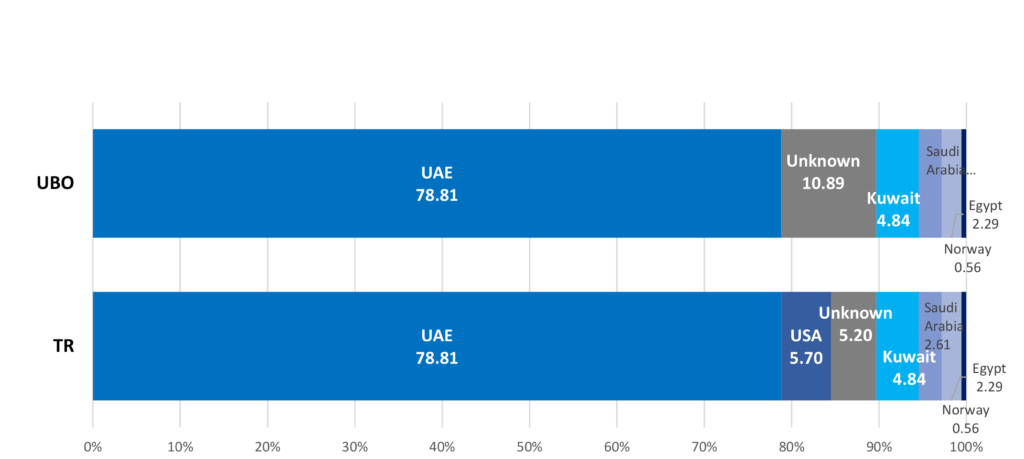

On the basis of tax resident (TR) method (See methodology),, SODIC is 79% UAE-owned (Figure 3). A distant second is USA based shareholders at 5.7%. In third are shareholders of Unknown nationalities – mostly foreign smallholders on the EGX and Abu Dhabi stock exchanges. Kuwaiti investors hold 5% of SODIC, while 2.6% of the company is held by investors from Saudi Arabia. Egyptian investors are in sixth place as the only own 2.3% of company stock.

In terms of Ultimate Beneficial Ownership (UBO) (See methodology), UAE investors remain the same, owning 79% of shares, while investors of Unknown nationalities almost double to 11.3%. (Figure 3). Kuwaiti investors are the third, and Saudi Arabian investors fourth largest investors in SODIC. Investors from Egypt are fifth, with only 2.3% of the company.

Figure 3: SODIC shareholding by nationality under the TR and UBO methods

Investor Types

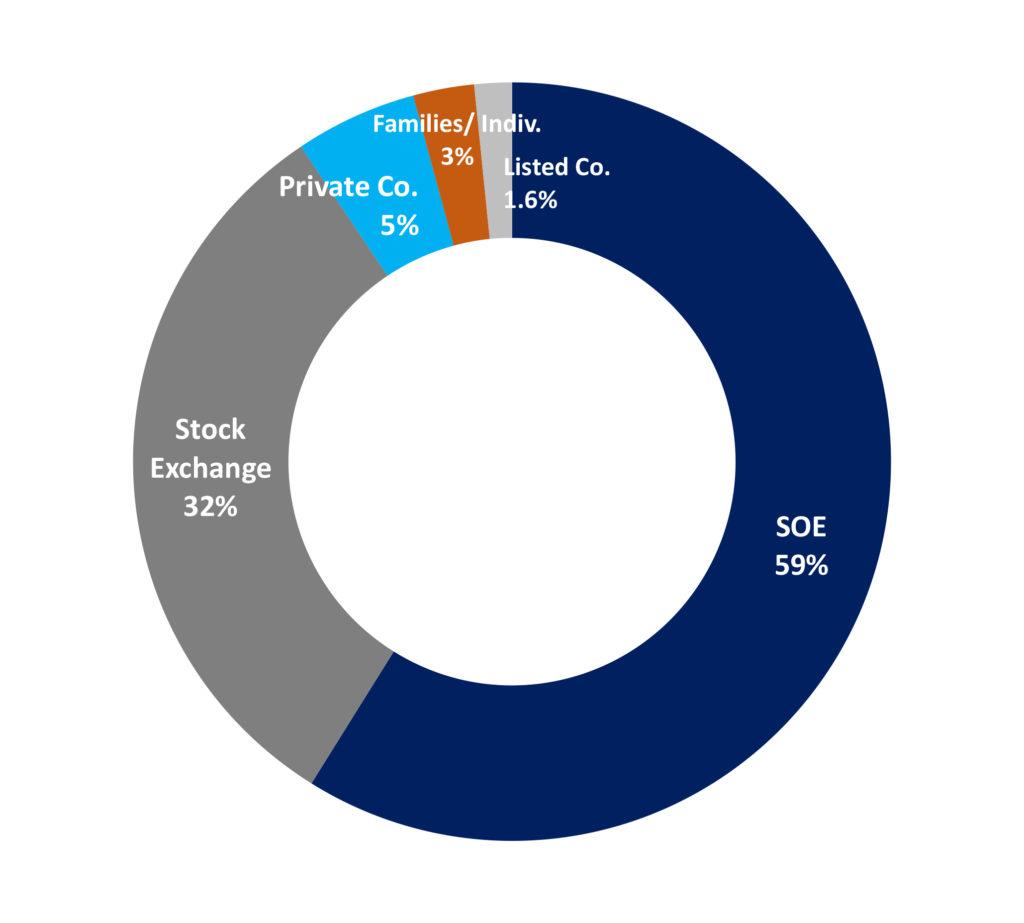

According to the typology of investor, SODIC is majority owned by SOEs (59%) from three different countries led by the UAE, and distantly followed by sovereign wealth funds from Kuwait and Norway. Smallholders on the Abu Dhabi Stock Exchange free float, and to a lesser extent, the EGX, are the second largest group holding 32% of SODIC. The third largest investor type are private non-listed companies (5%), followed by families/individuals (3%), and listed companies (1.6%).

Figure 4: SODIC shareholding by investor type – UBO

Back to Case Study Companies Page

Back to Case Study Companies Page

Appendix A: Landholding Details

| Location | Development (Allocation date) | Subsidiary/ Co-development | Land Area (Acres) | Sources | ||

| Initial Land | De Jure Owned 2021 | Control 2021 | ||||

| 6th of October City | October plaza | 30.8 | 30.8 | 30.8 | MoH 10/2019 | |

| Shorouk City | SODIC East | Co-development with HELI (New Heliopolis) | 0.0 | 0.0 | 655.0 | SODIC PR 03.03.2016 |

| New Cairo City | East town (2006) | Sorrell for Real Estate Investment (99%) | 204.3 | 204.3 | 204.3 | MoH 467/2016 |

| Katameya Plaza (2008) | Sorrell for Real Estate Investment (99%) | 31.1 | 31.1 | 31.1 | SODIC IP 2010 Q3 | |

| Villete and V Residences and Sky Condos (2014) | Sorrell for Real Estate Investment (99%) | 603.0 | 603.0 | 603.0 | MoH 330/2015, 989/2017, 1414/2019 | |

| Sheikh Zayed City | SODIC West MAIN PLOT (1995) | 2,550.0 | 1,452.8 | 1,438.8 | MoH 58/2015 | |

| SODIC West Returned to NUCA (2002) | -884.8 | -884.8 | ||||

| SODIC West Sold to Al Ahly/ARCO (2005) | -238.1 | -238.1 | ||||

| SODIC West Additional Plot (2007) | Plots 4, 7 | 81.7 | 81.7 | |||

| Casa (2008 approval) | Royal Gardens for Real Estate Investment (20.00% SODIC, 50% PHD, 30% Others) | -56.0 | -70.0 | |||

| SODIC West – Allegria, Allegria Residence, Designopolis (2008 approval) | 578.9 | 578.9 | ||||

| SODIC West – Beverly Hills, Bel Air, The Strip | Sodic Garden City for Development and Investment Co (50.00%) | 271.9 | 543.8 | |||

| SODIC West – West Town, Forty West, Six West, The Polygon | 291.3 | 291.3 | ||||

| The Estates – Frmr Esplanade (2010) | El Yosr for Projects and Agriculture Development Co (100%) [Half initial plot size paid in-kind to NUCA in 2019] | 300.0 | 150.0 | 150.0 | MoH 667/2019,

|

|

| VYE and Karmell (2020) | 500.0 | 500.0 | 500.0 | MoH 980/2019 | ||

| SODIC TOTAL | 4,219.1 | 2,971.9 | 3,612.9 | |||

| MoH: Minister of Housing Decree, IP: Investor Presentation, PR: Press Release. All subsidiary ownership percentages based on the annual consolidated financial statements of 2021 | ||||||

Appendix B: Shareholding Details

Direct Shareholding

| Company | Shares | Sources |

| Gamma Forge Limited* | 25.66 | “SODIC BoD and Shareholders 2021 Q4.”

“Six of October for Development and Investment Company SODIC Ownership.” Simply Wall St, n.d. Accessed 04.04.2022 |

| Aldar Properties PJSC* | 59.87 | |

| Ekuity Holdings SAE | 4.84 | |

| Olayan Saudi Investments Limited Co | 2.61 | |

| The Vanguard Group, Inc. | 2.65 | |

| BlackRock, Inc. | 0.69 | |

| FMR LLC | 0.09 | |

| State Street Global Advisors, Inc | 0.06 | |

| Eaton Vance Management | 0.03 | |

| DBX Advisors LLC | 0.02 | |

| EGX FF | 3.48 | |

| *Related parties | ||

Indirect Shareholding

| Company | Nationality | Shareholder (%) | Sources |

| Gamma Forge Limited | UAE | Abu Dhabi Developmental Holding Company PJSC (ADQ) (UAE) 100 | Aldar-ADQ consortium completes acquisition of majority stake in EGX-listed SODIC, Aldar PR 16.12.2021 |

| Aldar Ventures International Holding RSC Limited | UAE | Aldar Properties PJSC (UAE) 100 | Aldar Properties PJSC Reports and Consolidated Financial Statements For The Year Ended 31 December 2021, p25 |

| Aldar Properties PJSC | UAE | Alpha Dhabi Holding PJSC (UAE) 28.42 [Through wholly owned subsidiaries: Sublime Commercial Investment (12.2097%), Sogno Two Co (8.2553%), Sogno Three Co (7.9527%)]

Mamoura Diversified Global Holding PJSC (UAE) 25.12 The Vanguard Group, Inc. (USA) 2.19 BlackRock, Inc. (USA) 1.41 Norges Bank Investment Management (Norway) 0.93 ADX FF (UAE) 41.93 |

Ownership of 5%> see: Aldar Properties PJSC -Shareholders and Board, ADX.ae. n.d. Accessed: 02.03.2022

Ownership of <5% see: Aldar Properties PJSC – Ownership, Simply Wall St. n.d. Accessed: 20.01.2022, and: Government Pension Fund [Norges Bank] Global Holdings of Equities at 31December 2021. p296

|

| Alpha Dhabi Holding PJSC | UAE | International Holding Company (IHC) PJSC (UAE) 44.00

Infinity Wave Holding LLC (UAE) 42.64 ADX FF (UAE) 13.36 |

Alpha Dhabi Holding PJSC -Shareholders and Board, ADX.ae. n.d. Accessed: 02.03.2022

|

| International Holding Company (IHC) PJSC | UAE | PAL Group of Companies LLC (UAE) 58.52

Royal Group Companies Management LLC (UAE) 15.22 ADX FF (UAE) 26.26 |

International Holding Company PJSC -Shareholders and Board, ADX.ae. n.d. Accessed: 02.03.2022

|

| Infinity Wave Holding LLC | UAE | Royal Group Holding LLC SOE (UAE) 100 | Stated as ‘Entity under common control’ in relation to IHC. Therefore, owned by same ultimate parent company.

See: International Holding Company (IHC) PJSC – Interim Condensed Consolidated Financial Statements: Nine Months Period Ended 30 September 2021. p49; IHC Annual Report 2020. p101. |

| PAL Group of Companies LLC | UAE | Royal Group Holding LLC SOE (UAE) 100 | Ultimate parent of IHC PJSC. See: IHC Annual Report 2020. p101.

Chairman is UAE Royal family member HH Sheikh Tahnoon Bin Zayed Al Nahyan, therefore SOE. See: Royal Group – Chairman’s Message, royalgroupuae.com n.d. Accessed: 13.02.2022 |

| Royal Group Companies Management LLC | UAE | Royal Group Holding LLC SOE (UAE) 100 | Ultimate parent of IHC PJSC. See: IHC Annual Report 2020. p101.

Chairman is UAE Royal family member HH Sheikh Tahnoon Bin Zayed Al Nahyan, therefore SOE. See: Chairman’s Message, Royal Group. n.d. Accessed: 13.02.2022 |

| Ekuity Holdings SAE | Egypt | Kuwait Investment Authority SOE (Kuwait) 100 | Our Firm, Ekuity Holdings. n.d. Accessed: 15.01.2022 |

| Mamoura Diversified Global Holding PJSC | UAE | Mubadala Investment Company PJSC SOE (UAE) 100 | The Company is wholly owned by Mubadala Investment Company PJSC, and the ultimate parent of the Company is the Government of the Emirate of Abu Dhabi. See: Mamoura Diversified Global Holding PJSC, Unaudited Interim Condensed Consolidated Financial Statements for The Six-Month Period Ended 30 June 2021. p11 |

| Norges Bank | Norway | Government of Norway 100 | About the Bank. Norges Bank, n.d. Accessed 30.03.2022 |

| Olayan Saudi Investments Limited (OSICO) | Saudi Arabia | Olayan Financing Company (OFC)

Olayan Family (Saudi Arabia) |

Olayan Saudi Investment Company (OSICO) – oshco.com, n.d. Accessed: 23.02.2022

About The Olayan Group – olayan.com, n.d. Accessed: 23.02.2022 |

Back to Case Study Companies Page

Notes & References

[1] SODIC Consolidated Financial Statements for the year ended 31.12.2021, p6

[2] SODIC Press Release, 09.12.2018

[3] “Egypt ex-housing minister gets 8 yrs jail for graft”, Reuters. 29 March 2012.

[4] Sixth of October for Development and Investment Company “SODIC”, Bod Change Disclosure, 19 August, 2010.

[5] EFG-Hermes, Invitation to Alter Capital, 25 May, 2011.

[6] Sixth of October for Development and Investment Company “SODIC”, Shareholder Disclosure Q4, 8 January 2017.