- Published on 04 September 2022

Who Owns Cairo: Case Study Companies

Overview

Full Name: Talaat Moustafa Group Holding SAE (Reuters Code TMGH.CA)

Established: 2007 (As a holding company of pre-existing companies)

Listed on EGX: 2007

Scope and activities: The company engages in the establishment of companies that issue securities, or raises their capital. It also establishes and develops hotels, touristic and residential projects in Egypt. [1]

Company Vitals:

| Indicator | Value | Case Study Ranking |

| Annual Profits (Avg. 2010-2021) | LE 1.2bn | 2/10 |

| Market Capitalization (12.2021) | LE 18.7bn | 1/10 |

| Cairo Land Ownership – De Jure (12.2021) | 16,341 acres | 1/10 |

| Cairo Land Ownership – Control (12.2021) | 16,442 acres | 1/10 |

| 40% of case study land |

How much land does TMGH own in Cairo?

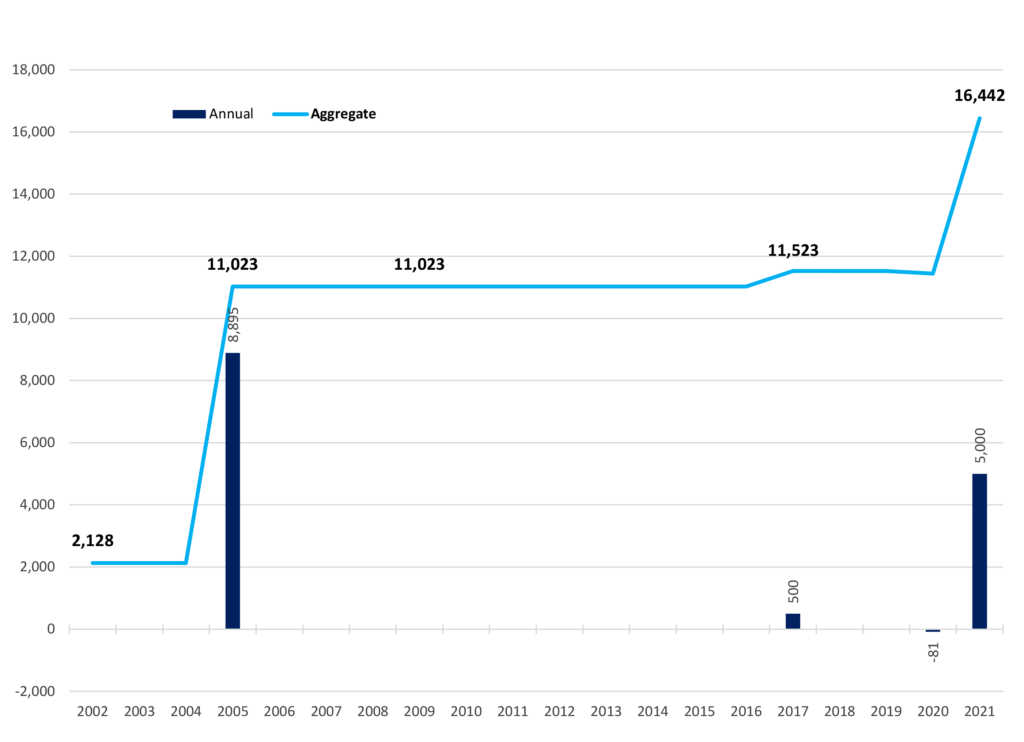

Under the de jure method (See Methodology), TMGH indirectly owns 16,341 acres in Cairo (See Appendix A below). At 16,442 acres, its ownership doesn’t change much under the control method as it has rarely been involved in co-development deals with other companies. It has however pioneered the co-development model with NUCA, buying its significant land plots in Cairo through in-kind payment (finished units) agreements with NUCA, meaning that land payments do not represent an upfront burden for it. This has been the cause of legal dispute, where a court ruling nulled the original land contract for Madinaty, forcing NUCA and TMGH to sign a new contract with clearer payment terms better reflecting the value of the land.[2] In 2021, TMGH had the largest landbank of the case study companies, however despite its size, the landbank was mostly acquired more than a decade ago, specifically in 2005, when over half of its current land bank was allocated (Figure 1).

Figure 1: TMGH landbank accumulation analysis – Control Method 2002-2021 (Acres). Sources: See Appendix A

Who Owns TMGH?

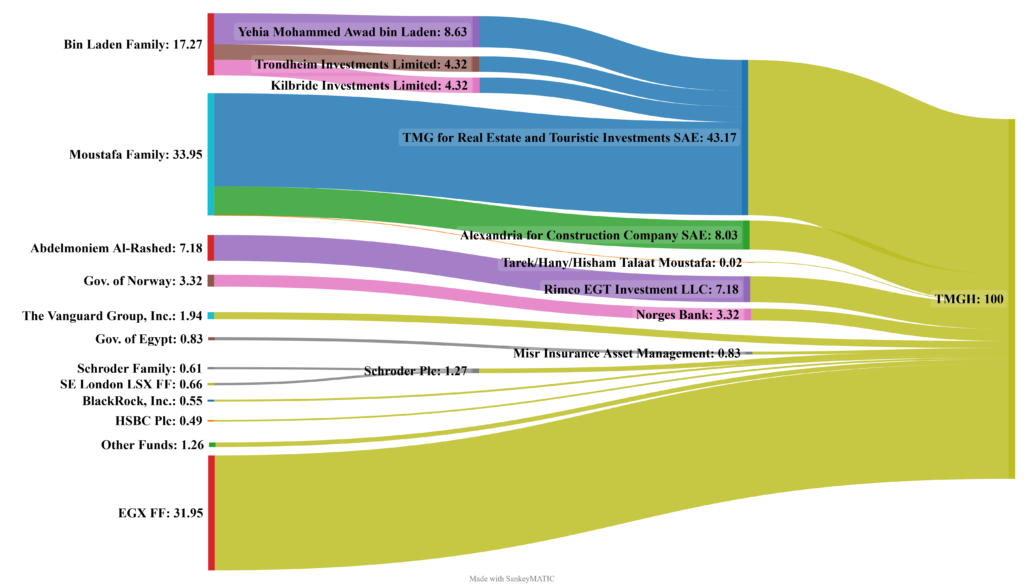

The Talaat Moustafa Group’s largest shareholder is TMG for Real Estate and Touristic Investments, a company jointly held by the Egyptian Talaat Moustafa Family and the Saudi Bin Laden family (Figure 2). With stakes through another company brothers Tarek, Hisham and Hany ultimately own 34% of TMGH’s stock. Hisham Talaat Moustafa has been group CEO since the 2017, and has also served as a member of the Shura Council (Upper House). Brother Tarek Talaat Moustafa is group Chairman since 2008 and a former member of parliament.

The second largest shareholder is the Saudi Bin Laden family, famous for their large construction interests in their home country through the Saudi Binladen Group. In Egypt, brothers Yehia and Omar Bin Laden have various real estate investments, owning 17% of TMGH through an Egypt based company – with the Talaat Moustafa family, and the Cayman Islands. The third largest shareholder is another Saudi family, that of Abdelmoniem Alrashed, owning 7% of the group through a UAE based company. The remaining identifiable owners are mostly investment funds, led by the Norges Bank who owns 3.3% of TMGH’s shares.

Figure 2: TMGH shareholding structure according to the UBO method as of 2021 Q4 (See Appendix B and Methodology)

Investor Nationalities

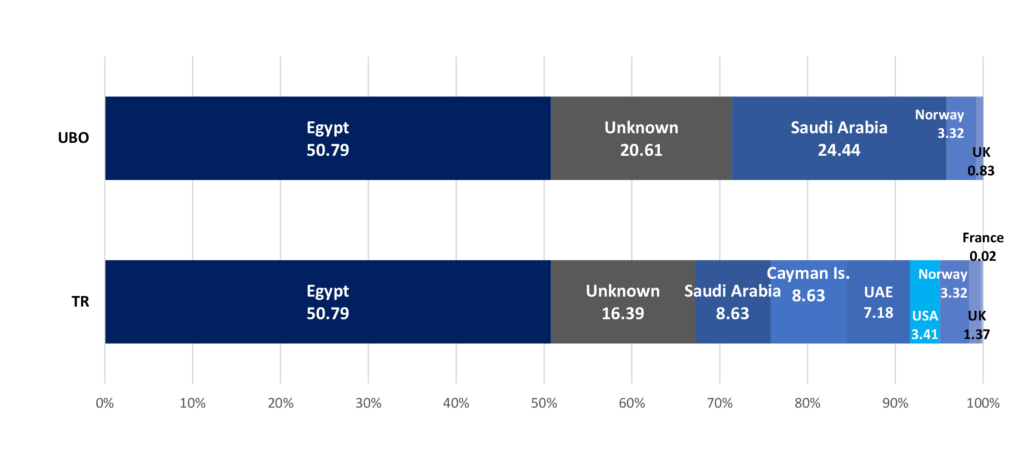

Egypt based investors owned less than half of the company’s shares under the tax resident (TR) method (See Methodology), with the second largest group being investors of unknown nationalities: free float investors with small holdings (Figure 3). In third place is Saudi Arabia with 8.6% of the shares, followed by the Cayman Islands with an equal percentage, and in close fifth place the UAE with 7%. Funds based in the USA and Norway, owned the remaining portion.

Shifting the ultimate beneficial owner (UBO) method, leaves Egypt in first place with 46% of the shares, while investors of unknown nationalities grow to almost a quarter o the shares as other listed companies and funds are added to the group (See Methodology). Saudi Arabia remains in third place, though balloons to near one quarter of the shareholdings as UBOs of Cayman Islands and UAE companies are added. The Government of Norway’s Norges Bank is the fourth largest owner at 3.3% of the shares.

Figure 3: TMGH shareholding by nationality under the TR and UBO methods

Investor Types

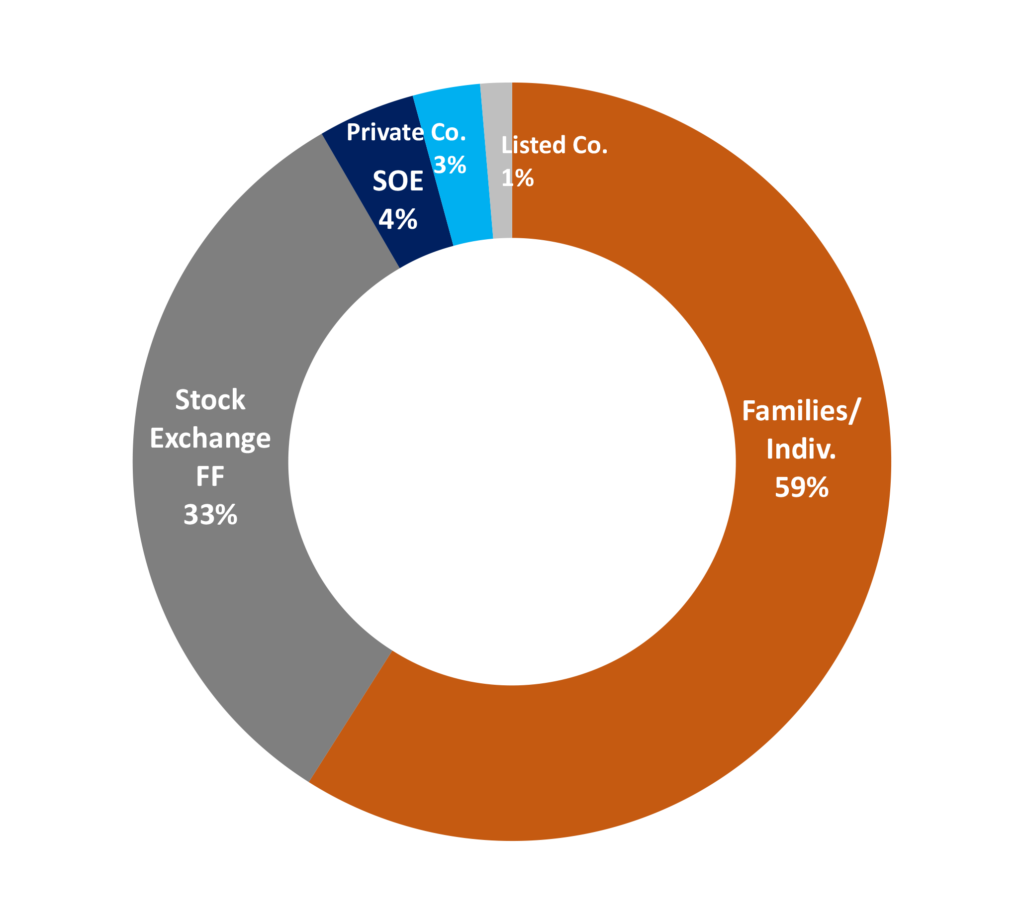

Under the UBO method, families made it the largest portion of investors, holding almost 60% of TMGH (Figure 4). Unidentifiable smallholders on the EGX free float represented the second largest group at a third of the company. SOEs were the third largest shareholder with 4% of shares – mostly through the Norges Bank, while private and listed companies owned the remaining 4%.

Figure 4: TMGH shareholding by investor type – UBO

Back to Case Study Companies Page

Appendix A: Landholding Information

| Location | Development (Allocation date) |

Subsidiary / Co-development (% Owned) |

Land Area (Feddans) | Sources | ||

| Initial Land | De Jure Owned 2021 | Control 2021 | ||||

| Capital Gardens | Noor (2021) | Arab Company for Urban Investment (99.97%) | 5,000.0 | 4,998.5 | 5,000.0 | MoH 424/2021 |

| El Shorouk | MayFair (1993) | Alexandria Company for Urban Projects SAE (40%) | 148.3 | 59.3 | 148.3 | TMGH Annual report 2007 |

| New Cairo | Al Rehab I (1996) | Arab Company for Projects and Urban Development SAE (99.99%) | 1,461.0 | 1,461.0 | 1,461.0 | MoH 413/2017 |

| Al Rehab II (2005) | Arab Company for Projects and Urban Development SAE (99.99%) | 895.0 | 895.0 | 854.4 | MoH 728/2016 | |

| Madinaty (2005) | Arab Company for Projects and Urban Development SAE (99.99%) | 8,000.0 | 8,000.0 | 7,959.4 | MoH 129/2021 | |

| Madinaty – Plot Sale & co-dev (2020) | Sale to and co-dev. w First Design for Urban Investment and Development SAE [Misr & Ahly Banks] Note: Land area is equally divided between the two projects | -40.6 | TMGH Market Update 01.07.2021 | |||

| New Administrative Capital | Celia (2017) | Arab Company for Projects and Urban Development SAE (99.99%) | 500.0 | 500.0 | 500.0 | TMGH Press Release 23.04.2017 |

| Sheikh Zayed | El Rabwa I & II (1994) | Alexandria for Real Estate Investment SAE (97.93%) | 518.9 | 508.2 | 518.9 | TMGH Annual report 2007 |

| TMG TOTAL | 16,523.2 | 16,340.8 | 16,442.0 | |||

| MoH: Minister of Housing Decree. All subsidiary ownership percentages based on the annual consolidated financial statements of 2021 | ||||||

Appendix B: Shareholding Information

Direct Shareholding:

| Company | Shares | Sources |

| TMG for Real Estate and Touristic Investments SAE | 43.16 | “TMG Holding SAE BoD & Shareholders Disclosure 2021 Q4.”

“Talaat Moustafa Group Holding SAE Ownership.” Simply WallSt. n.d. Accessed 04.04.2022

“Government Pension Fund Global Holdings of Equities at 31 December 2021” (Norges Bank) |

| Alexandria for Construction Company SAE | 8.03 | |

| Rimco EGT Investment LLC (UAE) | 7.18 | |

| Norges Bank | 3.32 | |

| The Vanguard Group Cos (USA) | 1.94 | |

| Schroder Investment Management Limited (UK) | 1.27 | |

| Misr Insurance Asset Management | 0.83 | |

| BlackRock, Inc. (USA) | 0.55 | |

| HSBC Global Asset Management (UK) Limited | 0.49 | |

| Russell Investment Management, LLC (USA) | 0.48 | |

| Eaton Vance Management (USA) | 0.11 | |

| Deutsche Asset & Wealth Management (DWS) (Germany) | 0.11 | |

| Van Eck Associates Corporation (USA) | 0.1 | |

| Northern Trust Global Investments (UK) | 0.06 | |

| Azimut (DIFC) Limited, Asset Management Arm (UAE) | 0.05 | |

| Teachers Insurance and Annuity Association of America – College Retirement Equities Fund (USA) | 0.05 | |

| State Street Global Advisors, Inc. (USA) | 0.06 | |

| Quaestio Capital Management SGR S.p.A Unipersonale (Italy) | 0.05 | |

| Boston Partners Global Investors, Inc. (USA) | 0.04 | |

| RWC Partners Limited (Lincoln Peak Capital, Inc.) (USA) | 0.03 | |

| DBX Advisors LLC (USA) | 0.03 | |

| Geode Capital Management, LLC (USA) | 0.03 | |

| Polunin Capital Partners Limited (UK) | 0.02 | |

| Mackenzie Financial Corporation (Canada) | 0.02 | |

| AXA Investment Managers S.A. (France) | 0.02 | |

| Tarek, Hisham and Hany Talaat Moustafa (Egypt) | 0.02 | |

| EGX FF | 31.95 |

Indirect Shareholding:

| Company | Nationality | Shareholders (%) | Sources |

| TMG for Real Estate & Tourism Investment SAE

|

Egypt | Talaat Moustafa Family (Egypt) 60

[Tarek, Hany and Hisham Talaat Moustafa]

Bin Laden Family 40 [Yahia Mohammed Awad Bin Laden 20 (Saudi Arabia), Trondheim Investments Limited, rep. Akbar Aly Mohammed Aly Mwala, 10 (Cayman Is.) Kilbride Investments Limited, rep. Omar Mohammed Awad Bin Laden 10 (Cayman Is.) |

“Articles of Incorporation of T.M.G. Holding (Egyptian Joint Stock company)”, Capital Market Authority. Publication No. 46, April 2007.

“Talaat Moustafa Group Holding Company SAE Offering Circular [IPO]”, 16.11.2017. p97 |

| Alexandria Construction Company SAE | Egypt | Talaat Moustafa Family (Egypt) 100 | Based on the BoD representation as per MCDR disclosure |

| Rimco EGT Investment LLC | UAE | Abdulmonem Rashed Alrashed (Saudi Arabia) 100 | “RIMCO EGT Investment Owned By Abdulmonem Rashed Alrashed One Person Company L.L.C in Dubai” Dubai Chamber: Dubai Commercial Directory. n.d. Accessed 30.03.2022 |

| Norges Bank | Norway | Government of Norway 100 | About the Bank. Norges Bank, n.d. Accessed 30.03.2022 |

| Schroder Investment Management Limited

|

UK | Ultimate parent company: Schroders Plc

Main shareholders: Schroder Family (UK) 47.93 LSE FF (UK) 52.07 |

“Schroders Annual Reports and Accounts 2020”, Schroders Plc. p104 |

| Misr Insurance Asset Management | Egypt | Government of Egypt | “Misr Insurance Asset Management Company Profile, Shareholders” Misr Holding. p.5. |

| HSBC Global Asset Management Limited | UK | HSBC Holdings Plc (UK) | “HSBC Governance.” HSBC, 2022. |

| HSBC Holdings Plc | UK | BlackRock, Inc. 8.52

The Vanguard Group, Inc. 4.13 Norges Bank 2.68 SE London LSX FF 84.67 |

“HSBC Holdings Plc Annual Report and Accounts 2021” HSBC. p.289

“HSBC Holdings Plc Ownership” Simply Wall St. n.d. Accessed 13.07.2022 |

| Deutsche Asset & Wealth Management LTD (DWS KGaA from 2018) | Germany | Deutsche Bank AG (Through DB Beteiligungs-Holding GmbH) 79.49

Nippon Life Insurance Company 5 |

“Annual Report 2021”,DWS. pXXVI

|

| Deutsche Bank AG | Germany | BlackRock, Inc 5.23

The Capital Group Companies, Inc. 5.20 (USA) Douglas L. Braunstein 3.18 Paramount Services Holdings Ltd. 3.05 (UK) Supreme Universal Holdings Ltd. 3.05 (Cayman Islands) |

“Deutsche Bank Shareholder Structure.” Investor Relations. n.d. Accessed 04.04.2022 |

| Boston Partners Global Investors, Inc. | USA | ORIX Group (Japan) 100 | “Our Group”, Orix Group website, n.d. Accessed 27.03.2022 |

| Azimut Limited | UAE | Azimut UK Holdings Limited 100 | DIFC: “Azimut Limited shareholders” n.d. Accessed 31.03.2022 |

| Azimut UK Holdings Limited | UK | Azimut Holding spa 100 | Azimut UK Holdings Limited: “CERTIFICATE OF INCORPORATION OF A PRIVATE LIMITED COMPANY” 29/07/2021. P. 7,8 . n.d. Accessed 28.03.2022 |

| Azimut Holding spa | Italy | Timone Fiduciaria Slr 22.10

Italian SX FF 77.9 |

Azimut Group: “Azimut Group.” n.d. Accessed: 30.03.2022 |

Notes and sources

[1] Talaat Moustafa Group Holding Consolidated Financial Statement for the year ended 31.12. 2021, p10

[2] State Council (administrative court) ruling in case 12622/62. And: Minister of Housing Decree 129/2021