- Published on 04 September 2022

Who Owns Cairo: Case Study Companies

Overview

Company name: Emaar Misr for Development SAE (Reuters Code EMFD.CA)

Established: 2005

Listed on EGX: 2015

Scope and activities:

The company is involved in commercial and residential real estate development projects in Egypt, such as residential villages and communities, yacht marinas, golf courses, diving centers, business centers, malls, shopping complexes, villas, townhouses, and apartments, design, construction, management, operation and maintenance of power plants, establishment, distribution, and operation of desalination and refining plants for drinkable water and sewage systems. The company also works on financial leasing.[1]

Company Vitals

| Indicator | Value | Case Study Ranking |

| Annual Profits (Avg. 2010-2021) | LE 2.3bn | 1/10 |

| Market Capitalization (12.2021) | LE 13.5bn | 2/10 |

| Cairo Land Ownership – De Jure (12.2021) | 2590 acres | 5/10 |

| Cairo Land Ownership – Control (12.2021) | 2590 acres | 5/10 |

| 6.3% of case study land |

How much land does Emaar own in Cairo?

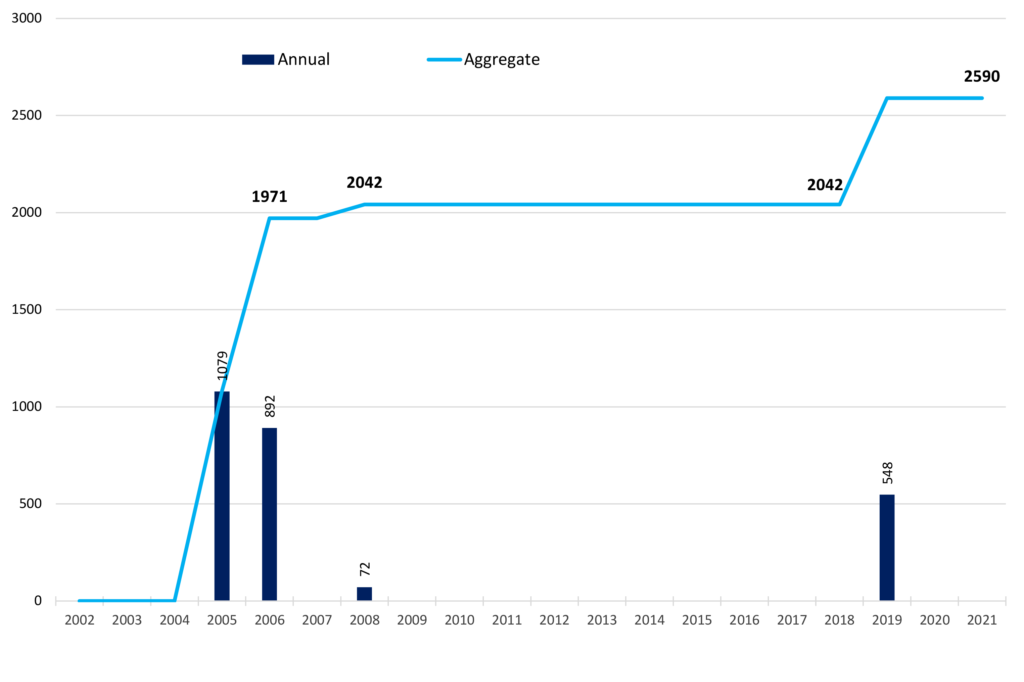

Under both the de jure and the control methods (see Methodology)), Emaar owned roughly 2600 acres in Cairo at the end of 2021. The majority of this landbank (80%) was acquired in just three years (Figure 1), and this was more than ten years ago. At 1066 acres, Uptown Cairo in Moqattam, Cairo, is its single largest development. However, in 2017 a dispute over the plot was sparked when El Nasr Housing and Development, the SOE that sold Emaar the plot, initiated an arbitration case citing breach of contract by falling behind the agreed development schedule, a condition of the contract, as well as unlawfully possessing an extra 48 acres of adjacent land.[2] Emaar counter arbitrated, and a settlement was reached in 2019 with Emaar paying for the extra land.[3] Only one significant acquisition has been made since 2006, and that was in 2019.

Figure 1: EMFD landbank accumulation analysis – Control Method 2002-2021 (Acres). Sources: See Appendix A

Who Owns Emaar?

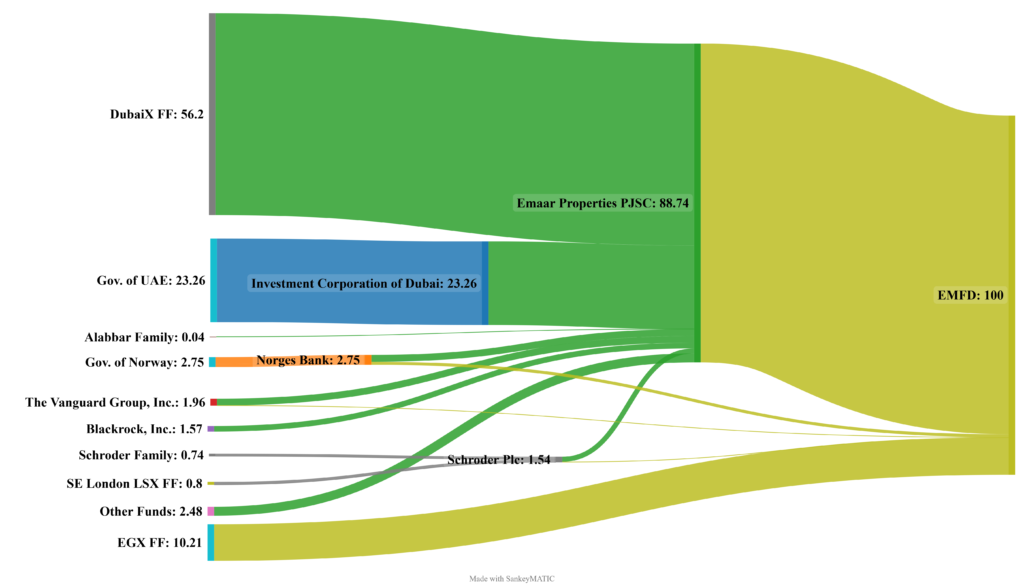

Emaar Misr was originally set up in 2005 as a joint venture between the Emirati Emaar Properties PJSC, a company listed on the Dubai stock exchange and controlled by the Dubai government, and the Egyptian businessman Shafiq Gabr. Emaar Properties bought Gabr’s share in 2007, and listed Emaar Misr on the EGX in 2015. Since then, it is an almost wholly owned subsidiary of Emaar Properties (88%), at the end of 2021 this translated into a 23% controlling stake in Emaar Misr by the Investment Corporation of Dubai, an Emirati SOE (Figure 2). The rest is held indirectly by smallholders on the Dubai stock exchange (57%), followed by the EGX free float (10%). Chief of these is the government of Norway through its sovereign wealth fund the Norges Bank (2.75%) with holdings in both the Emirati mother company and its Egyptian subsidiary, followed closely by transnational asset managers and funds the Vanguard Group and BlackRock.

Figure 2: EMFD shareholding structure according to the UBO method as of 2021 Q4 (See Appendix B and Methodology)

Investor Nationalities

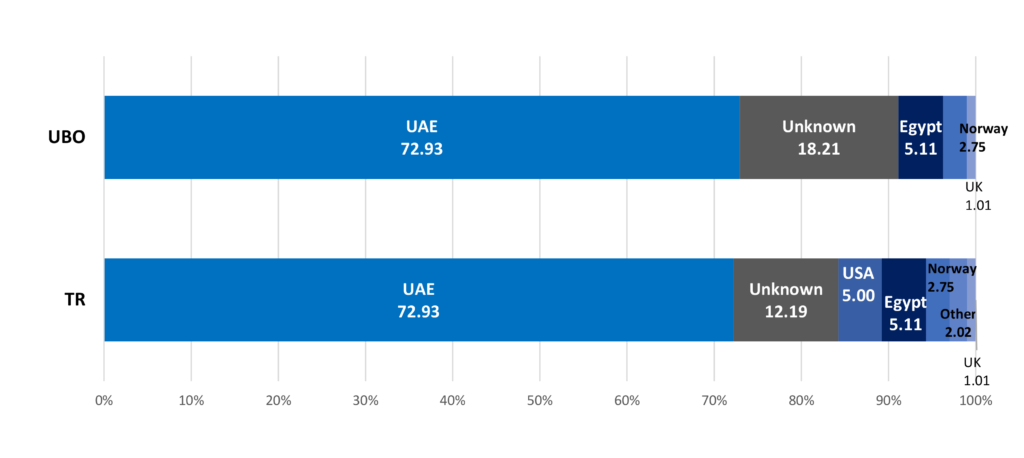

Using the tax resident method (TR – see Methodology), investors from the UAE represent the single largest shareholder of Emaar at 73% of its shares (Figure 3). This is followed by unidentifiable smallholders on the Dubai, Egypt, and London stock exchange free floats holding 13.4% of the company. In third place are funds from the USA with 5% holdings, followed by investors from Egypt – mostly smallholders on the EGX owning almost 4% of the company. Norway is the fifth largest investor with 2.75% of holdings, while 3% of the company is held by investors based in the UK and other European countries.

With the ultimate beneficiary owner method (UBO – see Methodology), the UAE remains the largest investor by far, holding 73% of Emaar. Investors of unknown nationalities grow to 20% of company holdings, followed by Egyptian investors in third place holding barely 4% of Emaar. Norway is the fourth largest investor (2.75%), followed by the UK (1.01%).

Figure 3: EMFD shareholding by nationality under the TR and UBO methods

Investor Types

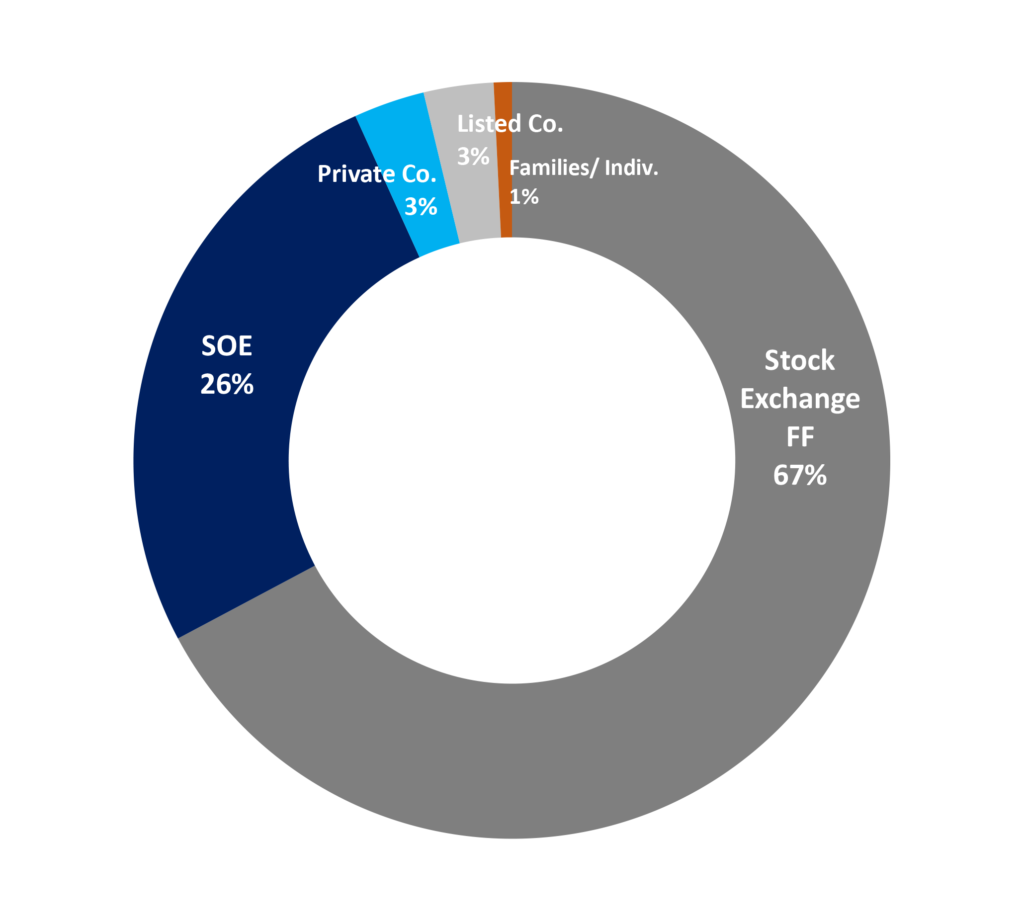

Even though Emaar is controlled by the Government of the UAE under the UBO method, the largest investor by type is the hundreds of smallholders on the stock exchange free floats, where they, directly and indirectly, hold 67% of the company (Figure 4). This is followed in second place by SOEs – mostly based in the UAE, and to a much smaller extent Norway, holding 26% of Emaar. The company’s third largest investor type are equally private non-listed companies (3%) as well as listed companies and funds. Families and individuals hold less than 1% of Emaar.

Figure 4: EMFD shareholding by investor type – UBO

Back to Case Study Companies Page

Appendix A: Landholding Information

| Location | Development (Allocation date) |

Land Area (Feddans) | Sources | ||

| Initial Land | De Jure Owned 2021 | Control 2021 | |||

| Cairo | Uptown Cairo (2005) | 1,078.8 | 1,065.9 | 1,065.9 | Cairo Gov Decree 501/2008, |

| Uptown Cairo – Roads and 5% of plot given up to Cairo Gov as services (2008) | -60.5 | -60.5 | |||

| Uptown Cairo – Land area difference bought (2019) | 47.6 | 47.6 | |||

| New Cairo City | Mivida (2006) | 891.9 | 891.9 | 891.9 | MoH 764/2020 |

| Sheikh Zayed City | Belle Vie (2019) | 500.0 | 500.0 | 500.0 | MoH 224/2021 |

| Cairo Gate – Vida Residences (2008) | 132.2 | 132.2 | 132.2 | MoH 623/2021 | |

| EMAAR TOTAL | 2,602.9 | 2,590.0 | 2,590.0 | ||

| MoH: Minister of Housing Decree | |||||

Appendix B: Shareholding Information

Direct Shareholding (as of 31.12.2021):

| Company | Shares | Sources |

| Emaar Properties PJSC (including Emaar Properties LLC, and Emirates Hills Phase 1 LLC)* |

88.74 | “Emaar Misr Shareholders and BoD 2021 Q4.” p.1. EGX. n.d. Accessed 04.04.2022

“Emaar Properties PJSC Ownership.” Simply WallSt. n.d. Accessed 04.04.2022

“Government Pension Fund Global Holdings of Equities at 31 December 2021” (Norges Bank) |

| Norges Bank | 0.84 | |

| Schroder Investment Management Limited | 0.14 | |

| The Vanguard Group, Inc. | 0.07 | |

| EGX FF | 10.21 | |

| *Wholly owned by Emaar Properties PJSC | ||

Indirect Shareholding (as of 31.12.2021):

| Company | Nationality | Shareholders/ Ultimate Parent | Sources |

| Emaar Properties PJSC | UAE | Investment Corporation of Dubai 26.21

The Vanguard Group, Inc. 2.13 BlackRock, Inc. 1.77 Schroder Investment Management Limited 1.57 Dimensional Fund Advisors, L.P. 0.57 Seafarer Capital Partners, LLC 0.39 Massachusetts Financial Services Company 0.34 Amundi Asset Management 0.31 Boston Partners Global Investors, Inc. 0.25 Pendal Group Limited 0.25 Charles Schwab Investment Management, Inc. 0.24 SEI Investments Company 0.22 Invesco (Emerging Markets All Cap Fund) 0.23 Mohamed Ali Alabbar & Relatives 0.04 Norges Bank 2.15 DubaiX FF 63.33 |

“Company Profile Page – Emaar Properties PJSC – Top Shareholders”, Dubai Financial Markets. n.d. Accessed: 15.01.2021

“Emaar Properties PJSC Corporate Governance Report for 2021”

Simply WallSt: “Emaar Properties PJSC Ownership.” n.d. Accessed: 15.01.2021

“Government Pension Fund Global Holdings of Equities at 31 December 2021” (Norges Bank) |

| Schroder Investment Management Limited | UK | Ultimate parent company: Schroders Plc

Main shareholders: Schroder Family (UK) 47.93 SE London LSX FF (UK) 52.07 |

“Schroders Annual Reports and Accounts 2020”, Schroders Plc. p104 |

| Investment Corporation of Dubai | UAE | Gov. of UAE 100 | “About ICD.” ICD, n.d. Accessed: 24.01.2021 |

| Massachusetts Financial Services Company | USA | Sun Life Financial Inc. 100 | “Massachusetts Financial Services Company Overview.” dun & bradstreet. |

| Amundi Asset Management | France | Amundi Group 100 | “Amundi Shareholders.” Amundi |

| Boston Partners Global Investors, Inc. | Netherlands | ORIX Corporation Europe N.V. 100 | “Boston Partners Global Investors, Inc. Transparency Report 2020.”Boston Partners, p3. |

Back to Case Study Companies Page

Notes and References

[1]Emaar Misr for Development Consolidated Financial Statement for the year ended 31.12.2021, p.9

[2] ‘Emaar, El Nasr Sign Dispute Resolution Agreement’, Enterprise, 8 July 2019,

[3] Emaar Misr for Development, EGX Disclosure, 07.10.2019

[4] Hussein, Abdel-Rahman. (2007). Gabr speaks out on Emaar furor, Artoc chief refutes newspaper talk. Daily News Egypt.