- Published on 11 September 2022

Holdings of traded securities by non-nationals hold different levels of importance for decision makers, stock analysts and investors. This is reflected in how some stock exchanges, or their regulators, collect such information, and others do not. For the purposes of this study, we aimed to compare foreign holdings of select stock exchanges, most of which hosted investors in the Egyptian Stock Exchange (EGX), to be able to compare foreign holdings on the EGX.

What is the Importance of Knowing Foreign Ownership?

The nationality of owners is important to know for a number of reasons. On the one hand, policies of housing and real estate development are partly shaped by stakeholders. If many of those stakeholders happen to be non-resident, then their interests lie mostly in meeting financial targets, rather than in developing neighbourhoods and homes that they would living in day to day. On the other hand, an almost equal portion of the profits of these investments can very much be repatriated back to the investors’ countries of origin, to be spent or reinvested elsewhere. Taxes too, on income, would be captured – or not – in countries other than where the investments have been made.

While the Government of Egypt has been working to attract ever more foreign investment, its impact on a market crucial to the basic social good of housing has not been positive.

Comparing Stock Exchange Foreign Ownership

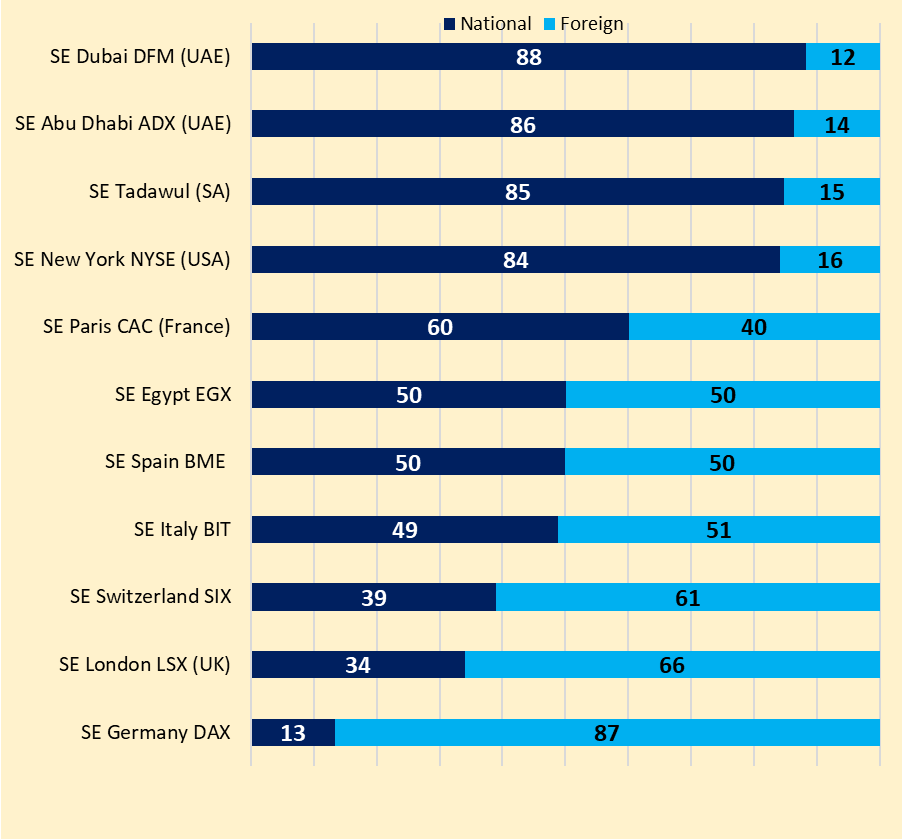

A comparison of foreign ownership in select stock exchanges with the EGX shows that the EGX, with a foreign ownership of 50% by market capitalization, falls between two groups of stock exchange patterns (figure 1). The first comprises of mostly Arab Gulf exchanges and the New York Stock Exchange (NYSE), where foreign ownership was minor ranging between 12% to 16%. The second group comprises European exchanges where foreign ownership was mostly equal to, or even more than local ownership.

While the low foreign ownership on Gulf exchanges reflects caps on foreign ownership of certain stocks, the exceptions are the NYSE, and to a lesser extent the CAC (France), which do not have such caps.

Figure 1: National versus foreign ownership of select stock markets (%)

Data Collection for the EGX

The only data the EGX publishes that shows national versus foreign holdings is on trading volume, rather than market capitalization which is the more reflecting measure. After a thorough review of market analysis and scholarly publications, we found only one paper citing data from the stock market’s central depository, Misr for Central Clearing, Depository and Registry (MCSD), showing a 45% shareholding by national institutional investors, 42% by foreign institutional investors, and 15% by retail investors, though not divided by nationality.[1] This data was however, from eight years ago, while the percentages did not add up to 100% (102%).

Table 1: Identifiable shareholding (non-FF) of case study companies listed on the EGX prorated to total holdings by nationality using the TR method (%). For source data see Company Overviews.

| Nationality | SODIC | TMGH | EMFD | PHDC | ORHD | PORTO | MNHD | HELI | HDBK | PRDC |

| Egypt | 1.12 | 76.47 | 0.00 | 83.50 | 99.24 | 28.53 | 52.08 | 97.12 | 76.21 | 69.98 |

| UAE | 87.62 | 0.00 | 98.83 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Saudi Arabia | 2.6 | 10.55 | 0.00 | 0.00 | 0.00 | 0.00 | 6.36 | 0.00 | 23.10 | 19.42 |

| Kuwait | 4.96 | 0.00 | 0.00 | 8.91 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 5.30 |

| Libya | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 71.47 | 0.00 | 0.00 | 0.00 | 0.00 |

| BVI | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cayman Is. | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| USA | 3.63 | 5.69 | 0.08 | 4.28 | 0.00 | 0.00 | 4.48 | 1.14 | 0.00 | 1.89 |

| Canada | 0.00 | 0.03 | 0.00 | 0.56 | 0.00 | 0.00 | 0.04 | 0.00 | 0.21 | 0.00 |

| Norway | 0.00 | 4.88 | 0.94 | 2.36 | 0.36 | 0.00 | 0.00 | 1.60 | 0.00 | 3.42 |

| France | 0.00 | 0.03 | 0.00 | 0.00 | 0.00 | 0.00 | 0.04 | 0.00 | 0.00 | 0.00 |

| Germany | 0.00 | 0.00 | 0.00 | 0.00 | 0.40 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Italy | 0.00 | 0.15 | 0.00 | 0.39 | 0.00 | 0.00 | 0.12 | 0.13 | 0.00 | 0.00 |

| Luxembourg | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Netherlands | 0.00 | 0.06 | 0.00 | 0.00 | 0.00 | 0.00 | 0.46 | 0.00 | 0.11 | 0.00 |

| Portugal | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Switzerland | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.37 | 0.00 |

| UK | 0.00 | 1.98 | 0.16 | 0.00 | 0.00 | 0.00 | 1.51 | 0.00 | 0.00 | 0.00 |

| Unknown | 0.00 | 0.16 | 0.00 | 0.00 | 0.00 | 0.00 | 34.93 | 0.00 | 0.00 | 0.00 |

| TOTAL | 100 | 100.00 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 |

Therefore, we formed our own national to foreign ratio for the EGX based on an analysis of the identifiable shareholdings (excluding unidentified free float), of the ten listed companies in our case study prorating it to the total shareholdings (), before applying those percentages to each company’s market capitalization giving average holding percentage per nationality (Table 2). Data on shareholding was based on stock market disclosures for Q4 2021 (See Company Overviews), and for market capitalization on EGX statistics on the last day of trading in 2021 (30.12.2021).[2]

Table 2: Share of case study company capitalizations by nationality – TR Method (LE Mn.)

| Nation | SODIC | TMGH | EMFD | PHDC | ORHD | PORTO | MNHD | HELI | HDBK | PRDC | TOTAL | % |

| Egypt | 312 | 14,313 | 0 | 5,709 | 140 | 178 | 2,273 | 8,701 | 1,503 | 1,467 | 34,596 | 50% |

| UAE | 4,507 | 1,989 | 13,340 | 0 | 0 | 312 | 5 | 12 | 456 | 255 | 20,875 | 30% |

| Switzerland | 0 | 0 | 0 | 0 | 6,591 | 0 | 0 | 0 | 7 | 0 | 6,599 | 9.6% |

| BVI | 0 | 0 | 0 | 0 | 0 | 0 | 1,527 | 0 | 0 | 257 | 1,783 | 2.6% |

| USA | 187 | 932 | 11 | 263 | 0 | 0 | 196 | 102 | 0 | 53 | 1,744 | 2.5% |

| Norway | 0 | 913 | 126 | 145 | 25 | 0 | 0 | 143 | 0 | 97 | 1,449 | 2.1% |

| Saudi Arabia | 138 | 0 | 0 | 0 | 0 | 0 | 278 | 0 | 0 | 549 | 964 | 1.4% |

| UK | 0 | 514 | 21 | 0 | 0 | 0 | 66 | 0 | 0 | 0 | 601 | 0.9% |

| Kuwait | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 150 | 150 | 0.2% |

| Libya | 0 | 0 | 0 | 0 | 0 | 134 | 0 | 0 | 0 | 0 | 134 | 0.2% |

| Germany | 0 | 30 | 0 | 0 | 27 | 0 | 0 | 0 | 0 | 0 | 57 | 0.1% |

| Luxembourg | 0 | 0 | 0 | 24 | 0 | 0 | 0 | 0 | 0 | 0 | 24 | 0.0% |

| Netherlands | 0 | 0 | 0 | 0 | 0 | 0 | 20 | 0 | 2 | 0 | 22 | 0.0% |

| Italy | 0 | 14 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 14 | 0.0% |

| Canada | 0 | 6 | 0 | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 7 | 0.0% |

| France | 0 | 6 | 0 | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 7 | 0.0% |

| Portugal | 0 | 0 | 0 | 0 | 0 | 0 | 5 | 0 | 0 | 0 | 5 | 0.0% |

| Cayman Is. | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 4 | 0 | 4 | 0.0% |

| TOTAL | 5,143 | 18,717 | 13,497 | 6,141 | 6,783 | 624 | 4,373 | 8,958 | 1,973 | 2,827 | 69,036 |

Data Collection for the other Exchanges

Data on a number of exchanges was gathered from statistics generated by them, or collected by regulatory agencies. For the NYSE, the Federal Reserve Bank of New York collects and publishes data on the foreign ownership of US securities, where we focused only on equities using the latest available report at the time of our research showing 2019 data.[3] We also used central bank data on foreign ownership of France and Spain’s markets by capitalization, where we used the latest available data of 2020 for the Euronext Paris CAC 40 (top 40 companies),[4] and for the Bolsas y Mercados Españoles (BME).[5] For Saudi Arabia, we used 2021 data collected by its Capital Market Authority.[6] For the Abu Dhabi Exchange (ADX),[7] and the Dubai Financial Markets (DFM),[8] both provide stock ownership statistics on a daily basis, though based on shareholding and not market capitalization.

Foreign ownership data for the remaining stock exchanges was based on studies conducted on a select group of companies in different years: 2015 for the Italian BIT,[9] 2019 for the Swiss SIX (top 30),[10] 2020 for the Frankfurt exchange (top 30),[11] and 2021 for the London Stock Exchange (LSE)’s top 100 listed companies.[12]

Table 3: National vs Foreign Ownership of Equities on Selected Stock Exchanges (%)

| Stock Market | National | Foreign |

| SE Dubai DFM (UAE) | 88 | 12 |

| SE Abu Dhabi ADX (UAE) | 86 | 14 |

| SE Tadawul (Saudi Arabia) | 85 | 15 |

| SE New York NYSE (USA) | 84 | 16 |

| SE Paris CAC 40 (France) | 60 | 40 |

| SE Egypt EGX | 50 | 50 |

| SE Spain BME | 50 | 50 |

| SE Italy BIT | 49 | 51 |

| SE Switzerland SIX 30 | 39 | 61 |

| SE London LSX (UK) | 34 | 66 |

| SE Germany DAX 30 | 13 | 87 |

Notes & References

[1] Maged Shawky Sourial and Alissa Amico (Koldertsova), “The Role of Institutional Investors in the Egyptian Capital Market,” SSRN Scholarly Paper (Rochester, NY, September 11, 2015), 15, https://doi.org/10.2139/ssrn.2659218

[2] The Egyptian Exchange, “YTD Statistical Report for Main Market Companies till 30/12/2021,” December 30, 2021, https://www.egx.com.eg/get_pdf.aspx?ID=35511&Lang=ENG

[3] Federal Reserve Bank of New York, “Foreign Portfolio Holdings of U.S. Securities as of June 28, 2019” (Department of the Treasury, April 2020), 7, https://ticdata.treasury.gov/Publish/shl2019r.pdf

[4] Banque de France, “Banque de France Bulletin 237/8 September-October 2021 – Non-Residents Held Fewer Shares in French CAC 40 Companies at End-2020” (Paris: Banque de France, October 2021), 1, https://publications.banque-france.fr/en/non-residents-held-fewer-shares-french-cac-40-companies-end-2020

[5] BME, “Annual Report on Ownership of Listed Stock [2020]” (BME, July 29, 2021), 8, https://www.bmegrowth.es/ing/BME-Growth/NotasPrensa/20210729/nota_20210729_2/Household_investment_in_the_Spanish_Stock_Exchange_rose_to_17_1__after_a_five_year_decline.aspx

[6] Capital Market Authority, “Annual Report 1442-1443H (2021)” (Riyadh: Capital Market Authority [Saudi Arabia], 2022), 49, https://cma.org.sa/en/Market/Reports/Documents/cma_2021_report-en.pdf

[7] Abu Dhabi Securities Exchange, “National vs Foreign Holdings by Security as of Dec 31, 2021” (ADX, December 31, 2021), https://publicdata.adx.ae/_layouts/15/ReportServer/RSViewerPageadxpublic.aspx?rv:RelativeReportUrl=/ADXPublic/DailyHoldings_EN.rdl

[8] Dubai Financial Markets, “Foreign Ownership as of 31 December 2021” (DFM, December 31, 2021), https://www.dfm.ae/issuers/listed-securities/foreign-ownership

[9] A study by Unimpresa in: Reuters, “Half of Italy’s Stock Market Now in Foreign Hands – Study,” Reuters, January 6, 2016, sec. Auto & Truck Manufacturers, https://www.reuters.com/article/italy-companies-ownership-idUSL8N14Q2EC20160106

[10]Ernst & Young and NZZ in: SDA-Keystone/NZZ/ds, “Foreign Investors Own 60% of Swiss Corporations,” SWI swissinfo.ch, April 7, 2019, https://www.swissinfo.ch/eng/foreign-investors-own-60–of-swiss-corporations/44880256

[11] IHS Markit, “Who Owns the German DAX? The Ownership Structure of the German DAX 30 in 2020” (IHS Markit – DIRK, 2021), https://www.dirk.org/wp-content/uploads/2021/06/DAX-Study-2020-Investoren-der-Deutschland-AG-8_0.pdf

[12] Alison Owers, “Foreign Investors Take an Increased Stake in UK Plc” (Orient Capital, 2021), https://www.orientcap.com/media/5nifl2bc/oc-foreign-investors.pdf