- Published on 11 September 2022

The Government of Egypt (GoE) was found to be an investor in five of the ten listed real estate companies in our case study. The pattern of investment constituted two main branches of the Executive – the Cabinet mainly, and to a lesser extent, the Presidency.

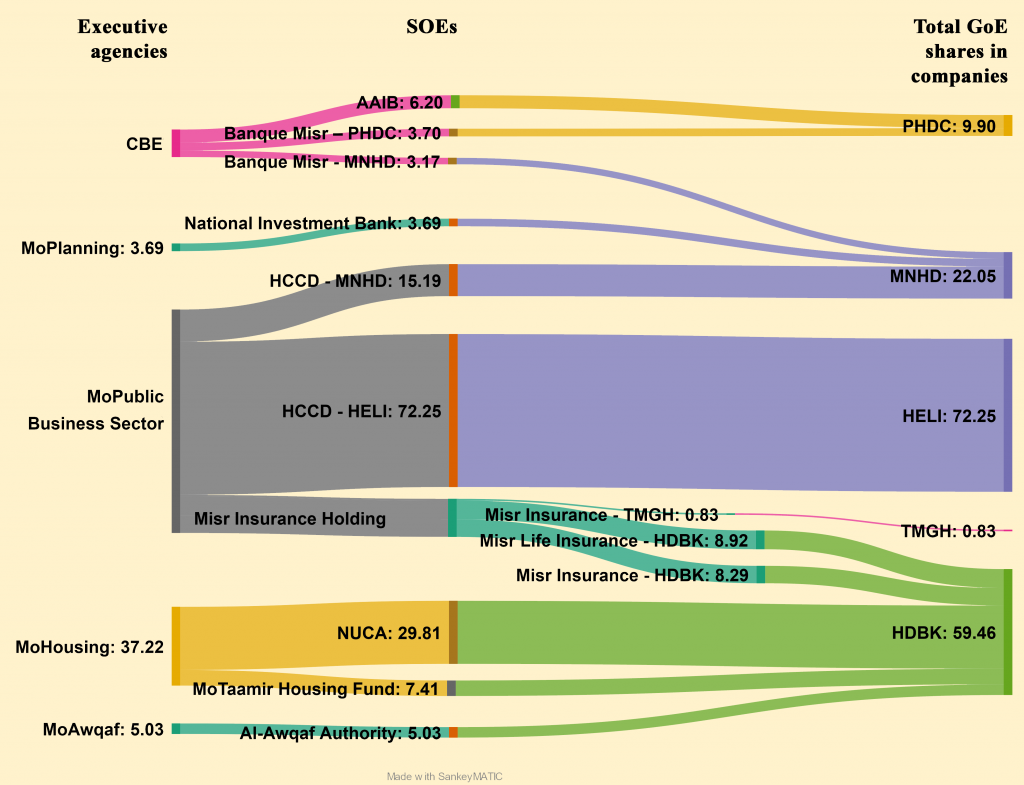

Under the Cabinet, three ministries were investors through five main SOEs, and two subsidiaries. Under the Presidency, the Central Bank (CBE) was the main investor through a wholly owned state-owned bank (Banque Misr), and the Arab African International Bank (AAIB), where ownership is split between the GoE and the Government of Kuwait.

Figure 6: Government of Egypt SOEs’ Share of Listed Real Estate Companies by Entity (%)

Patterns of Investment

The GoE owns controlling shares in two of the five companies through outright majority holdings (HDBK, HELI), and large minority shares with board representatives in two companies (MNHD, PHDC), and a small share in TMGH. The largest investor is the Ministry of Public Business Sector (MoPBS), which reflects the fact it is the custodian of the majority of SOEs by number through a host of sectoral holding companies. In the real estate sector we find two such companies. The Holding Company for Construction and Development (HCCD), owning the majority shares in HELI, and 15% of MNHD (both of which it used to own 100% of before they were listed in the 1990s). HCCD has a number of other real estate and construction holdings on the stock market, as well as companies that are not listed. The other MoPBS company is Misr Insurance Holding Company (MIHC), that holds 18% of HDBK through two subsidiaries most probably investing their insurance funds.

The Ministry of Housing, Utilities and Urban Communities (MoH) is the second largest GoE investor, holding 37% of the HDBK through two SOEs: the New Urban Communities Authority (NUCA), and the Reconstruction Housing Fund (RHF). The remaining ministries and banks own smaller non-controlling holdings.

Some Investment Inefficiency

With the GoE’s investments scattered across many SOEs and two executive bodies, in the companies where they do not hold a controlling interest, their interests are largely diluted. For example, in MNHD, the GoE is formally represented by only two of the ten investor board members, reflecting the consolidated shareholding of 15% by the HCCD. However, if its investments through the National Investment Bank (3.7%) and Banque Misr (3.2%) are added, its 22% shareholding against the other controlling party’s 27% holding, would give it a 4:6 board member ratio instead of the current 2:8 ratio.