- Published on 13 June 2017

Introduction

The cost for housing is one of the least flexible of a household’s expenses; a family could give up one of its three daily meals rather than lose their residence. Hence, each surge in prices entails families making large sacrifices in other areas of expenditure so they can keep their home.

The economic reform decisions taken by the government in the last quarter of 2016 have raised inflation to record levels. Housing costs, including rents, electricity, and maintenance, have been greatly affected by the reform plan, whether directly, in relation to decisions associated with energy and power prices for housing, or indirectly through the current economic crisis affecting real estate prices. This has made financial sacrifices for the sake of housing more arduous for poor and middle-income households.

The economic reforms that took place in the final quarter of 2016 focused on three main actions. The first was the shift from the sales tax to a VAT (value added tax) last October. This raised taxes from 10% to 13%

In the same month, the currency was devalued, after the Central Bank of Egypt (CBE) deregulated dollar auctions on November 3rd, allowing banks the liberty to price currency independently, which lead to the local currency losing more than half its value.

In the same month, the government announced increases in fuel prices of between 30% and 87%.

Priming the real estate market before the devaluation of the currency

These harsh reforms have come as an attempt to contain an aggravated monetary crisis constituted by an increase in the budget deficit and local debts with the widening gap in foreign investment. The crisis had already been placing a strain on housing costs long before last November which raised living expenses for Egyptian families.

With the availability of foreign currency shrinking since 2011, the real estate market predicted high inflation early on, which led those with enough disposable income to venture into real estate, contributing to a surge in real estate prices of between 35% and 50% annually.[1]

With a market share of around 2000 units per year, analysts believe that high end real estate companies have deliberately contributed to the rise in prices through constantly offering a small number of housing units at every stage so that the demand would remain higher than supply.

Speculative buying contributed a large portion of demand, where CI Capital revealed that real estate CEOs estimated that speculative buying was behind 25% to 30% of transactions.[2]

It was not just the private sector contributing to the commodification of housing. The government has been encouraging speculative buying through the deregulation of the real estate market over the last decade and a half.[3] It is also the largest owner of land earmarked for urban development, mostly the desert land in so-called New Cities. In a study published last February, Arqaam Capital estimated that land prices rose by almost 50% since 2013, all because of the interest in real estate and the government’s need to use its resources to plug its budget deficit.[4]

In this context, some connect the increase in the construction sector’s contribution in the last years to the Gross Domestic Product (GDP) to the rise of currency speculation in the market due to the currency crisis. The construction sector’s share in the GDP has risen from 2.6% in 2010-2011 to 10.4% in the last financial year. Moreover, the sector’s total contribution in investments increased from 7.4% to 9.9% during the same period.

Considering that over half of urban residents buy their homes – almost 54% of families are home owners [5]– those who needed to buy apartments to live in during the last years have suffered from house price inflation caused by speculation.

What happened to real estate after the devaluation of the pound?

With the devaluation of the Egyptian pound last November, the costs of construction material rose, either because they are imported, or because local production costs increased. All this has led high-end and middle-income real estate companies to raise prices in line with the surge in construction costs.

It is interesting to note that the rapid devaluation of the currency, and the rise in property prices, did not halt the wave of keen interest in buying property. The Palm Hills’ sales figures offer a telling example. The company declared on the 22nd of November (2016) that all units offered for sale in a project in New Cairo on the 16th of the same month, were sold-out.[6]

During the first quarter of 2017, the company was able to gross the highest profit since its’ foundation, with an increase of 58% on last year.[7] We cannot attribute this boom only to the rise in real estate prices as the company has made a rapid growth of 53% in the number of units sold in that period.

Looking at an example of a middle income real estate company, Madinet Nasr for Housing and Development has stated that it has grossed the “highest business results in the company’s history” in the first 11 months of 2016 up to November,[8] when the Egyptian pound was floated. The company also stated that the second part of the Saray Project, launched in November when the floatation happened, played a primary role in boosting its figures for this year. Taking into consideration that the price of the square meter in the second phase increased by 32% in comparison with its price in the first phase of the project.

While house price inflation in the wake of the currency devaluation presented an even greater burden on most households, the housing market not just stayed buoyant, but experienced a strong surge in demand. This demand was boosted significantly by an important sector of buyers who were not affected by devaluation; Egyptians working and living abroad. On the contrary to their fellow countrymen and women, these families saw their hard currency earnings rise in relation to the Egyptian pound, and even out pace local house price inflation, rendering homes as cheaper to them than before the devaluation, sparking a new round of speculative buying.

How did the effects of the inflation differ among the different classes?

The annual inflation indicators shocked public opinion with its escalation after the devaluation by January 2017 to surpass the highest point it had reached since 1986.

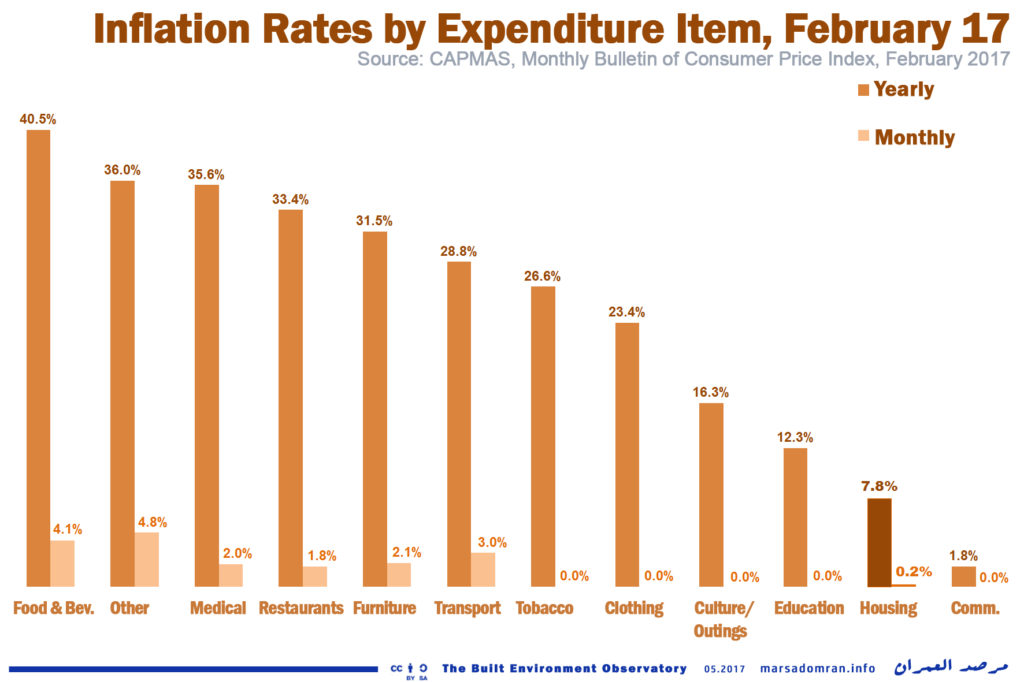

However, the inflation in housing costs was not a factor that saw a large change in that period (7.8% annual inflation) in comparison with other expenses on food and health (figure 1).

Figure 1: Inflation Rates by Expenditure Item, February 2017

This implies that the methodology used in official inflation statistics, does not accurately monitor housing costs, such as prices or rent. At the very least, rents rise by 10% annually, the maximum allowed for by the New Rent law, and could exceed this amount when the contract is renewed. Meanwhile, property prices have been increasing by 20% annually between 2008 and 2016;[9] before the devaluation of the pound and the wave of prices increase.

The Household Income, Expenditure and Consumption Survey (HIECS), also gives very low rent-to-income ratios, where its average rents constitute only 11% and 14.6% of total monthly expenses in rural and urban areas respectively. (Table 1).

Table 1: Breakdown of HIECS Housing Costs and Share of Household Expenditure

| Egypt | Urban | Rural | ||

| Total HH Expenditure | Yearly (EGP) | 36,700 | 42,500 | 31,800 |

| Monthly (EGP | 3058.3 | 3541.7 | 2650 | |

| Housing Costs | Yearly (EGP) | 6400 | 8096.5 | 5022.2 |

| Monthly (EGP | 533.3 | 674.7 | 418.5 | |

| % of Total HH Exp. | 17.50% | 19.00% | 15.80% | |

| Actual Rents | Monthly (EGP | 35.2 | 64.8 | 10 |

| % of Housing Costs | 6.60% | 9.60% | 2.40% | |

| % of Total HH Exp. | 1.20% | 1.80% | 0.40% | |

| Imputed Rents | Monthly (EGP | 357.9 | 451.4 | 281.7 |

| % of Housing Costs | 67.10% | 66.90% | 67.30% | |

| % of Total HH Exp. | 11.70% | 12.70% | 10.60% | |

| Total Rents | Monthly (EGP | 393.1 | 516.2 | 291.7 |

| % of Housing Costs | 73.70% | 76.50% | 69.70% | |

| % of Total HH Exp. | 12.90% | 14.60% | 11.00% | |

| Maintenance & Repair | Monthly (EGP | 16 | 22.3 | 10.9 |

| % of Housing Costs | 3.00% | 3.30% | 2.60% | |

| % of Total HH Exp. | 0.50% | 0.60% | 0.40% | |

| Water & Services | Monthly (EGP | 36.8 | 40.5 | 33.9 |

| % of Housing Costs | 6.90% | 6.00% | 8.10% | |

| % of Total HH Exp. | 1.20% | 1.10% | 1.30% | |

| Electricity & Gas | Monthly (EGP | 87.5 | 95.8 | 82 |

| % of Housing Costs | 16.40% | 14.20% | 19.60% | |

| % of Total HH Exp. | 2.90% | 2.70% | 3.10% | |

| Source: CAPMAS 2015 HIECS, July 2015 | ||||

These very conservative averages do not distinguish between different types of tenure, where households renting according to the New Rent law (market rents) spend more on housing than families renting under Old Rent law (rent control) which has a much lower rent value. This comparison also includes families who own their houses, assigning them an assumed value for rent, which seems to be very low. The HIECS also does not include debts or installments which many property-owning households will be paying off. According to another, more detailed housing study which uses the same household sample used in the HIECS, expenditure on market rent in urban settings ranged between 24% and 15.4% of income for the poor and those with the highest incomes respectively (Table 2). [10]

Table 2: Rent-to-income ratios for New Rent by income quintile

|

Extremely Poor |

Poor |

Middle |

Upper Middle |

High |

Average |

|

24.00% |

22.20% | 20.00% | 18.30% | 15.40% | 20.00% |

| Source: USAID, Housing Study for Urban Egypt. 2008 | |||||

All this would indicate that poor families in cities have had a hard time coping with the repercussions of price increases of all commodities and services. Here, rural households seem at an advantage, where the relatively lower housing costs and the lower proportion of renters, may help them cope better with inflation. However, rural households earn less in cash terms than urban households, (EGP 38,300 annually rural versus EGP 51,100 annually urban). This means that the rural family has less chances to reprioritize areas of expenditure with the increase in prices. [11]

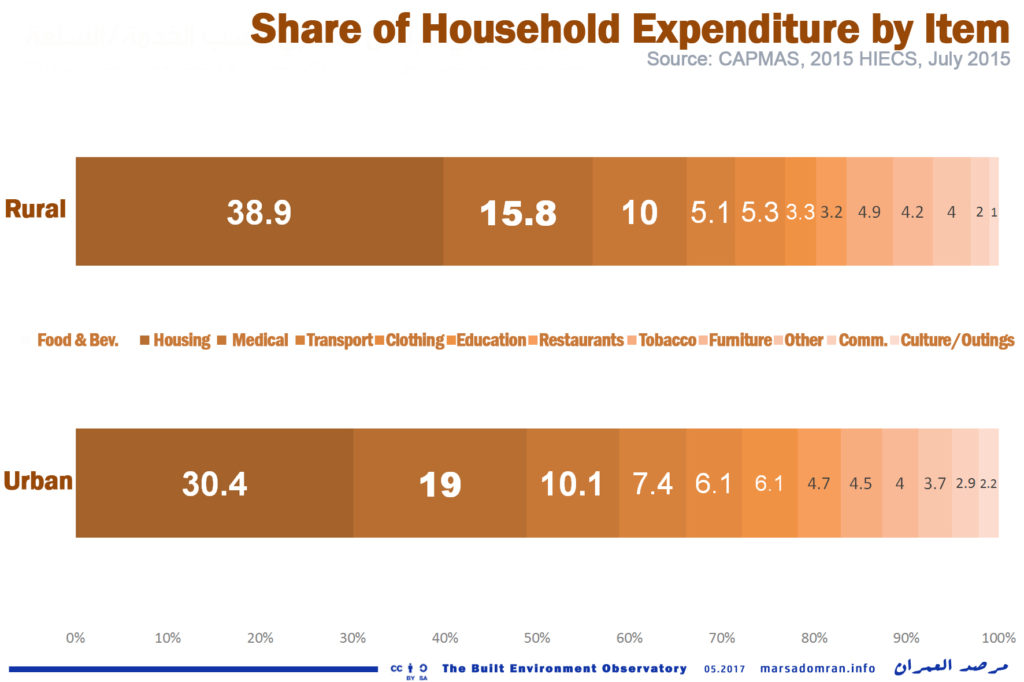

In light of the HIECS, if a low-income household living in a rural area attempted to cut down on non-essentials to buy a home under current price surges, they can only cut back on tobacco, entertainment and clothing expenses. However, this would not be of much use as these expenses already take up very little from their total expenses (figure 2).

Figure 2: Share of Household Expenditure by Item

Therefore, some rural households would have to cut down on expenses when it comes to education, transportation, and communication to fund their housing costs, which means its members would have less opportunities in joining the job market, and with it, less chance of finding a way out of the cycle of poverty.

All these calculations are based on the HIECS estimating housing costs at less than 20% of household expenditure, with rent alone making up only 13% of expenses, rather than the more real-world figures of 15% to 25%.

The Impact of the Devaluation on Household Energy Costs

Some are of the opinion that rural households are not affected as much by the increase in housing prices as they are not directly affected by real estate speculation. However, the repercussions of the economic reform plan on housing costs are not limited only to property.

One of the main foci of the reform plan was the deregulation of fuel prices. Butane gas cylinders, the main source of energy for cooking and heating in rural areas and for the urban poor, saw the biggest increase.

According to the HIECS, expenditure on energy was higher for rural households than urban ones, with the former equal to 3.1% of total expenditure and the latter 2.7% (table 1).

Therefore, every increase in energy items would entail a larger percentage from the budget of a poor rural family more than it would from that of a well-off urban family.

Fuel expenses for rural households are not just limited to gas cylinders, but also include the cost for electricity which the government has been raising since 2012. Prices for low income families jumped 47% and 51% for middle income families in July 2016. [12] Electricity bills also represented 2.6% and 2.2% pf income for poor and middle-income respectively.

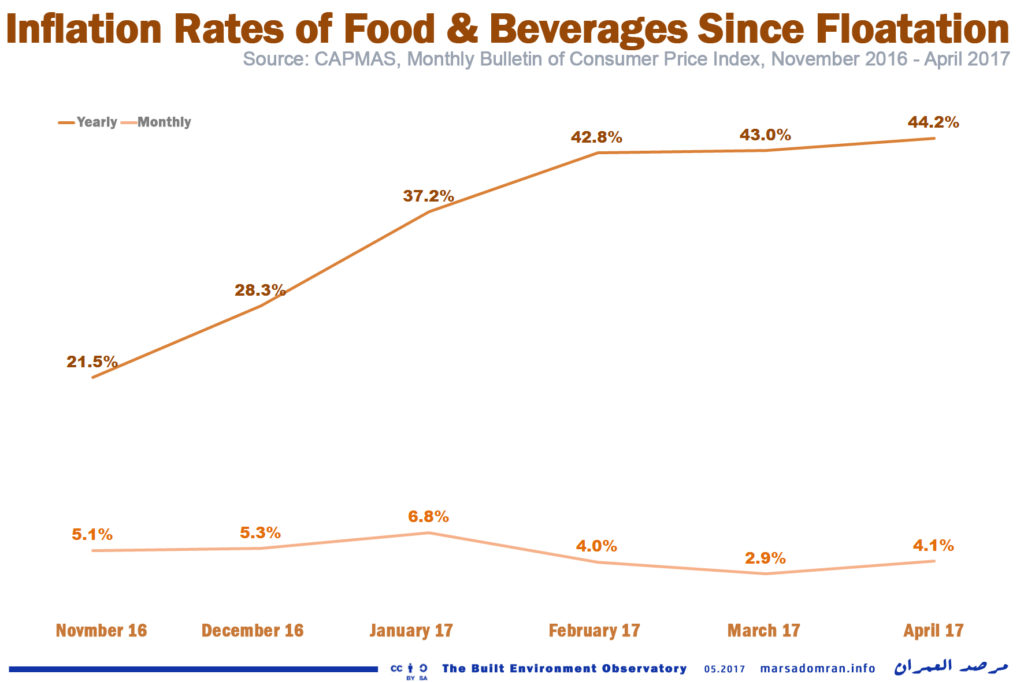

When discussing basic expenses, we should not disregard the cost of food and beverages which are the largest contributor to inflation, as its index rises much faster than the general index for consumer prices. According to the HIECS, food and beverage expenses make up around 40% of a rural family’s total expenses. Hence, any fast-paced increase in prices would imply a great blow to their income (figure 3).

Figure 3: Inflation Rates of Food & Beverages Since Flotation

Health is the third highest expense for rural households, after food and housing. However, there are no quantitative estimates of the rise in health services’ costs. We only know that the government raised the prices of subsidised medicine between 30% and 50% in January. Medical equipment also saw a rise of 50% since the Egyptian pound was floated. This can only mean, that these increases will be borne by households, and represent a further burden to their living expenses.

With the three main household expense items all experiencing price surges, what about wages? In its’ annual report for 2017, Beltone Financial predicted that wage increases would range between 20% and 25%, which is considerably lower than inflation. For certain workers, wage increases will also be lower, as based on disclosures by state-owned companies on the stock market, the average increase in a worker’s wage in the 2017/2018 budget will be around 14.4 %.[13]

Conclusion

With over half of Egyptian households already finding housing to be unaffordable before the bite of the recent economic reforms,[14] along with the fast pace by which nominal wages are being eroded under the weight of spiking inflation, the conclusion can only be that housing costs are at a catastrophic level.

The burden however, does not end here, as Egyptians are waiting for a new wave of inflation during the coming financial year (FY) 2017/2018 in less than a month.

Arqaam Capital has predicted an increase of between 35% and 40% in energy prices as the government continues lowering fuel and electricity subsidies.[15] Drinking water prices are also planned to rise at an average of 47% next July.[16] In the meantime, the government is raising the prices of land and property it owns, including social housing, which will rise by about 17% at least per unit.[17] The VAT will also rise from 13% to 14% with the start of the new financial year according to the law.

It does not end here. The government’s is looking to increase its revenue through slapping expensive fines on more than four million families living in illegal housing, as Parliament is about to discuss a law to regularise buildings built without a permit. Parliament has also already begun discussions around abolishing rent control, which a not inconsiderable number of poor and middle income families currently benefit from.

It is therefore necessary that the government issue legislation to protect those with low incomes from the increase in housing costs. Without such legislation, a large segment of Egyptians is on the brink of an economic and social crisis, where they face two forced options. The first would be to lose their homes and resort to less adequate shelter; smaller and more crowded dwellings, dwellings in remote and unsafe neighbourhoods, units in dilapidated buildings or a shack on adversely possessed land. The second would be to cut down on other basic expenses such as food, health or education. Either option would only lead to more poverty and suffering

[1] “As’ar al-‘aqarat tuwagih ikhtivar al-ta’wim”,– Al-Mal – 26.2.2017 – http://bit.ly/2lLNXH9

[2] Ibid.

[3] Shawkat, Y. Egypt’s Deregulated Property Market: A Crisis of Affordability. MEI. 05.05.2015 http://www.mei.edu/content/at/egypts-deregulated-property-market-crisis-affordability

[4] MENA Real Estate 2017 Outlook: Cruise control – Arqaam capital – 15.02.2017

[5] 2006 Census of population and living conditions. CAPMAS, 2008. Final Results.

[6] Palm Hills Developments successfully launch sales in Palm Hills New Cairo with 100% sellout of offered standalone units – press release. Reuters, 22.11.2016 http://www.reuters.com/article/idUSFWN1DO06S

[7] Palm Hills Developments achieves record Net New Sales of EGP3.1 billion, a growth of 58% YoY in the first quarter of 2017 – press release. Arab Finance, 18.04.2017 https://www.arabfinance.com/2015/Pages/news/newsdetails.aspx?Id=396605

[8] Madinet Nasr Housing and Development releases management accounts for 11M 2016- the strongest result in the company’s history – press release. MNHD 12.12.2016 http://www.mnhd.com/en/PressRelease/Index/40

[9] 10 Tooba. Built Environment Deprivation Index – Affordability. September 2016 http://10tooba.org/bedi/en/affordability/

[10] Housing Study for Urban Egypt. USAID 2008. http://tinyurl.com/mvpd4q6

[11] Did the cost of living rise faster for the rural poor – ERF – May 2017 – http://erf.org.eg/publications/15246/

[12] The Built Environment Observatory, “Haqa’iq al-Kahraba’ ll-Sanat 2016/2017” (Electricity Fact2016/2017 – The Built Environment Observatory 21.2.2017 http://bit.ly/2qza1IY

[13]“Tahlil – Muwaznat al-sharikat al-‘amma tuthir ziyadat al-ugur ba’d al-ta’wim” ( Public sector budgets reveal increase in wages after devaluation)– Masrawy – 11.4.2017 http://bit.ly/2pUGUQA

[14] In 2016, 59.4% of households would have to pay more than 25% of their monthly income to rent the median priced home (EGP 800). While almost half of households (49.2%) would not be able to buy the median home which at EGP 225,000 surpassed the House Price to Income (HPI) ratio of 6.6. See: 10 Tooba. Built Environment Deprivation Index – Affordability. September 2016 http://10tooba.org/bedi/en/affordability/

[15] Egypt- Building Materials Assessing the impact of further energy price hikes – Arqaam capital – March 2017

[16] “Ziyada gadidah fi as’ar al-miyah” (New Increases in the Price of Water), Parlamany, 25.05.2017 http://tinyurl.com/lo7tu79

[17] “Tarh wehdat al-sikan al-Igtima’I li 2017 qariban” (Offering Social Housing Units for 2017 Soon), Masrawy, 27.03.2017 http://tinyurl.com/ksq8akf